If the bonus/rebate amount is greater than the amount that our company owes to the supplier, then the difference might be considered an advance payment. If the supplier provided us with proper tax invoice, we can adjust the recoverable VAT according to the projected advance amount.

| A Rebate (bonus) is created as a Debit Note (Transaction Type = Mutual Settlements Adjustment) with the bonus amount. |

|---|

How to process

Where: Accounting > Value Added Tax > Input VAT Transactions

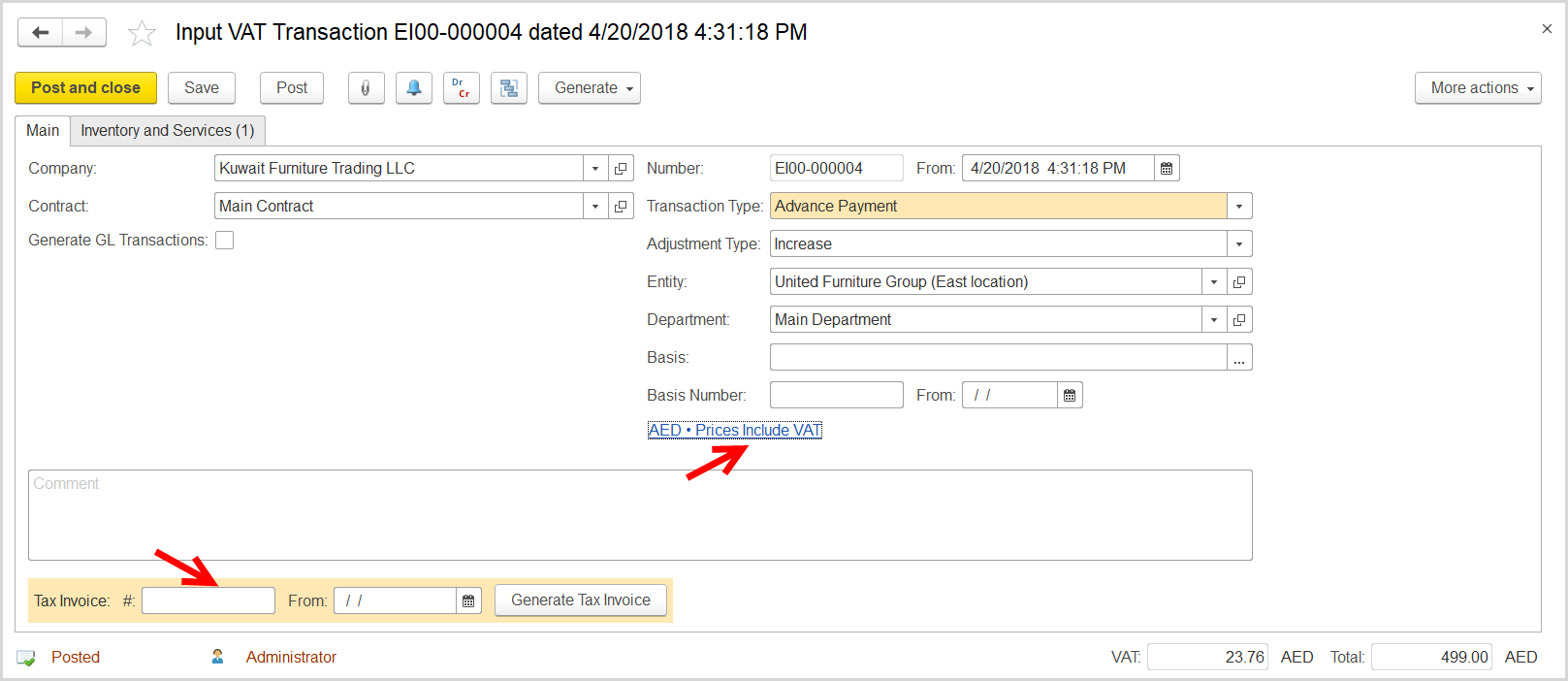

- Click Create to create a new Input VAT Transaction.

- In the Company box, select the supplier.

- In the Transaction Type field, select Advance Payment.

- In the Adjustment Type field, select Increase.

- Make sure the link below the fields contains Prices Include VAT. Otherwise, click the link to open the Prices and Currency dialog box, select the Prices Include VAT check box there, and close the dialog box.

- Click Save to assign the number to this document.

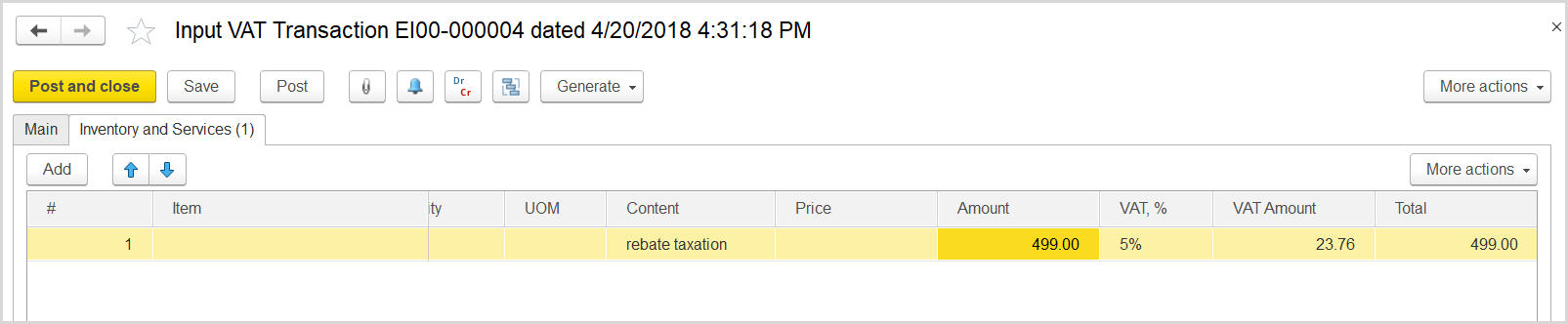

- On the Inventory/Services tab, click Add to append a new line.

- In the Contents column enter any comment to the transaction, for instance rebate taxation.

- In the Amount column, enter the bonus amount minus the amount that the company owes to the supplier.

- Click Post to register the document in the system.

- At the bottom of the Main tab, enter the number and date of the tax invoice received from the supplier. Click the Generate Tax Invoice button. A link to the generated tax invoice received appears.