On sales, an incorrect VAT rate was used, and now, when it has been found out, there is no possibility to change the invoice−for example, the VAT Return report for the period to which this invoice belongs had been submitted. The entity must show the corresponding adjustments on VAT Return for the current tax period. For example, in the original invoice a standard rate (of 5% in UAE) was used, while the services are considered tax-exempt. In case, the zero rate was used incorrectly in the original document, refer to Case 4. Unconfirmed right to use 0% rate.

The processing of the case includes the following stages:

I. Create an Output VAT Transaction with the Decrease adjustment type to roll back the taxable and tax amounts of the incorrect original Invoice. Also, generate a Tax Credit Note.

II. Create an Output VAT Transaction with the Increase adjustment type to restore the correct taxable and tax amounts in the database.

How to process

I. Where: Taxes > Tax Documents > Output VAT Transactions

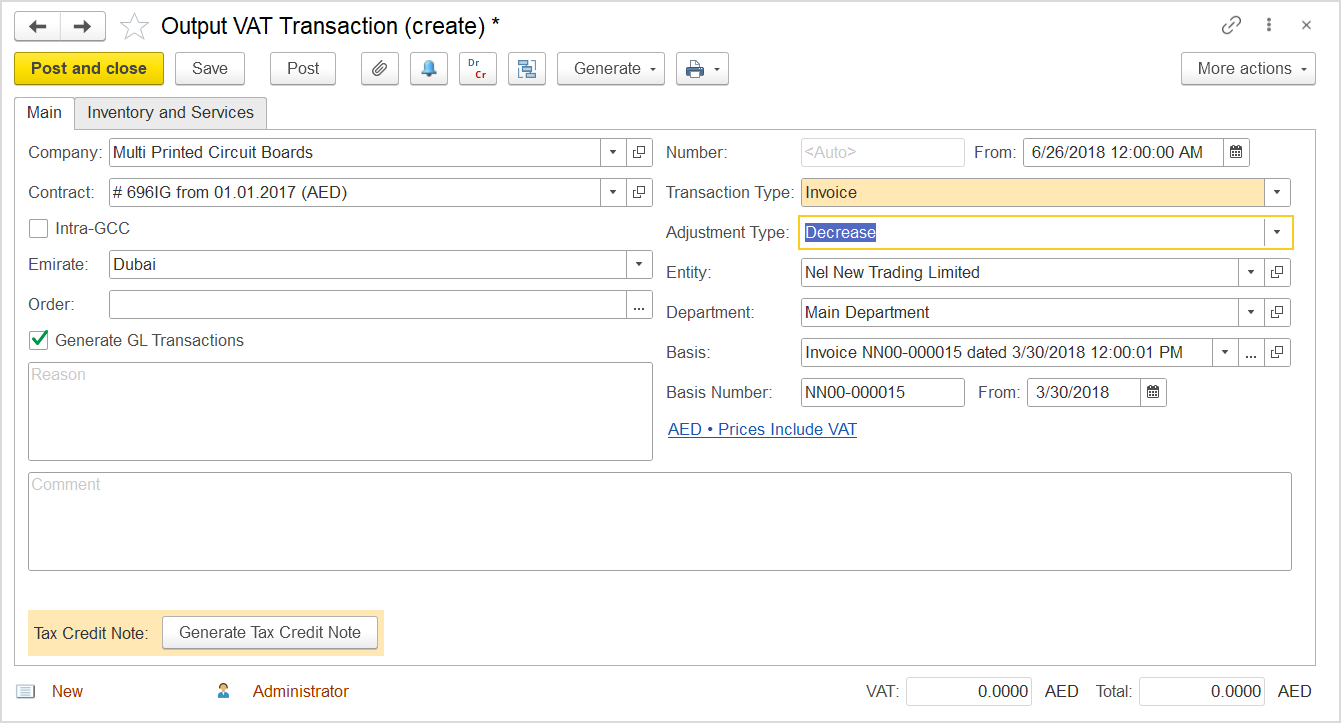

- Click Create to create a new Output VAT Transaction.

- On the Main tab, in the Company box, select the customer.

- In the Transaction Type field, select Invoice.

- In the Adjustment Type field, select Decrease.

- Select the Generate GL Transactions check box.

- Select the original document, Invoice, as a basis.

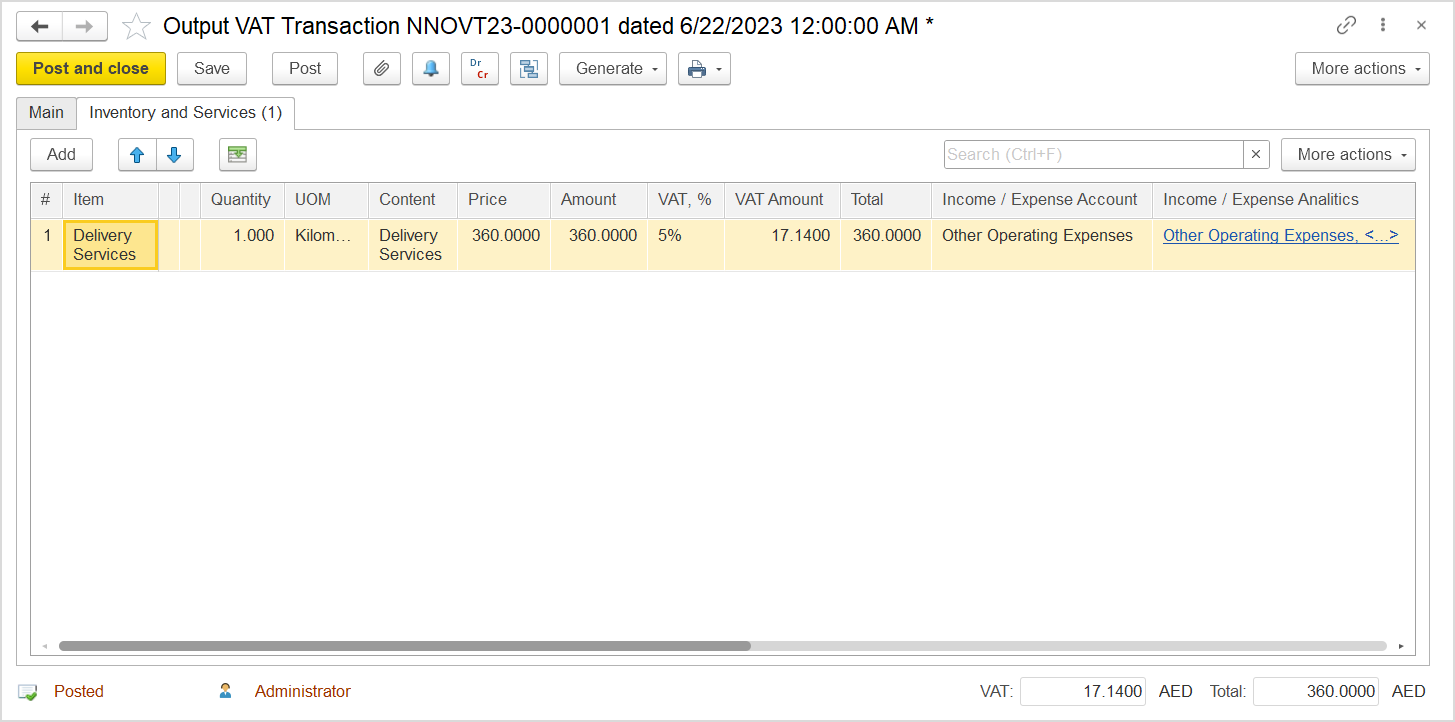

- On the Inventory and Services tab, click Add to append a new line.

- Add the items for which correction is needed.

- In the Amount column, enter the amount from the original invoice.

- In the Income / Expense Account column, select the income account from the original invoice.

- In the VAT, % column, select the standard rate that was used in the original invoice. Make sure that the same (as in the Invoice) option, Prices Do Not Include VAT or Prices Include VAT, is selected.

- Make sure that the VAT amount is exactly the amount from the basis.

- Click Post to register the document in the system.

- On the Main tab, notice the Generate Tax Credit Note button. Click it to generate the tax document or on the toolbar click Generate > Tax Credit Note.

II. Where: Taxes > Tax Documents > Output VAT Transactions

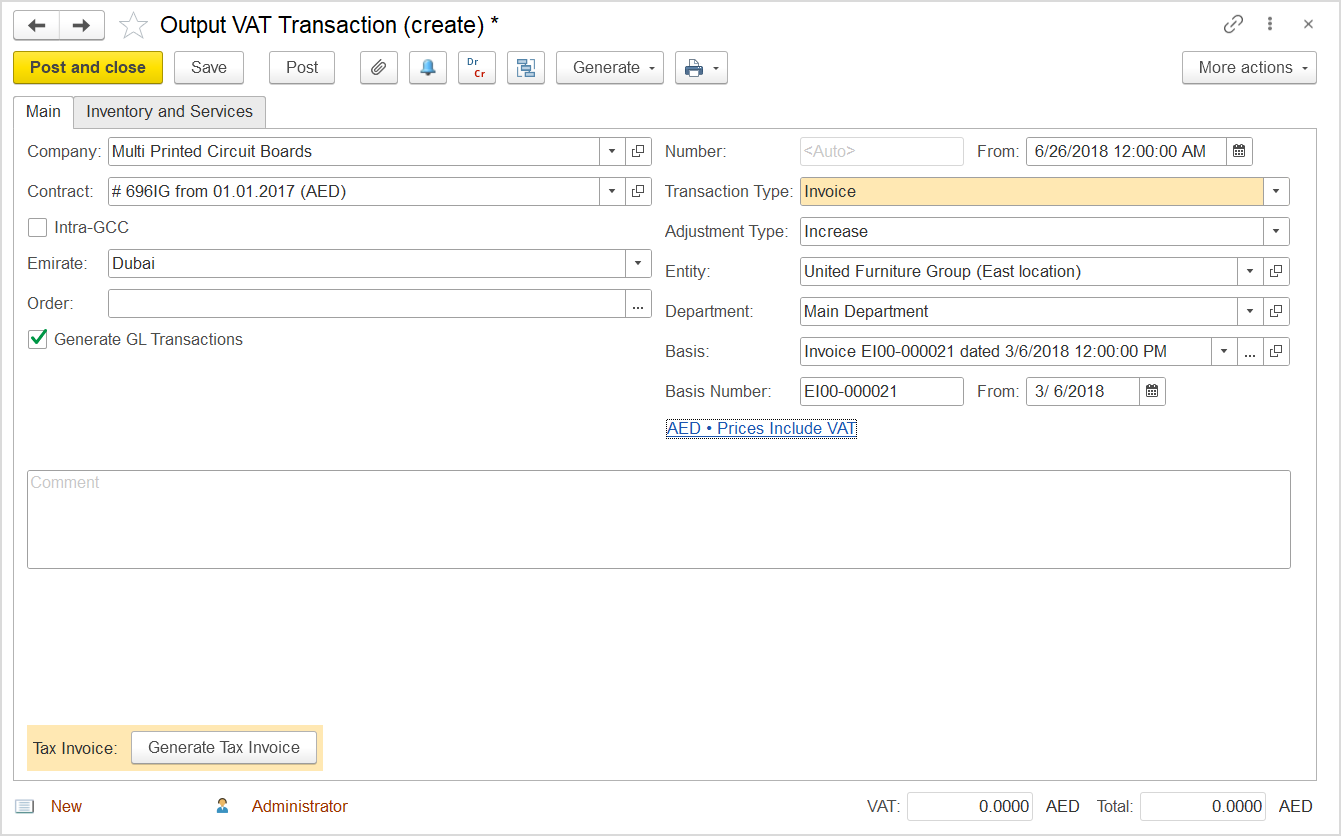

- Click Create to create a new Output VAT Transaction.

- In the Company box, select the customer.

- In the Transaction Type field, select Invoice.

- In the Adjustment Type field, select Increase.

- Select the Generate GL Transactions check box.

- Make sure that the Prices Do Not Include VAT option is selected.

- Select the original document, Invoice, as a basis.

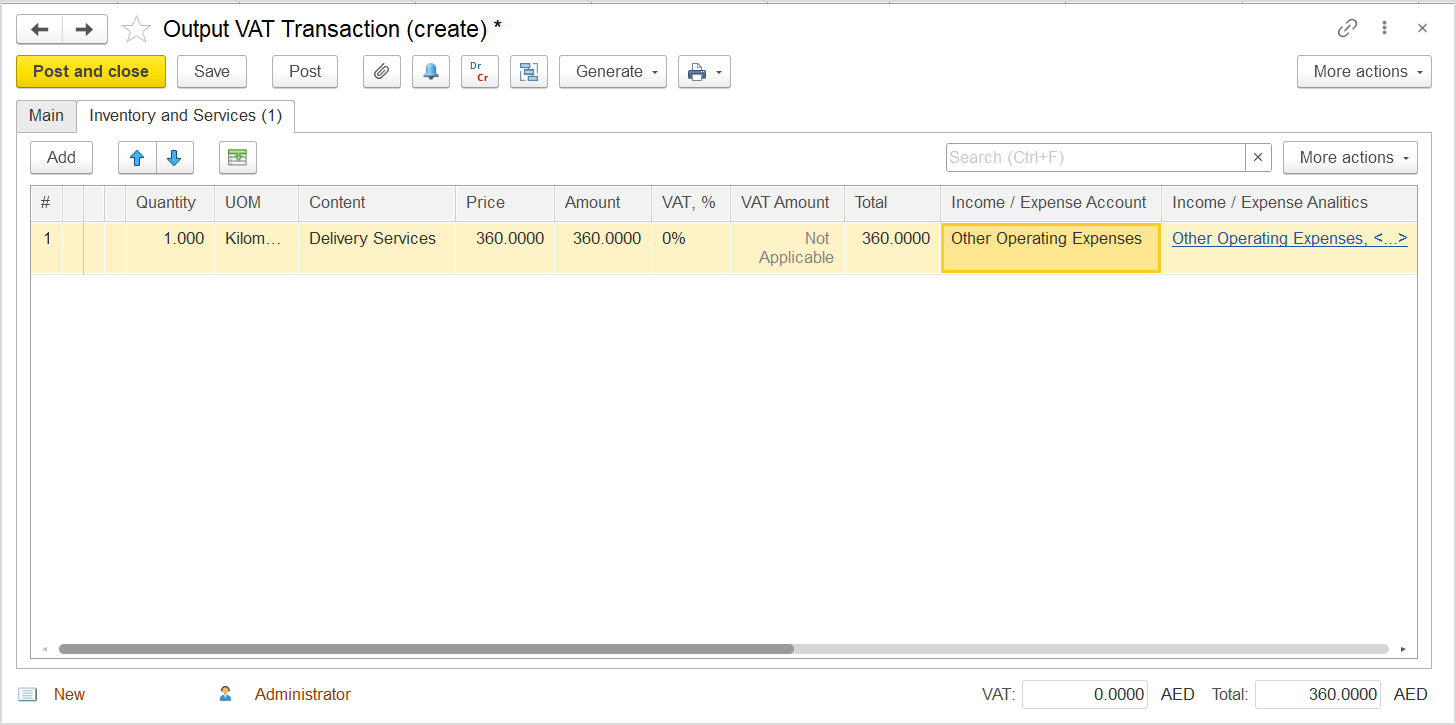

- On the Inventory and Services tab, click Add to append a new line.

- Add the items for which correction is needed.

- Make sure that the taxable amount is correct and the applied VAT rate is now 0% (or exempt).

- Click Post to register the document in the system.