To access the Bank Payments document list, go to Money > Bank Documents > Bank Payments.

Bank Payments are created when you need to register any payments made by your company from its bank account, for instance payments to suppliers for supplied goods and services rendered, customer refunds, advances to employees to reimburse their business expenses, and so forth.

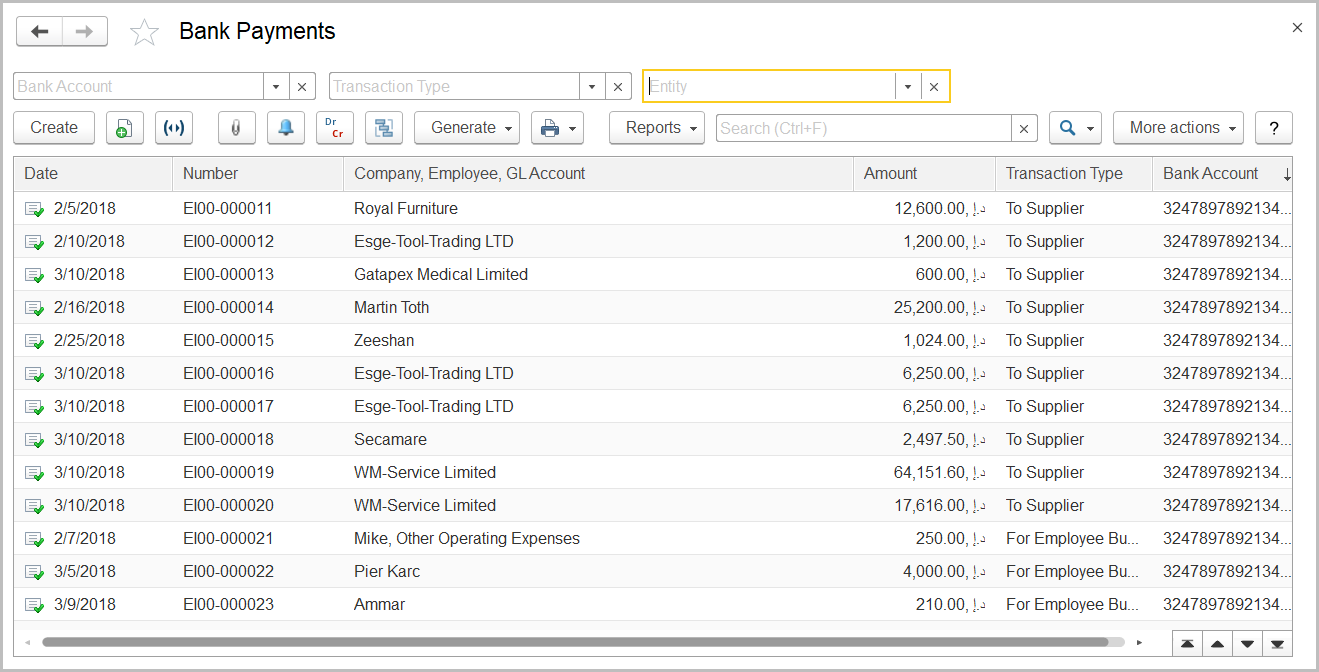

The Bank Payments list

The list of bank payments includes all the bank payments available in the system. You can filter the list by bank account, entity, and transaction type by using the fields above the toolbar. If you don't see a specific document, rearrange the list by date or document number or use the Search field to locate the document by a string in its description, or bank name. You can change the list display settings to suit your particular needs. To learn more about the list display settings, see Working with the item list.

Bank payments can be based on documents of multiple types depending on the transaction type.

The following types of bank payments are available in the system (some of the transaction types are available if the specific features are turned on):

- To Supplier: To register the payment made to supplier from your company's bank account. As the basis, documents of the following types can be used: Invoice Received, Purchase Order, and Additional Expenses.

- To Customer: To register any refund made to customer from your company bank account. As the basis, Credit Notes can be used.

- Loan To Employee: To register the funds paid out to an employee as the loan principal amount (documents of this type are available if the Enable Loans to Employees option is selected on the Administration > Settings > Setting: HR & Payroll form). As the basis document, Loan to Employee can be used.

- Salary: To register the payments made to the company employees as their salaries for the pay period. As the basis, a document of the Payroll Sheet type can be used.

- For Employee Business Expenses: To register the advance payments to employees for their incoming business expenses.

- Repayment of Loan Received: To register the repayment installments made to a company that lent the funds to your company (documents of this type are available if the Enable Long-Term Credits and Loans option is selected on the Administration > Settings > General Settings form).

- Loan Issued: To account for funds received from another company as a long-term loan (documents of this type are available if the Enable Long-Term Credits and Loans option is selected on the Administration > Settings > General Settings form).

- Tax Payment: To account for the VAT amounts paid to FTA.

- Other: To register the funds moved from the bank account as the result of other transactions.

Bank payments can be used as a basis for documents of the following types:

- Employee Expense Report: To register in the system the list of business expenses paid with the advance received by the employee.

- Tax Invoice Received: To register the recoverable VAT amount paid to the supplier with advance payments or payments for supplies and services.

- Tax Credit Note: To register the output VAT amount on customer refunds.

The toolbar buttons

To create a document based on a bank payment, select the appropriate bank payment from the list, click the Generate button and select the required document type. The data from the bank payment will be automatically copied to the new document.

To manually create a new document of the Bank Receipt type, click the Create button on the toolbar.

To edit an existing document, double-click the line with the document in the Bank Payments list. You can also select the line, right-click it, and select Edit or click More actions > Edit on the toolbar.

If you need to print the selected document, send it by email, or perform other operations, refer to List Toolbar.

See also