To access the FTA Audit File service, go to Taxes > Service Tools > FTA Audit File.

The FTA Audit file service

An FTA Audit file (FAF) can be generated at the end of each tax period for each entity.

Such a file contains all the data of all the entity's transactions incurred in the period. When the FTA is conducting a periodic audit of the company, the FTA Audit files can be used to verify the data shown on the VAT return and confirm that the return has been prepared correctly.

On the form, select the reporting period in the Period field and the entity on behalf of which the FAF file will be generated and uploaded. Then, click Upload on the toolbar.

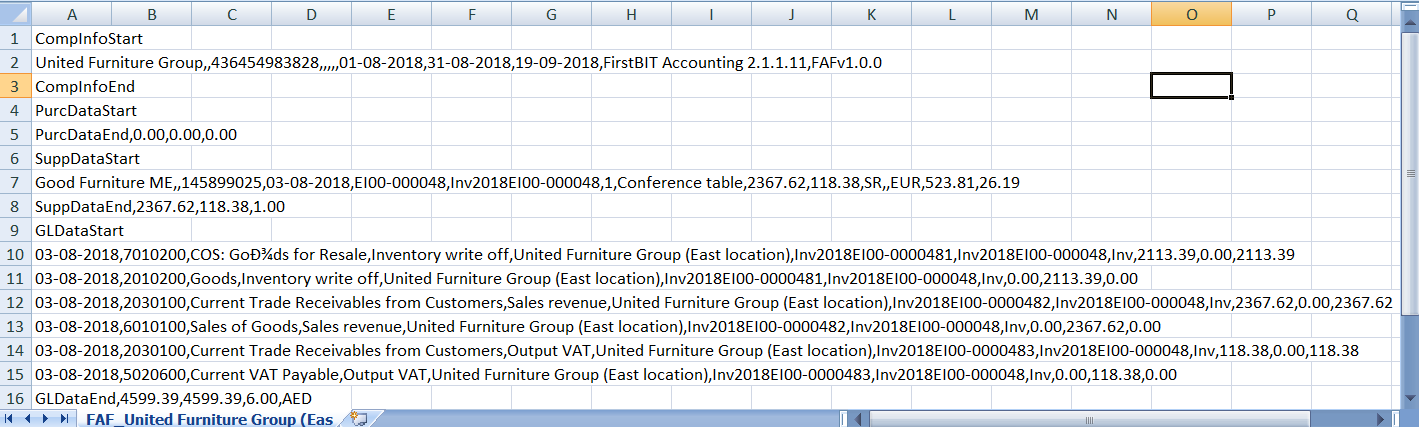

The application prompts you to specify the destination folder for the file. Also, you can change the name of the file. Once the file is downloaded, locate the file and open it in any text editor. The file is exported in the .CSV (comma-separated values) format.

The FAF file

An FTA Audit file captures the following information:

- The entity's details: The entity's or taxable person’s full name in English and in Arabic and TRN (Taxpayer registration number. If tax agent is involved, the agent name, TAN (Tax Agency Number) or TAAN (Tax Agent Approval Number).

- Sales transaction source documents (Invoices, Credit Notes) with all the details: document date and number, emirate of the customer location or country if not the UAE; product /service descriptions and VAT codes; the amount and VAT amount (in both the actual currency and AED); GL journal entries; the payment dates if payment transactions were made.

- Purchase transaction source documents (Invoices Received, Customs Declarations, Debit Notes) with all the transaction details: document date and number; product /service descriptions and VAT codes; the amount and VAT amount (in both the actual currency and AED); GL journal entries; the payment dates if payment transactions were made.

- Customer details: The customer name, address, and TRN if applicable.

- Supplier details: The supplier name, address, and TRN if applicable.