To access the Bank Receipts document list, go to Money> Bank Documents > Bank Receipts.

Generally, Bank Receipts are used to register the funds received to your bank accounts from customers, suppliers, employees, and as the result of some other transactions.

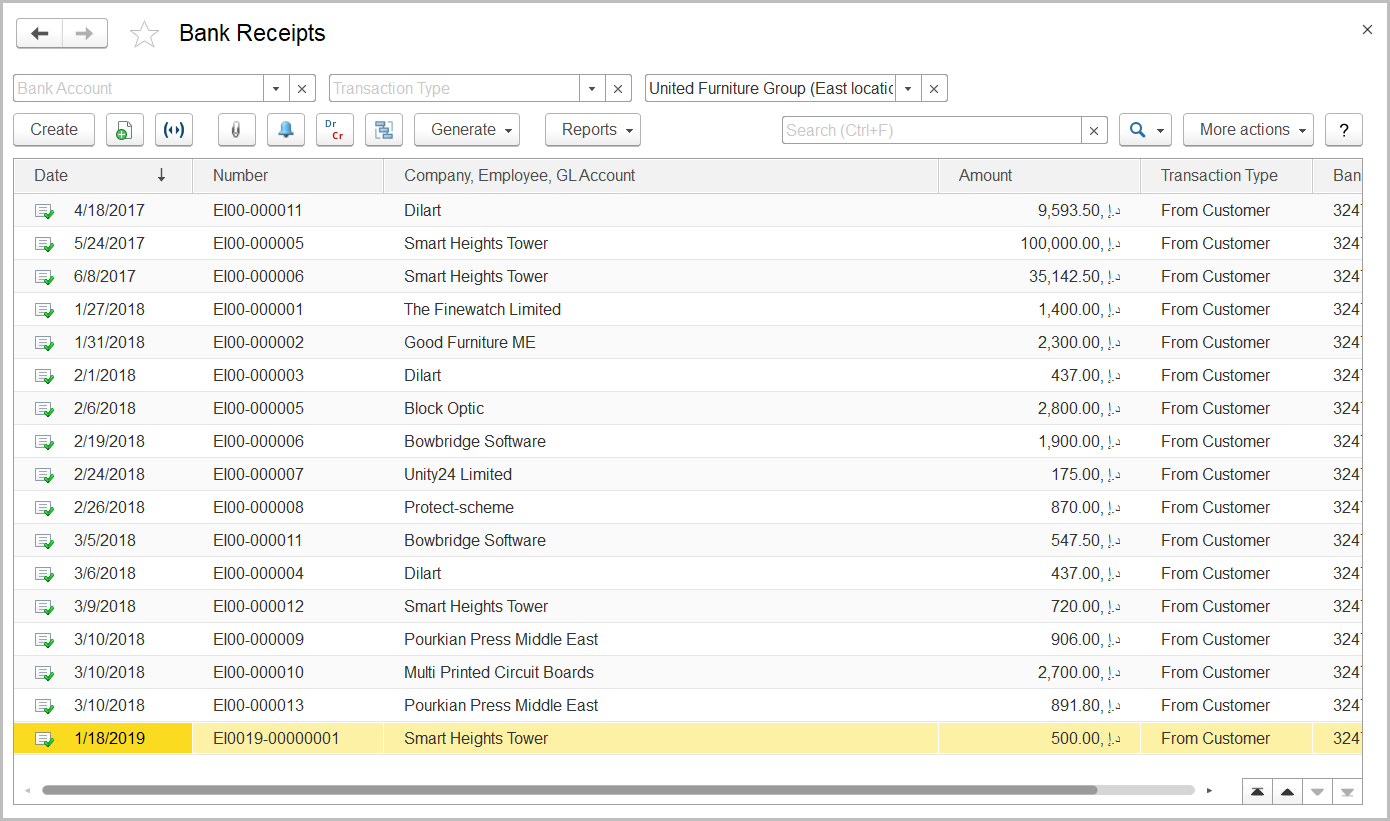

The Bank Receipts list

The list of bank receipts includes all the bank receipts available in the system. You can filter the list by bank account, entity, and transaction type by using the fields above the toolbar. If you don't see a specific document, rearrange the list by date or document number or use the Search field to locate the document by a string in its description, or bank name. You can change the list display settings to suit your particular needs. To learn more about the list display settings, see Working with the item list.

Bank receipts can be based on documents of multiple types depending on the transaction type.

The following types of bank receipts are available in the system (some of the transaction types are available if the specific features are turned on):

- From Customer: To register the customer payment made to your company bank account.

- From Supplier: To register the return of funds based on purchase returns or Debit Notes.

- Return of Prepaid Employee Expenses: To register the return of funds earlier issued to employees for their business expenses.

- Employee Loan Payment: To register the return of funds borrowed by an employee (documents of this type are available if the Enable Loans to Employees option is selected on the Administration > Settings > Setting: HR and Payroll form).

- Repayment of Loan Issued: To register the repayment of long-term loans that were issued to another company (documents of this type are available if the Enable Long-Term Credits and Loans option is selected on the Administration > Settings > General Settings form).

- Loan Received: To account for funds received from another company as a long-term loan (documents of this type are available if the Enable Long-Term Credits and Loans option is selected on the Administration > Settings > General Settings form).

- Currency Purchase: To register the amount in the bank account currency that was purchased by using another currency.

- Tax Refund: To account for the funds received from FTA (Federal Tax Agency) as tax returns.

- Other: To register the funds added to the bank account as the result of other transactions.

Bank receipts can be used as basis for documents of the following types (some of the document types are available if the appropriate features are turned on):

- Tax Invoice: This option is available for bank receipts with the From Customer transaction type; can be used to register the output VAT amounts applied to customer advance payments.

- Tax Credit Note Received: This option is available for bank receipts with the From Supplier transaction type; can be used to register the decrease in the recoverable input VAT incurred as the result of refund from supplier.

- Money Transfer: To plan the transfer of the received funds to another bank account or cash account.

The toolbar buttons

To create a document based on a bank receipt, select the appropriate bank receipt from the list, click the Generate button and select the required document type. The data from the bank receipt will be automatically copied to the new document.

To manually create a new document of the Bank Receipt type, click the Create button on the toolbar.

To edit an existing document, double-click the line with the document in the Bank Receipts list. You can also select the line, right-click it, and select Edit or click More actions > Edit on the toolbar.

If you need to print the selected document, send it by email, or perform other operations, refer to List Toolbar.

See also