This guide explains the steps required to fully close the financial year in the system.

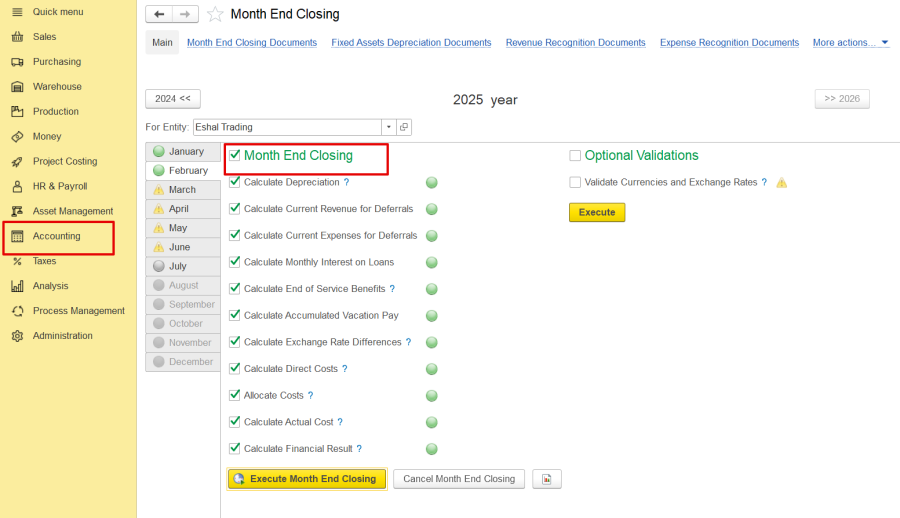

Step 1-Perform Month-End Closing

Review all financial data and ensure everything is recorded accurately.Run the month-end closing in order (month by month) and confirm that each period is closed without any errors.

Please refer to the following guide for detailed instructions: Month-End Closing Service Tool Manual

It explains the process and steps required to run the month-end closing correctly within the system

Step 2 - Close Income and Expense GL Accounts

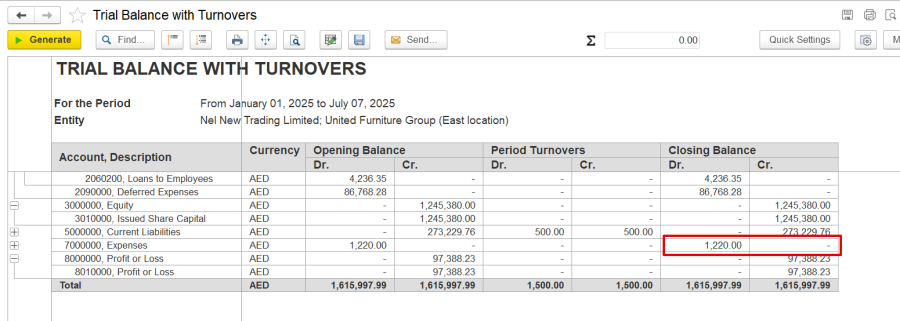

Sometimes, the month-end process may complete without errors, but income and expense GL accounts might still show balances. This usually indicates an issue that needs attention.

Check for any remaining balances in income or expense GL accounts. If found:

- Entry was posted after month-end closingReopen and re-close the affected period to include this entry.

For example, The expense Gl has a closing balance of AED 1,222, when detailed analysis is done, it shows it was created after Month end closing.

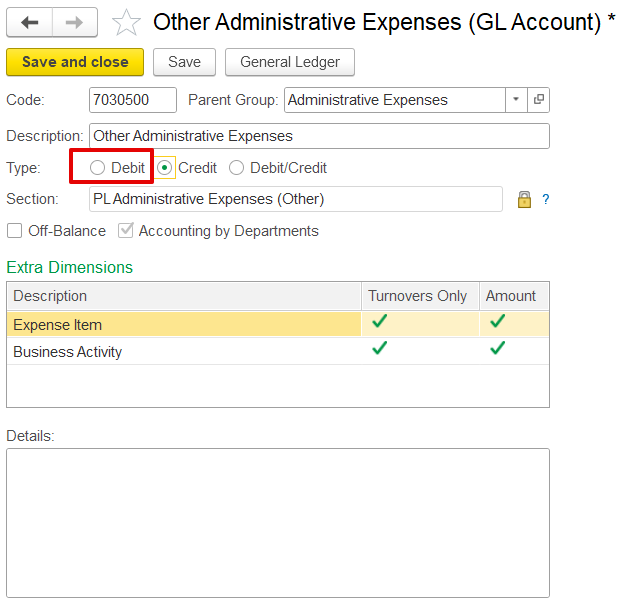

- Incorrect GL Section selectedVerify that the correct section type (Debit/Credit) was used when creating the GL account. If incorrect, fix it and re-run the month-end closing to reflect the proper balance.

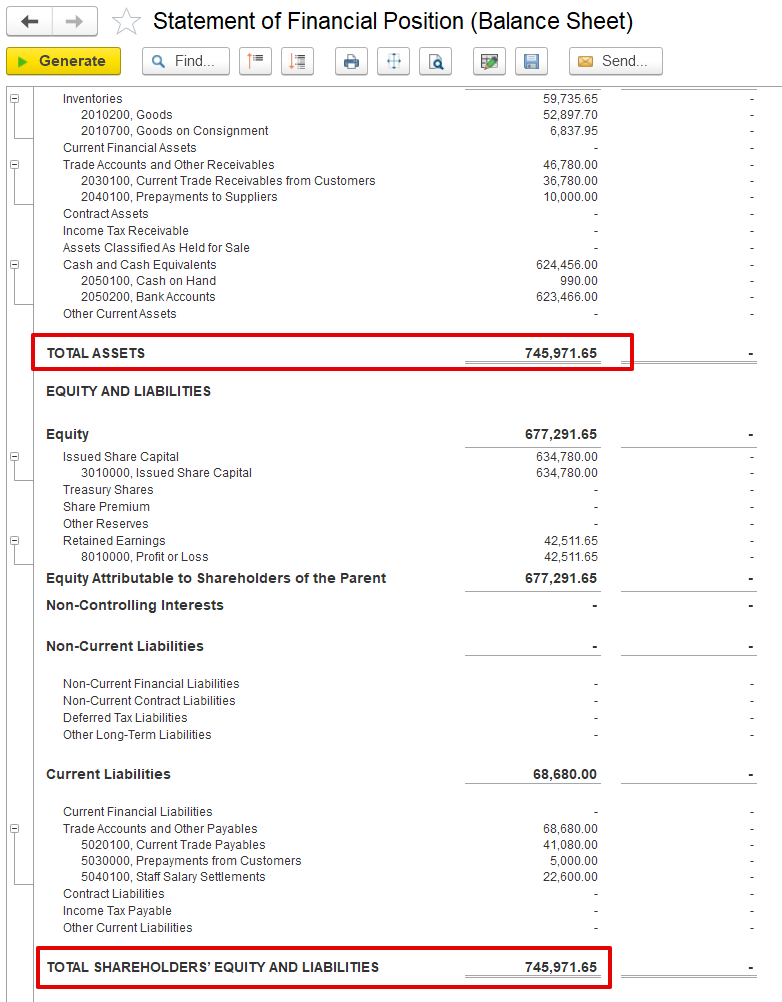

Step 3- Check the Statement of Financial Position and verify the accounting equation:

Assets = Equity + Liabilities

If there is a mismatch:

- Review the accounts involved

- Check for any missing or wrongly posted entries

- Reconcile the balances manually if needed

Step 4 – Transfer Profit to Retained Earnings

After all periods are closed properly, manually transfer the net profit/loss to the Retained Earnings account or allocate the amount as Dividends, if applicable.Follow the official manuals for the process: