...

I. Create an Output VAT Transaction with the Decrease transaction adjustment type to roll back the taxable and tax amounts of the incorrect original Invoice. Also, generate a Tax Credit Note.

II. Create an Output VAT Transaction with the Increase transaction adjustment type to restore the correct taxable and tax amounts in the database.

...

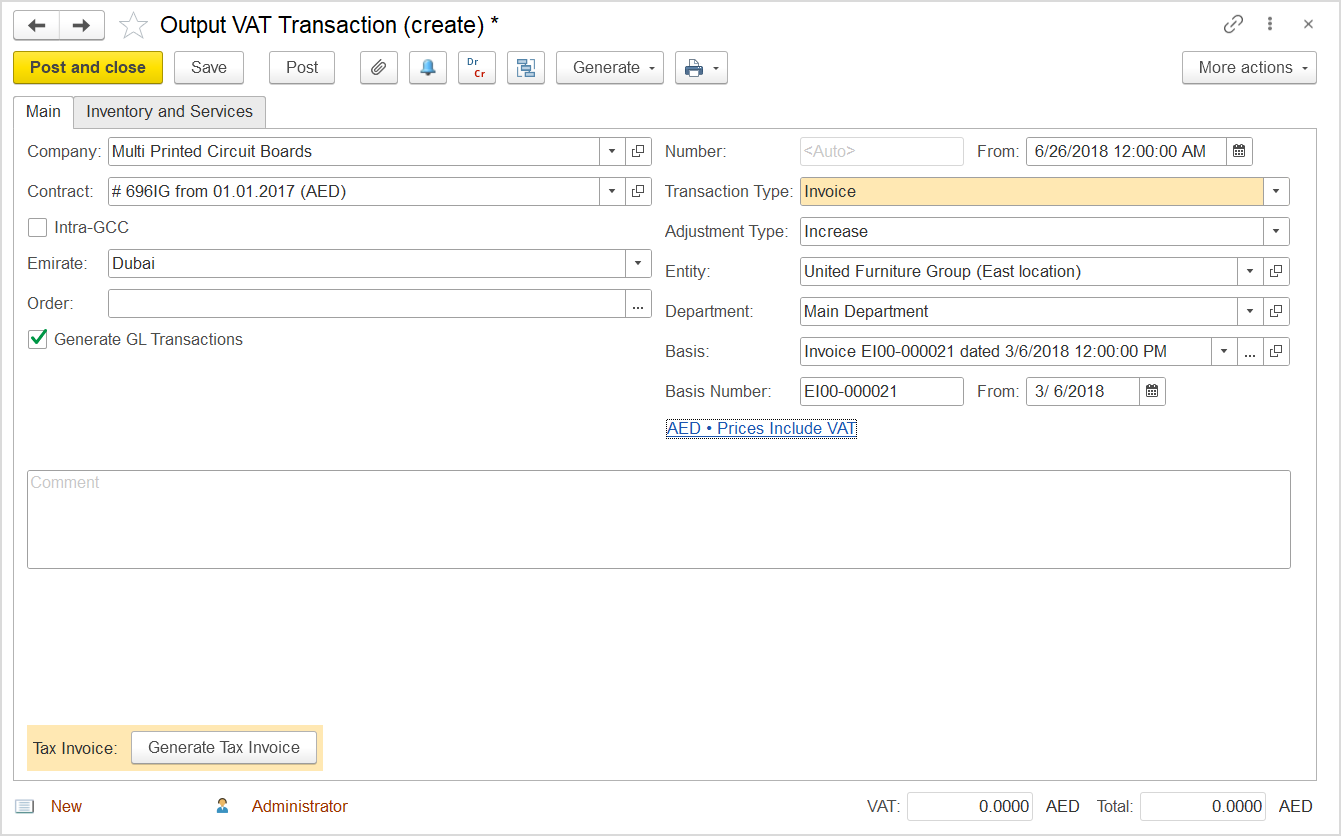

- Click Create to create a new Output VAT Transaction.

- In the Company box, select the customer.

- In the Transaction Type field, select Invoice.

- In the Adjustment Type field, select Increase.

- Select the Generate GL Transactions check box.

- Make sure that the Prices Do Not Include VAT option is selected.

- Select the original document, Invoice, as a basis.

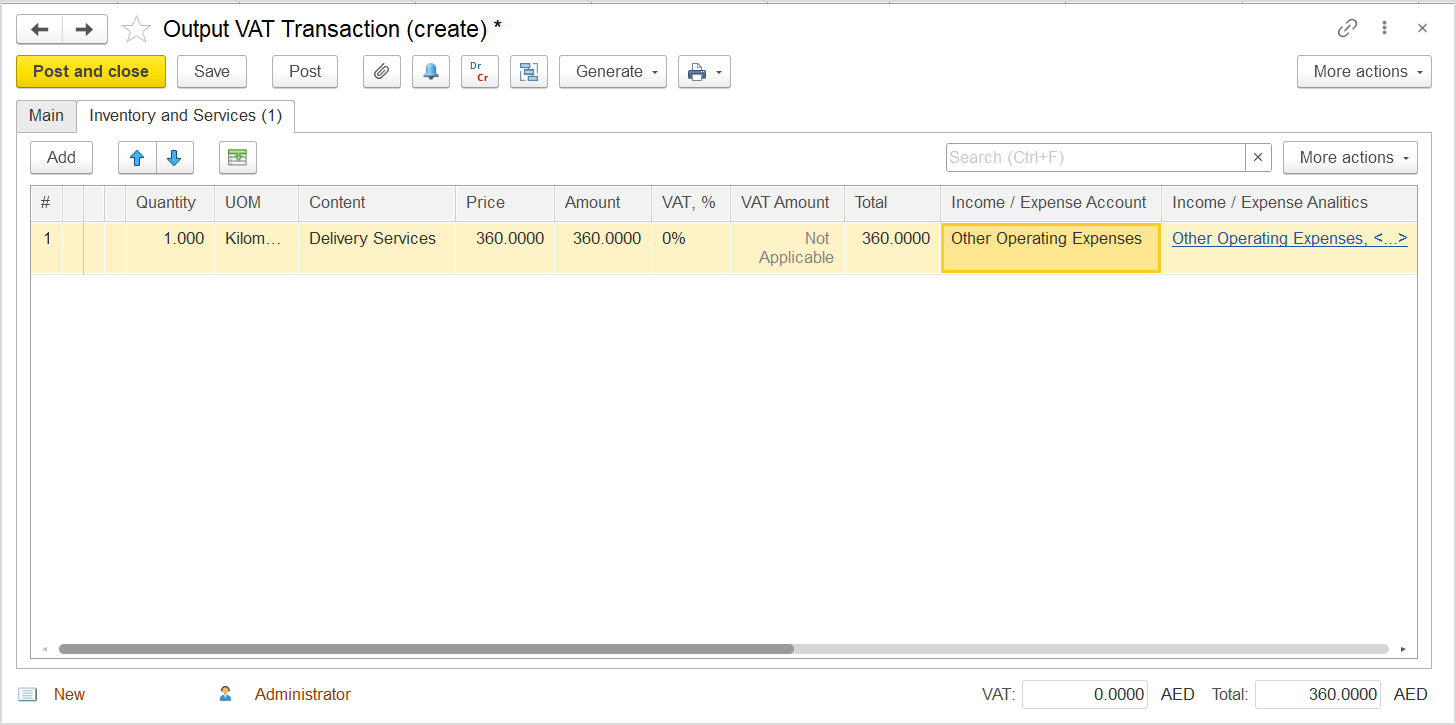

- On the Inventory and Services tab, click Add to append a new line.

- Add the items for which correction is needed.

- Make sure that the taxable amount is correct and the applied VAT rate is now 0% (or exempt).

- Click Post to register the document in the system.

...