To access the Loan Adjustments document list, go to Accounting > Service Tools > Loan Adjustments.

Documents of this type are available if the Enable Long-Term Credits and Loans option is selected on the Administration > Settings > General Settings form.

A Loan Adjustment is created when your organization needs to register the modifications made to loans, write off some loans, restructure some receivables or payables as loans.

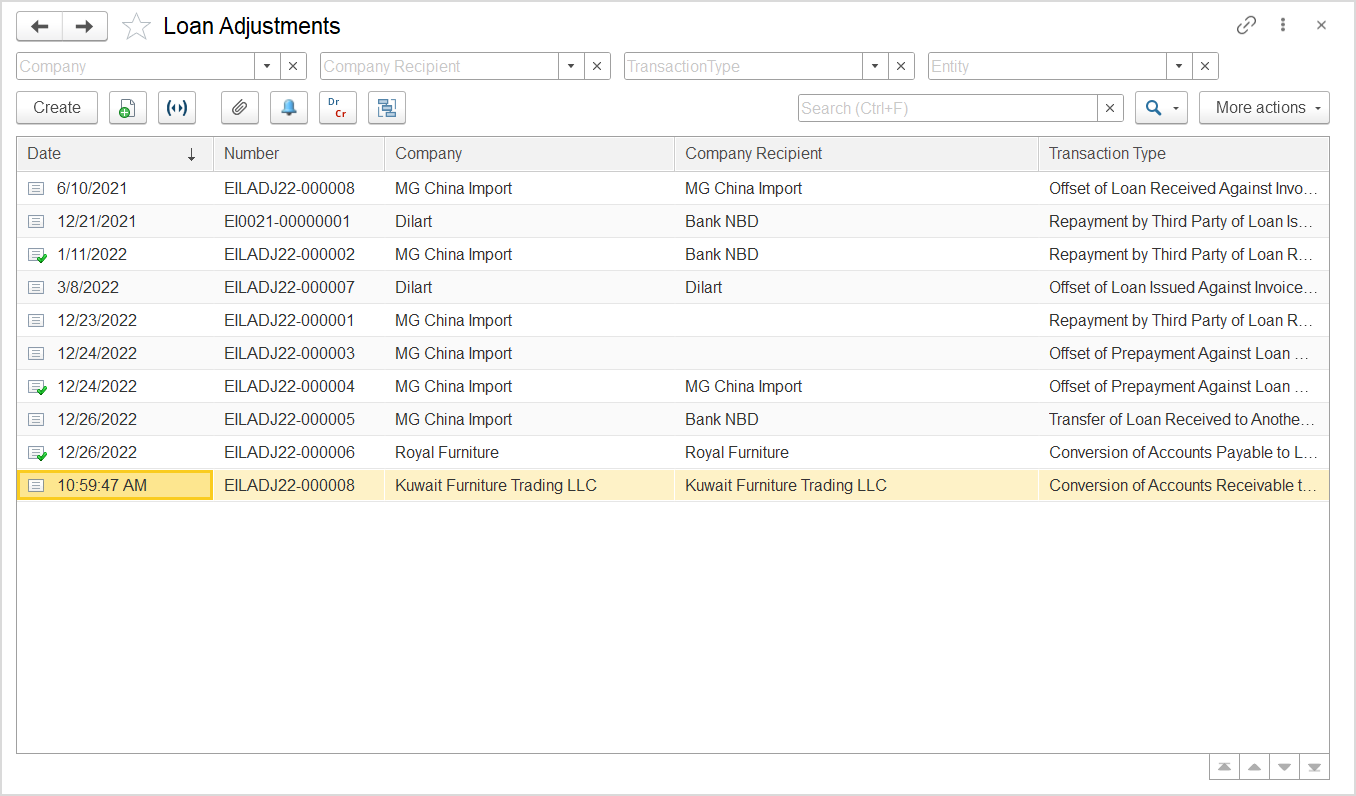

Loan Adjustments

The list of Loan Adjustments includes all the Loan Adjustments available in the system. You can filter the list by entity, company, and transaction type by using the fields above the toolbar. If you don't see a specific document, rearrange the list by date, or document number, or use the Search field to locate the document by its amount. You can change the list display settings to suit your particular needs. To learn more about the list display settings, see Working with the item list.

The following transaction types are available for Loans Issued:

- Offset of Loans Received Against Loans Issued: If you have Loans Received from some company that also received loans from your entity.

- Repayment by Third Party of Loans issued: For cases when a company other than the borrower repays the loans and the interest amounts to the entity.

- Writing off Loans Issued: To be used, for instance, when it is known that the borrower is not able to repay the loan.

- Offset of Prepayment Against Loan Issued: To use a prepayment received earlier from the borrower as a loan repayment.

- Offset of Loan Issued Against Invoice Received: When the borrower makes supplies to the entity to pay off the loan.

- Transfer of Loan Issued to Another Agreement: When it is needed to consolidate multiple loans to the same borrower into one loan or when the loan terms are changed.

- Conversion of Accounts Receivable to Loan Issued: When a customer cannot pay for supplies according to payment terms and agrees to pay the accumulated debt as a loan.

The following transaction types are available for Loans Received:

- Repayment by Third Party of Loan Received: For cases when a company other than the entity repays the loans received by the entity and the interest amounts to the lender.

- Writing off Loan Received: To be used, for instance, when it is known that the lender is out of business and there are no inheritors.

- Offset of Prepayment Against Loan Received: To use a prepayment sent earlier to the lender as a loan repayment.

- Offset of Loan Received Against Invoice: When the entity makes a supply lo the lender to pay off the loan received.

- Transfer of Loan Received to Another Agreement: When it is needed to consolidate multiple loans from the same lender into one loan or when the loan terms are changed.

- Conversion of Accounts Payable to Loan Received: When the entity is not able to pay for supplies according to payment terms and agrees to pay the accumulated debt to the supplier as a loan.

The toolbar buttons

To edit an existing document, double-click the line with the document in the Loan Adjustments list. You can also select the line, right-click it, and select Edit or click More actions > Edit on the toolbar. If you need to print the selected document, send it by email, or perform other operations, refer to List Toolbar.

See also