An employee had purchased specific services from outside of the UAE (a foreign country service provider or supplier) and specified this purchase on the Employee Expense Report. The entity can recover the input VAT on this service according to the Reverse Charge Mechanism. For this, the entity has to create the following documents:

- Employee Expense Report which reflects the purchase

- Input VAT Transaction based on the Employee Expense Report

- Tax Invoice Received based on the Input VAT Transaction

- Output VAT transaction based on the Employee Expense Report

How to process

Where: Money > Cash Documents > Employee Expense Reports

Prepare an expense report for the employee who has received an advance amount intended for purchasing specific services outside of the UAE. In the new expense report created for the employee with cash or bank payment as a basis, make sure Out of Scope is selected as Taxation option. For more details, see Creating an Employee Expense Report.

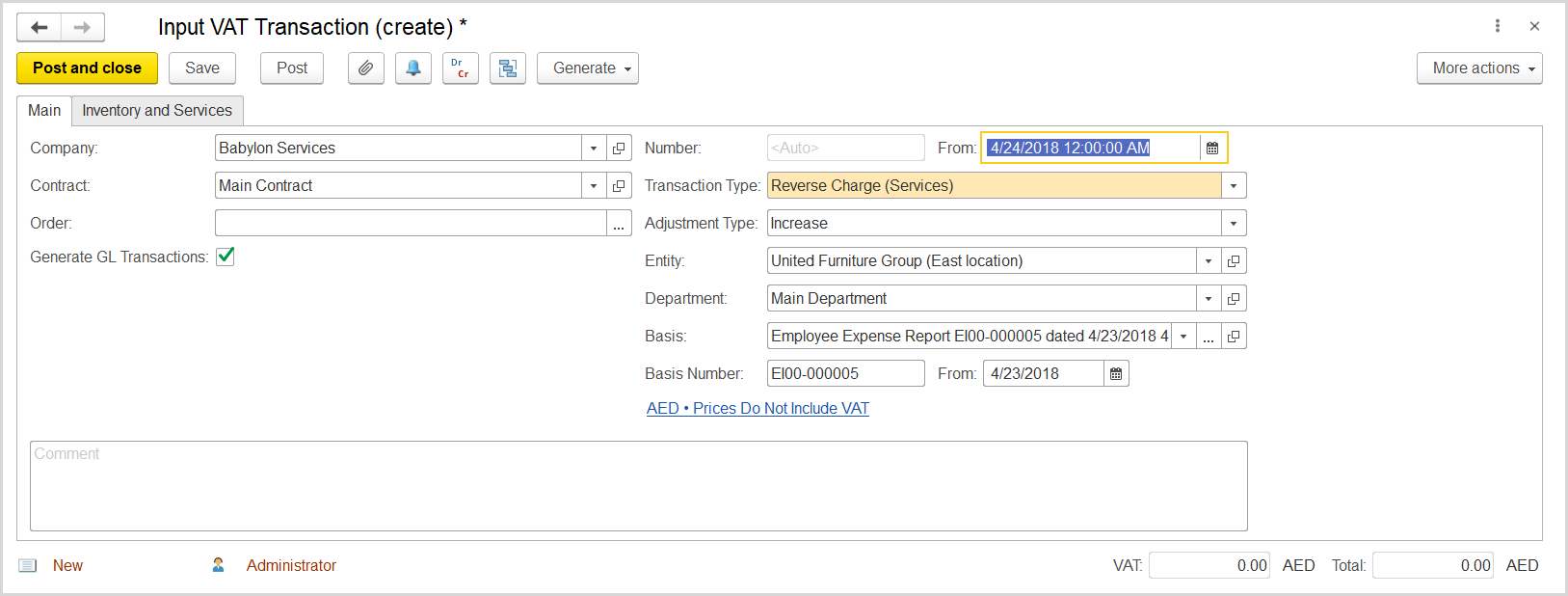

Where: Taxes > Tax Documents > Input VAT Transactions

Create an Input VAT Transaction based on the Employee Expense Report as follows:

- Click Create to create a new Input VAT Transaction.

- In the Company box, select the supplier.

- In the Transaction Type field, select Reverse Charge (Services).

- In the Adjustment Type field, select Increase.

- Make sure the correct entity is specified in the Entity field.

- In the Department field, select the department associated with the transaction.

- Make sure the link (below the fields) contains Prices Do Not Include VAT. Otherwise, click the link to open the Prices and Currency dialog box, clear the Prices Include VAT check box there, and close the dialog box.

- In the Basis field, select the employee's expense report in question.

- Click Save to assign the number to this transaction.

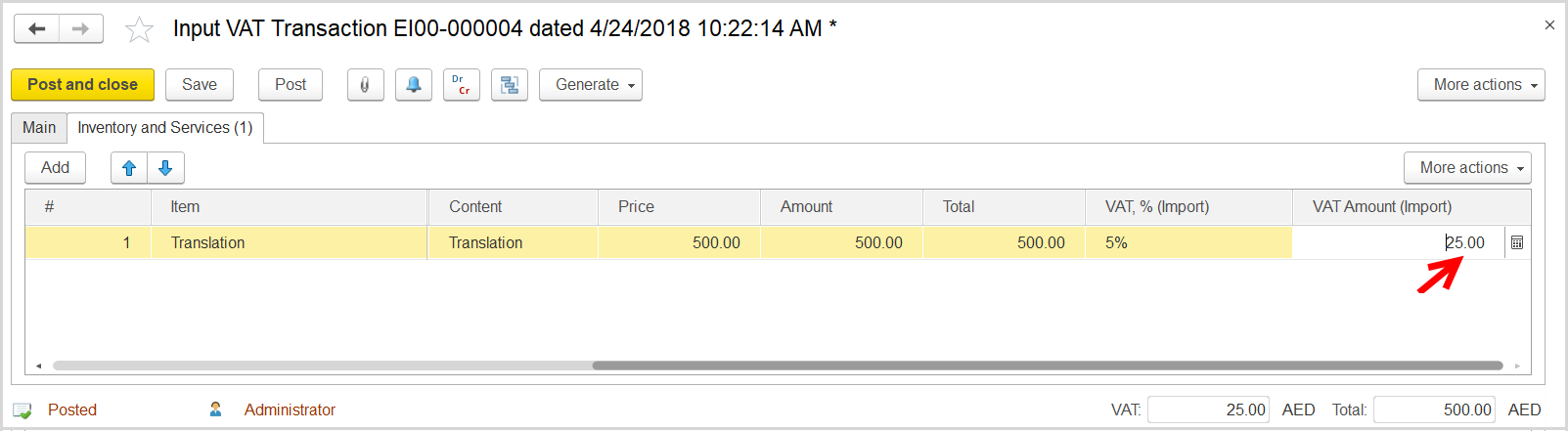

- On the Inventory/Services tab, click Add to append a new line.

- Select the service purchased by the employee.

- In the Amount column, enter the service amount.

- In the VAT Amount (Import) column, notice the reverse tax amount calculated on the service amount.

- Click Post to register the document in the system.

- Click the Generate button to open the drop-down list of options. Select Tax Invoice Received. The newly generated Invoice Received opens. It contain all the information from the Input VAT Transaction.

- Click Save and close to register the document in the system and close it.

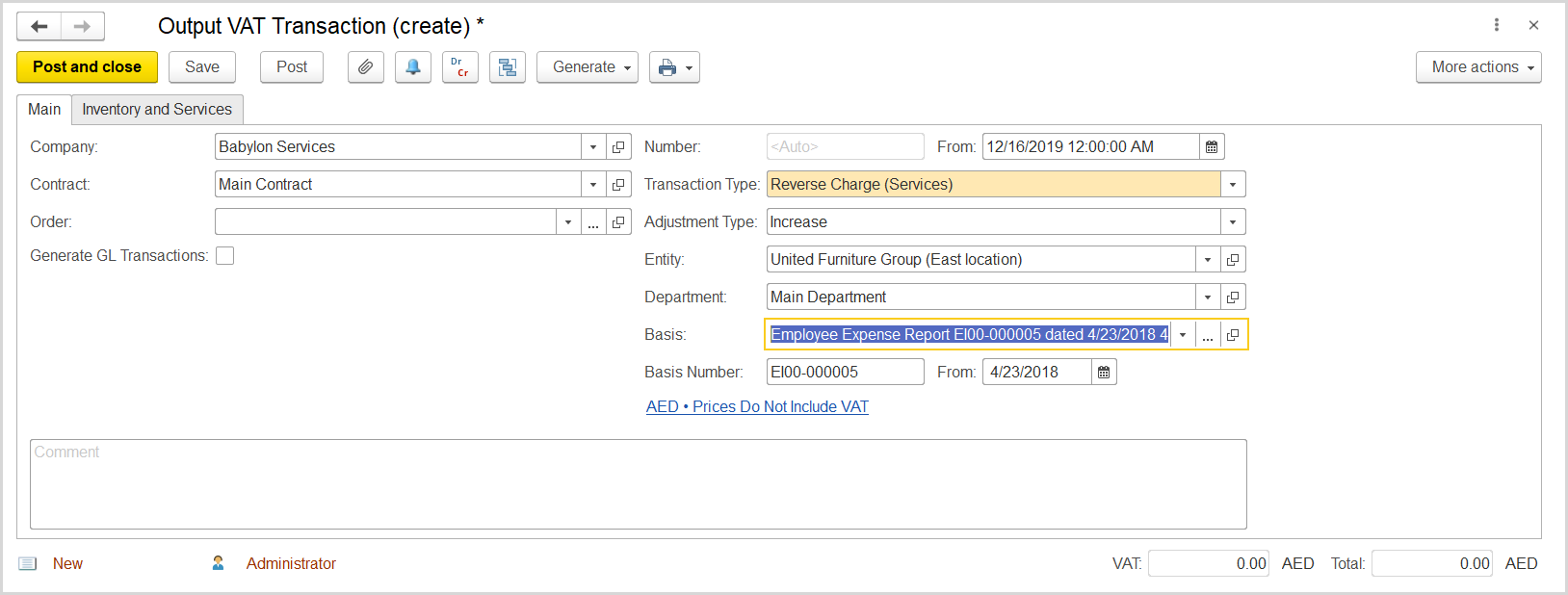

Where: Taxes > Tax Documents > Output VAT Transactions

Create an Output VAT Transaction based on the Employee Expense Report as follows:

- Click Create to create a new Output VAT Transaction.

- In the Company box, select the company from which the service was purchased.

- In the Transaction Type field, select Reverse Charge (Services).

- In the Adjustment Type field, select Increase.

- Make sure the link below the fields contains Prices Do Not Include VAT. Otherwise, click the link to open the Prices and Currency dialog box, clear the Prices Include VAT check box there, and click OK to close the dialog box.

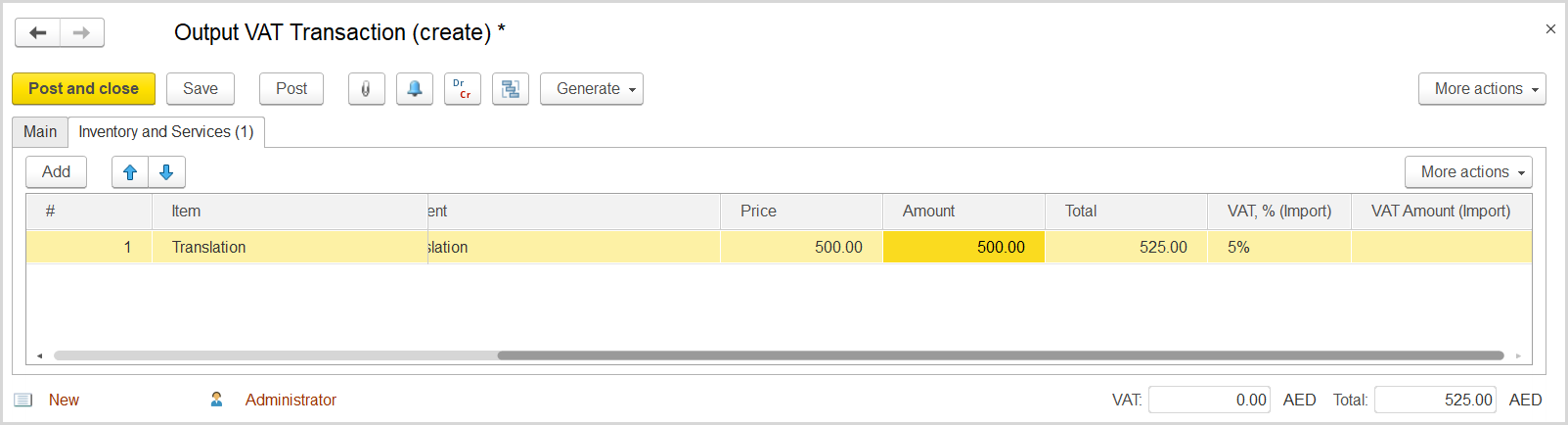

- On the Inventory/Services tab, click Add to append a new line.

- In the Contents column enter any comment to the transaction, for instance Reverse Charge on service.

- In the Amount column, enter the service amount from the expense report.

- In the VAT, % column, select the standard rate, 5%.

- Click Post to register the document in the system.