Problem: How to enter a purchase of fixed assets on bank credit?

Solution: Use a Loan Adjustment document with the transaction type Conversion of Accounts Payable to Loan Received.

An entity uses funds received as a loan to pay off its outstanding debt to a supplier by bank credit. This is typically formalized through a specific transaction type called Conversion of Accounts Payable to Loan Received.

1. Enter the Invoice Received from the Vehicle Supplier

- Go to Purchasing > Purchasing Documents > Invoices Received. Create a new document.

10

- Enter all relevant details in the Main tab, such as company name, warehouse, transaction type, and date of the transaction.

- In the Inventory tab, add the created inventory item, fill in the price, and complete all required fields.

See also: 4.2.3.1. Invoices Received (Receipt From Supplier) - FirstBit User Guide - FirstBit User Guide

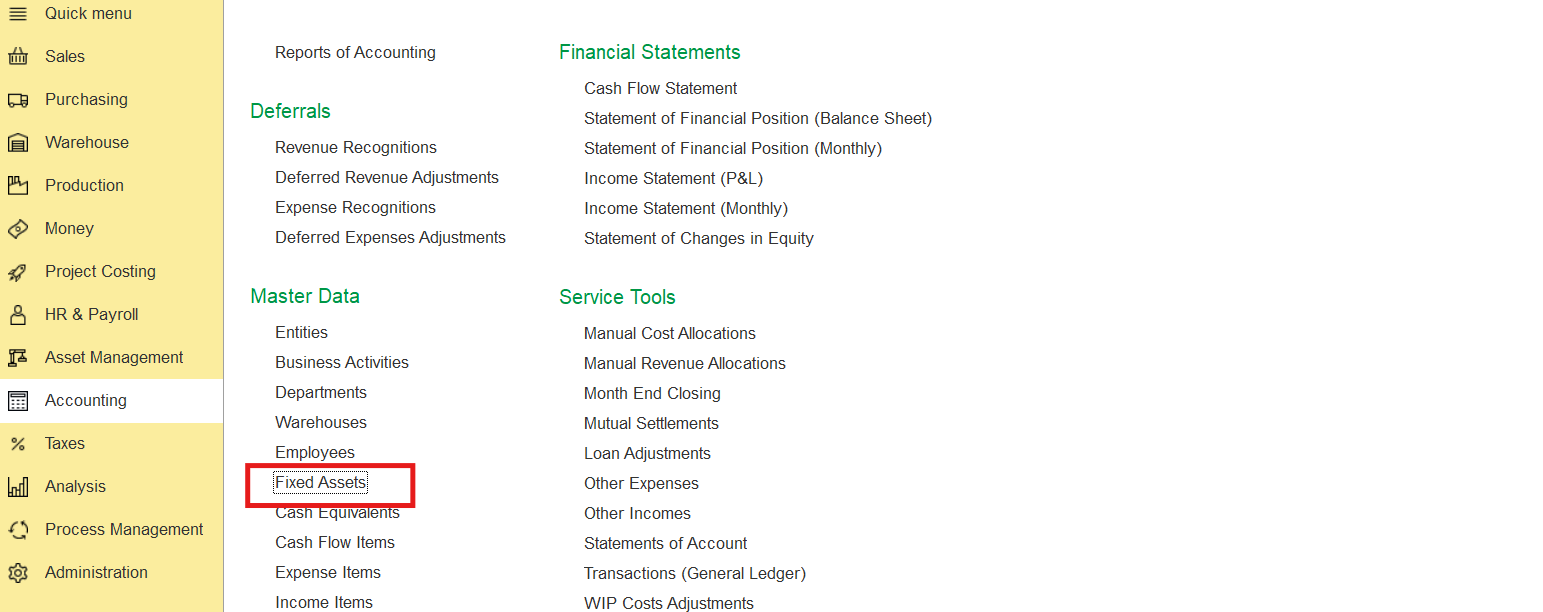

2. Record the Asset in Fixed Assets

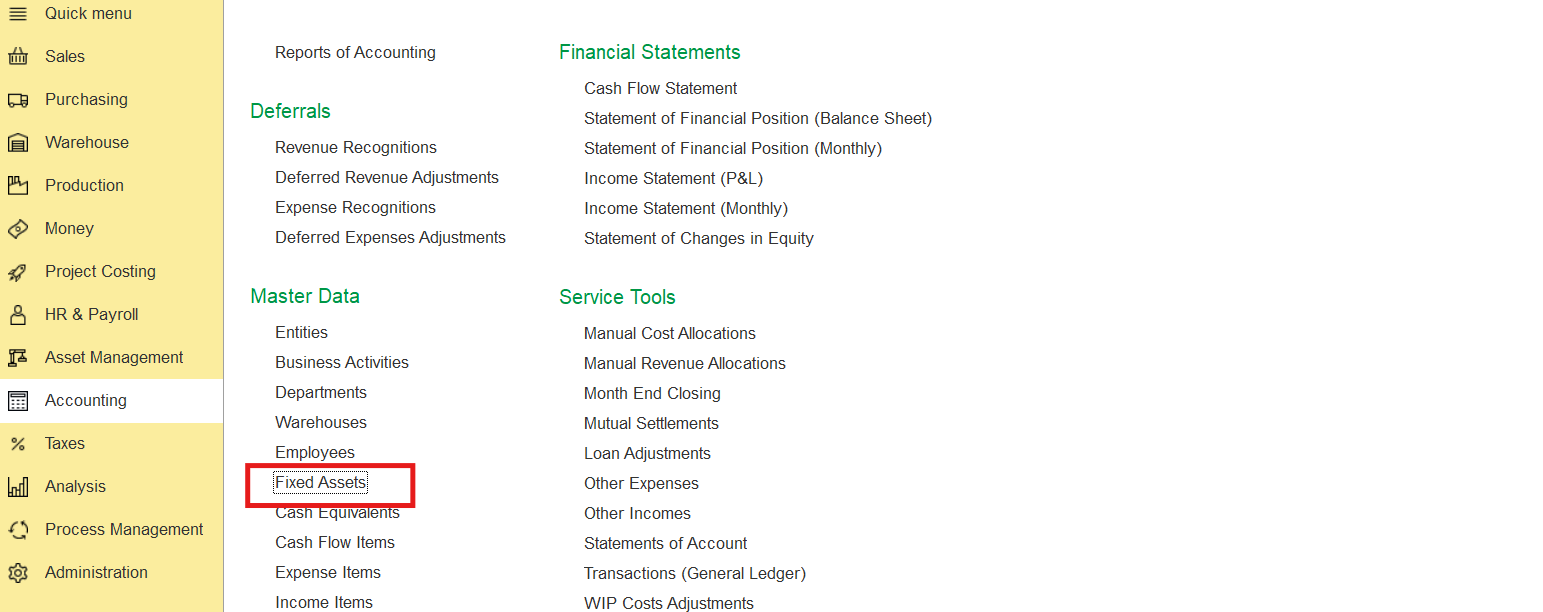

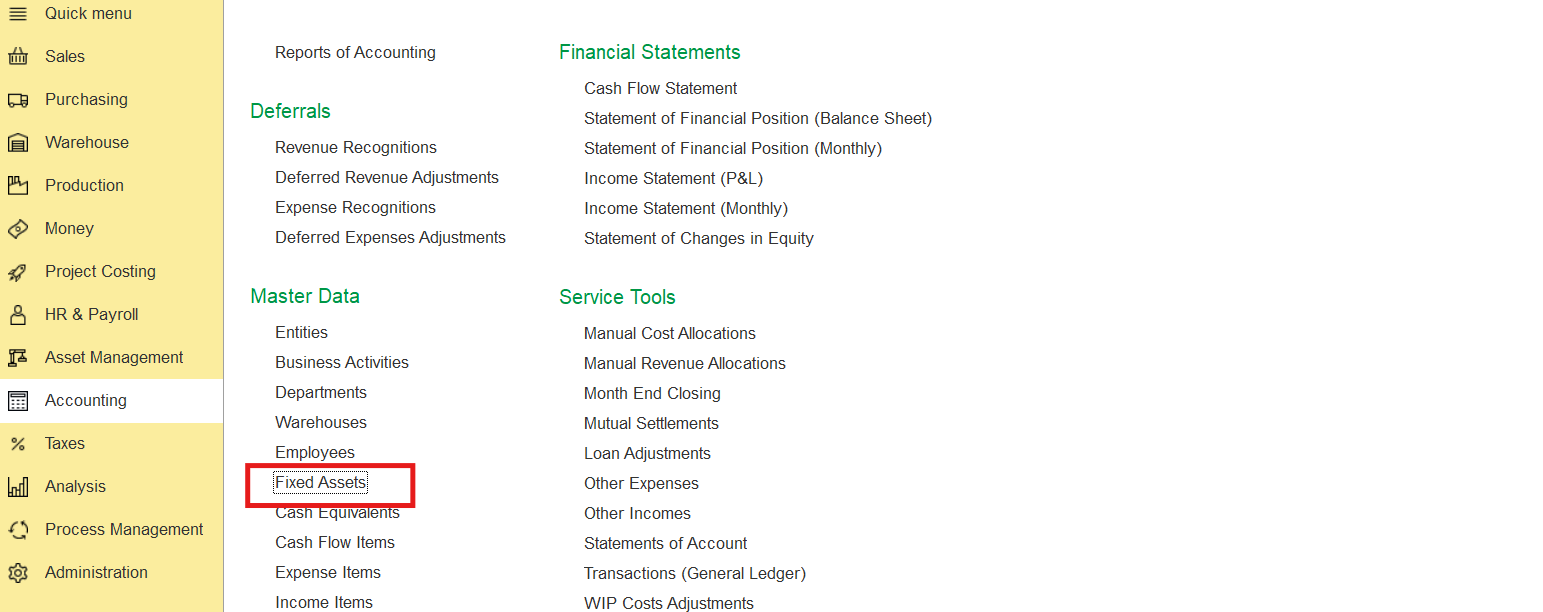

- Go to Accounting > Fixed Assets and create a new asset entry for the vehicle.

- Go to Asset Management > Fixed Asset Documents > Fixed Asset Entries and create a new Fixed Asset Entry.

- Enter all relevant details such as description, inventory number, initial amount (cost), useful life, and depreciation method.

- Post and close the document to activate the asset for accounting and depreciation.

See also: 12.2.1. Fixed Asset Entries - FirstBit User Guide - FirstBit User Guide

3. Create a loan agreement

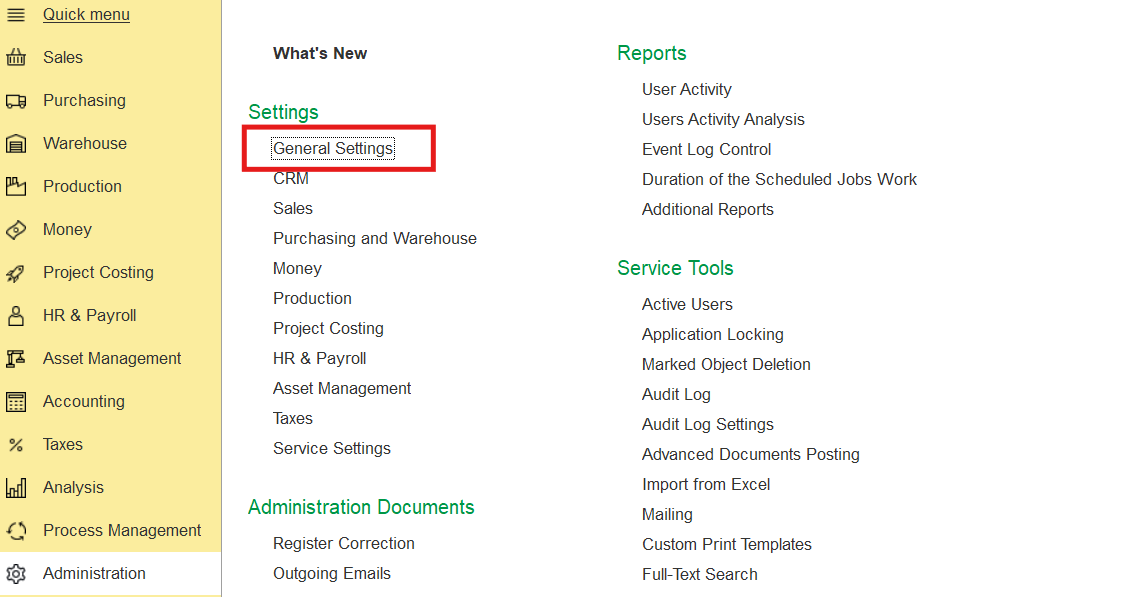

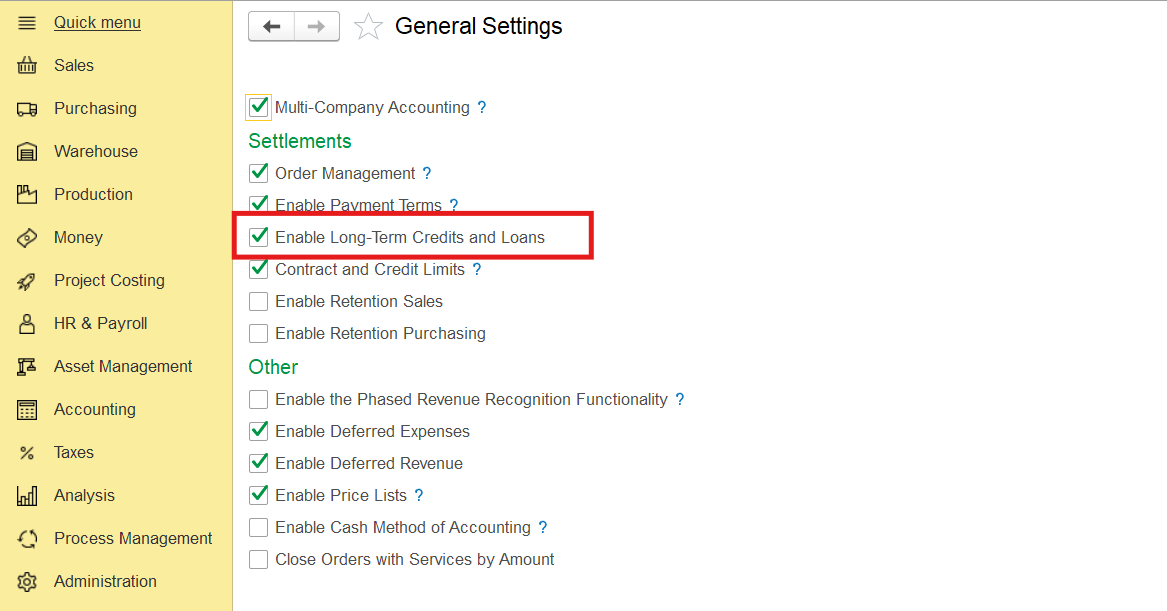

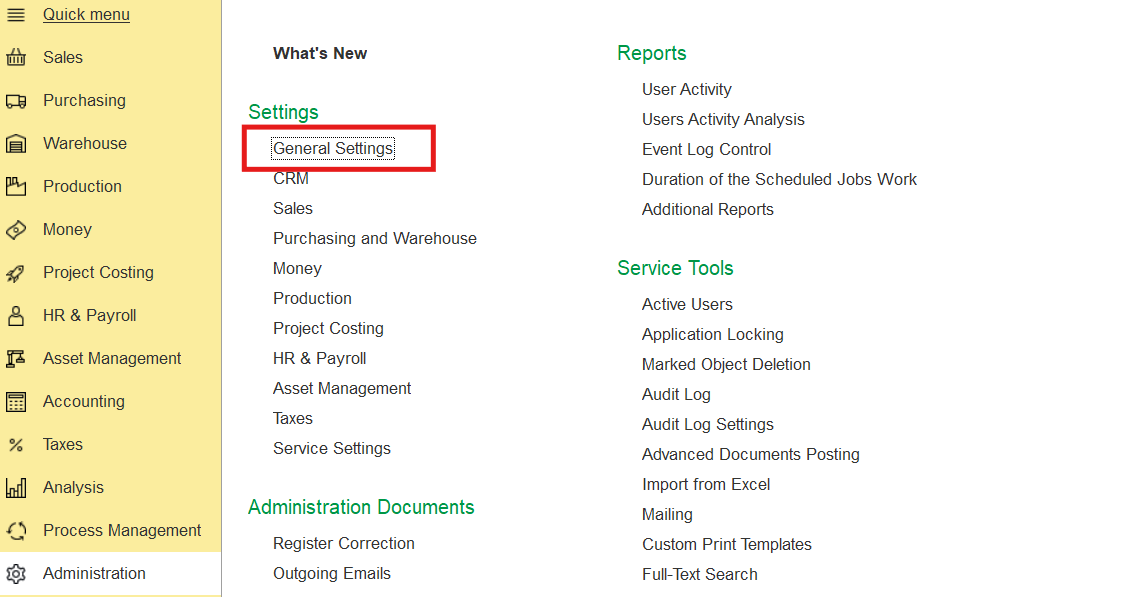

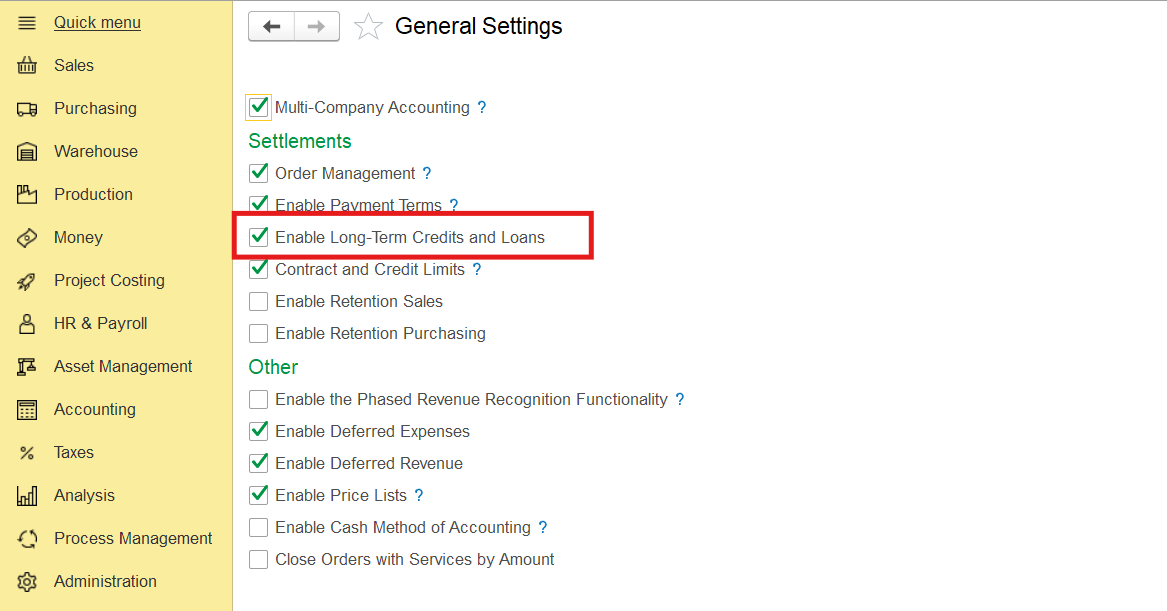

- Enable Loan Agreements: Make sure the "Enable Long-Term Credits and Loans" option is selected in Administration > Settings > General Settings.

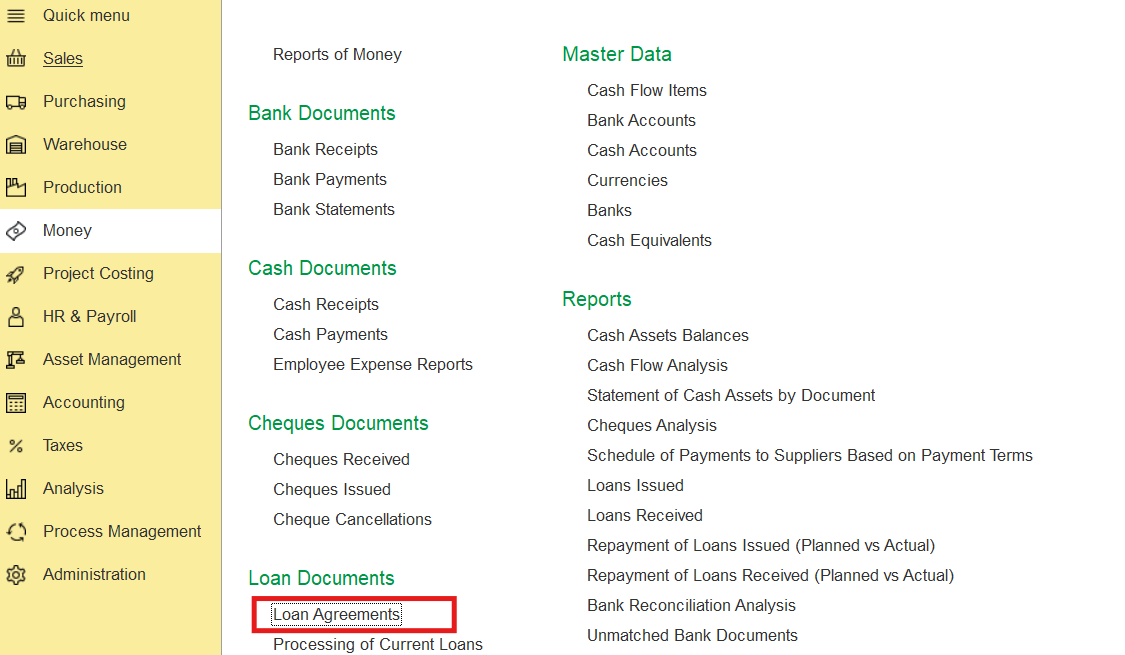

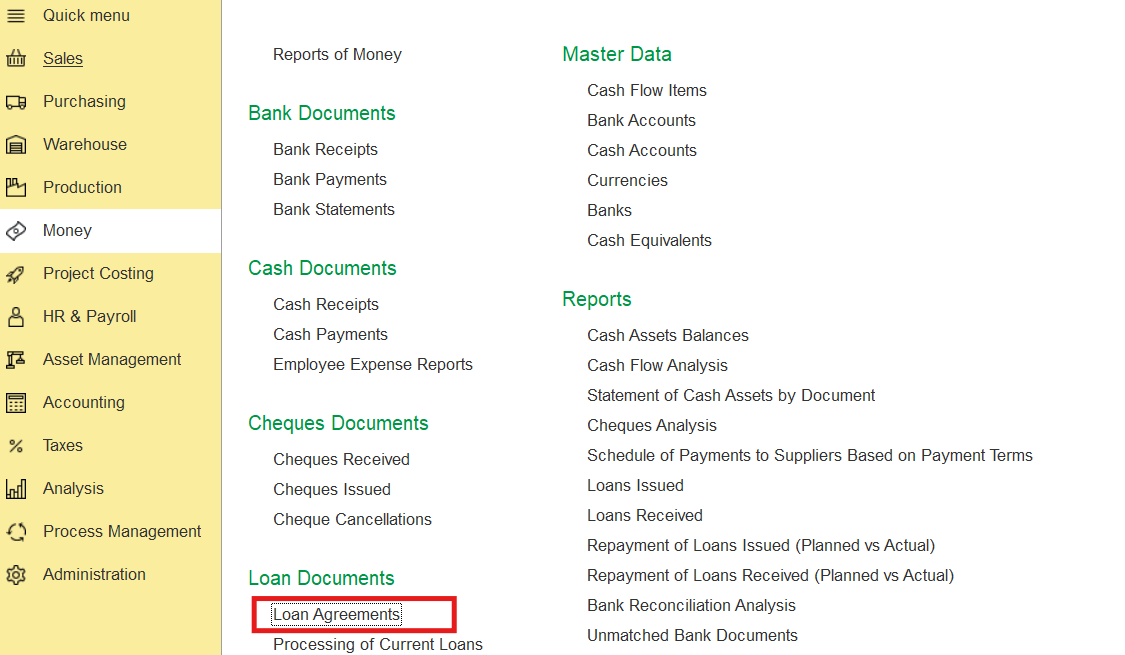

- Go to Money > Loan Documents > Loan Agreements and create a New Loan Agreement.

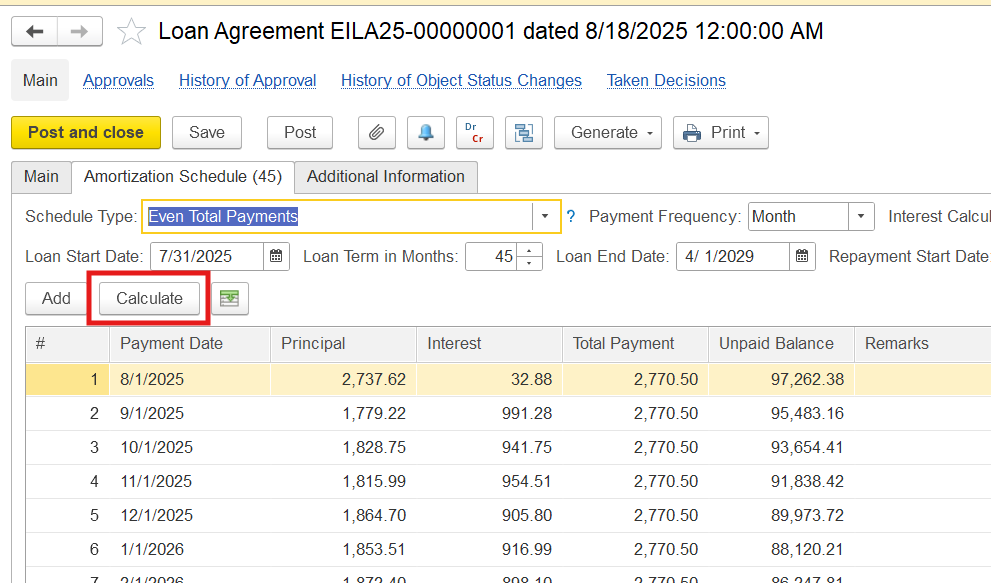

- Enter all relevant details in the Main tab, such as lender, contract, agreement number, loan amount, interest rate, transaction type (choose "Loan Received"), entity, GL accounts, department, business activity, and expense item.

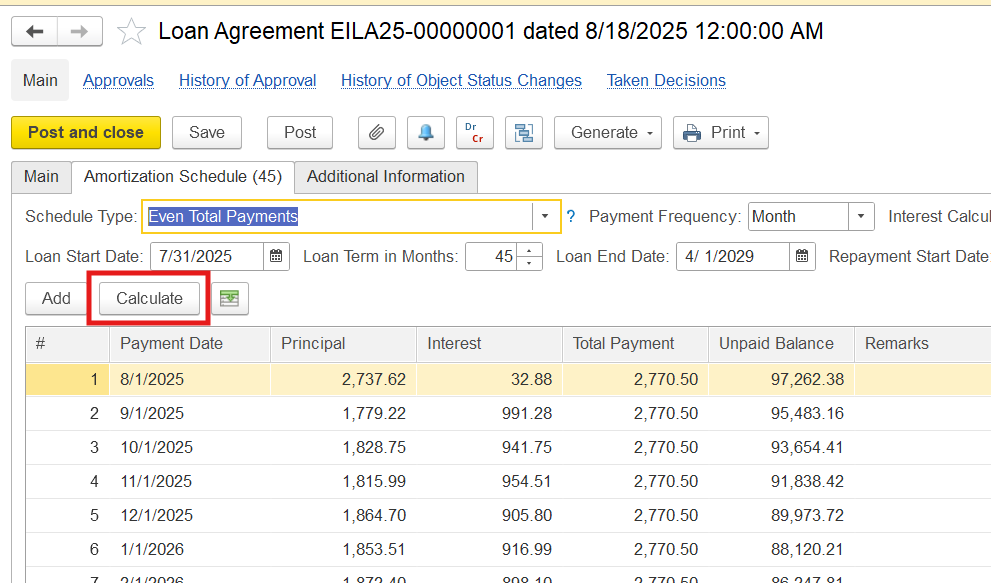

- On the Amortization Schedule tab, select the schedule type (e.g., Custom Schedule if the Bank’s repayment schedule is different from any suggested option for calculation), the payment frequency, the loan start and end dates, and the repayment start date.

- Click Calculate and after entering all required data, click the Save button.

See also: 6.6.1. Loan Agreements - FirstBit User Guide - FirstBit User Guide

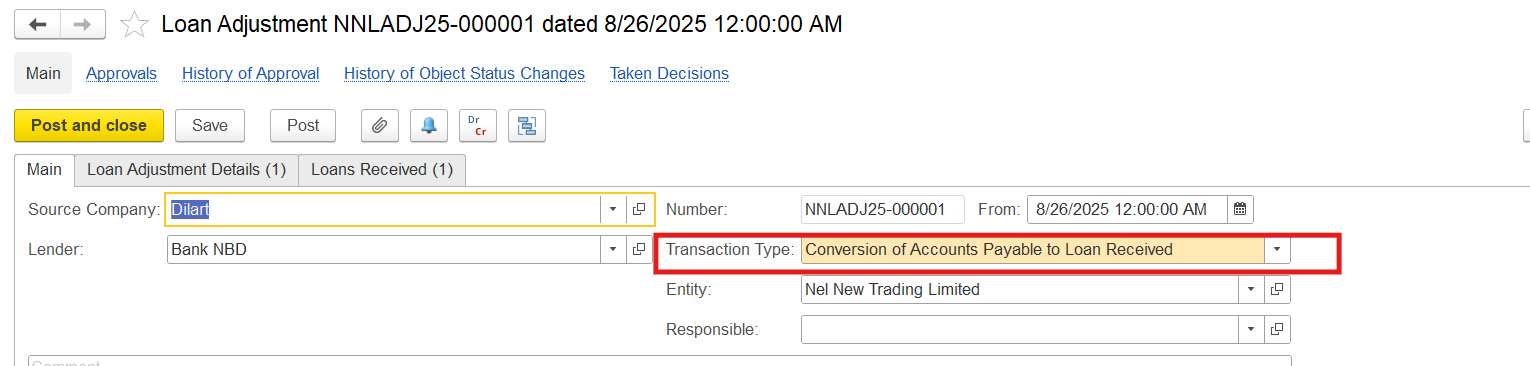

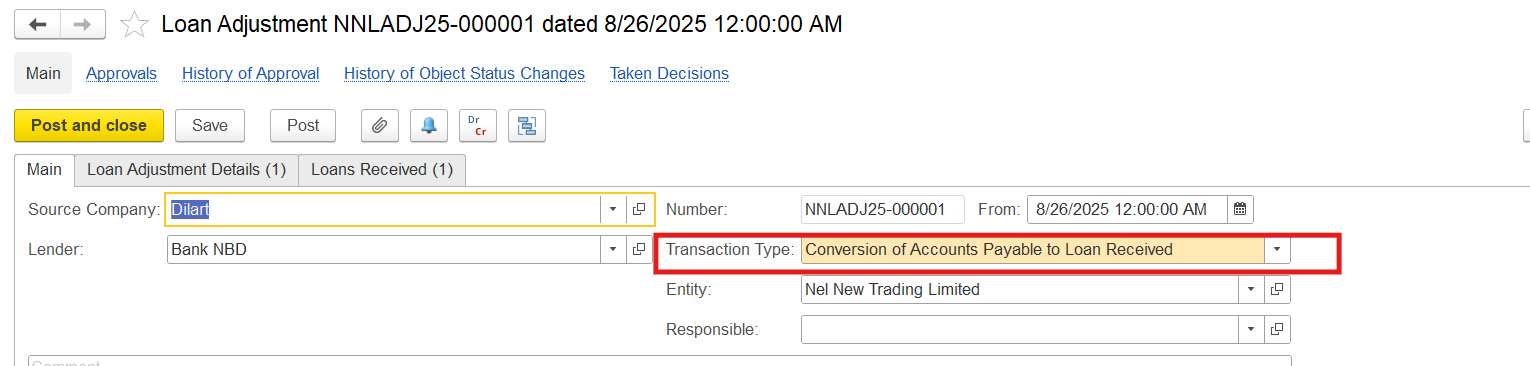

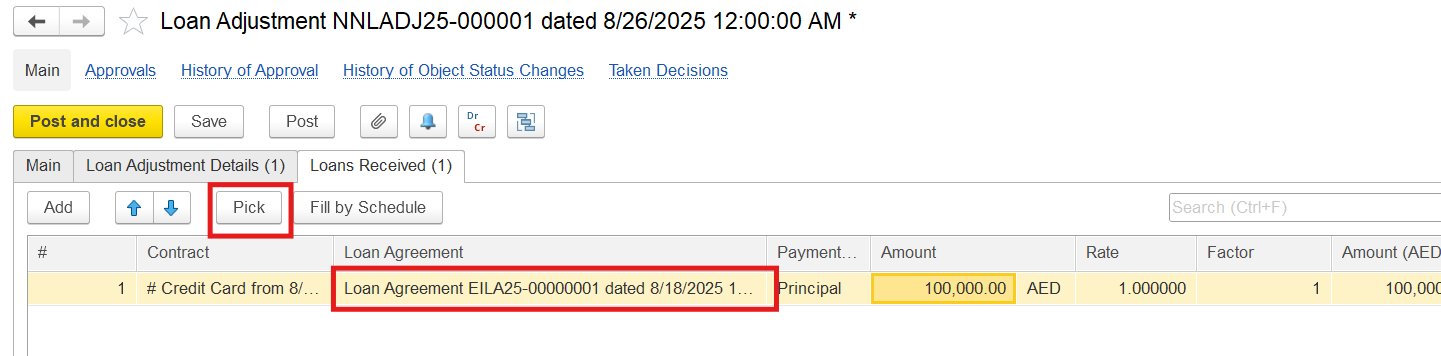

4. Create a Loan Adjustment document with the transaction type Conversion of Accounts Payable to Loan Received.

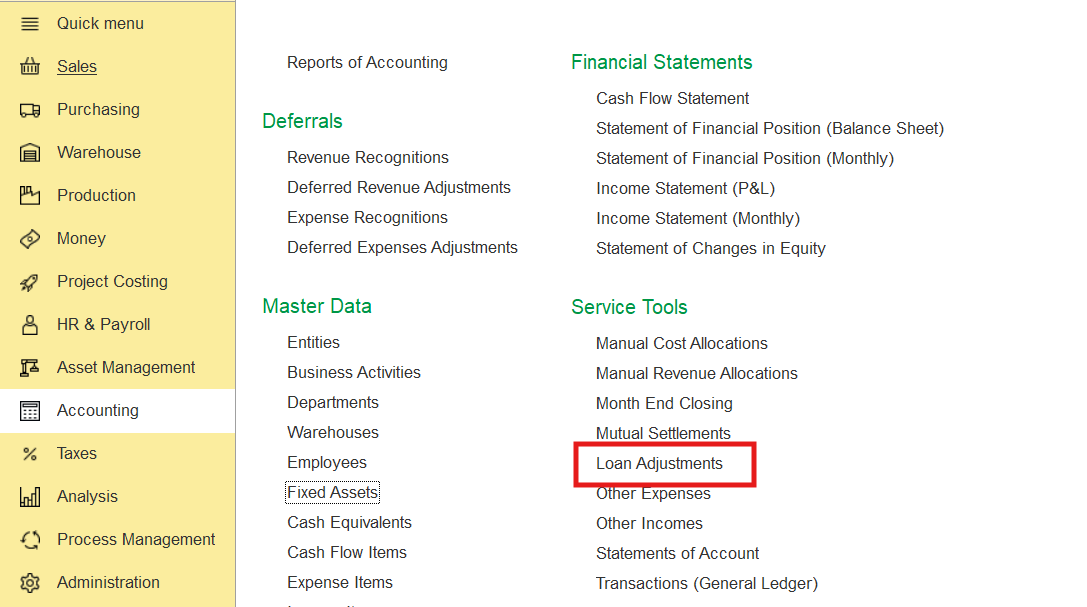

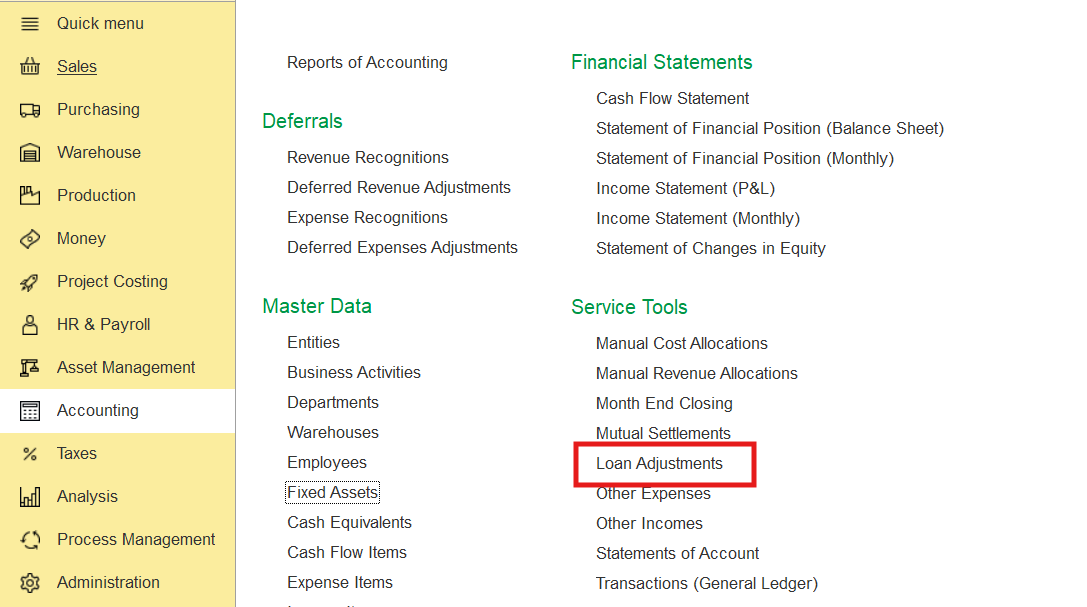

- Go to Accounting, in the Service tools section select Loan Adjustment. Create a Loan Adjustment document with Transaction Type: Converstion of Accounts Payable to Loan Received.

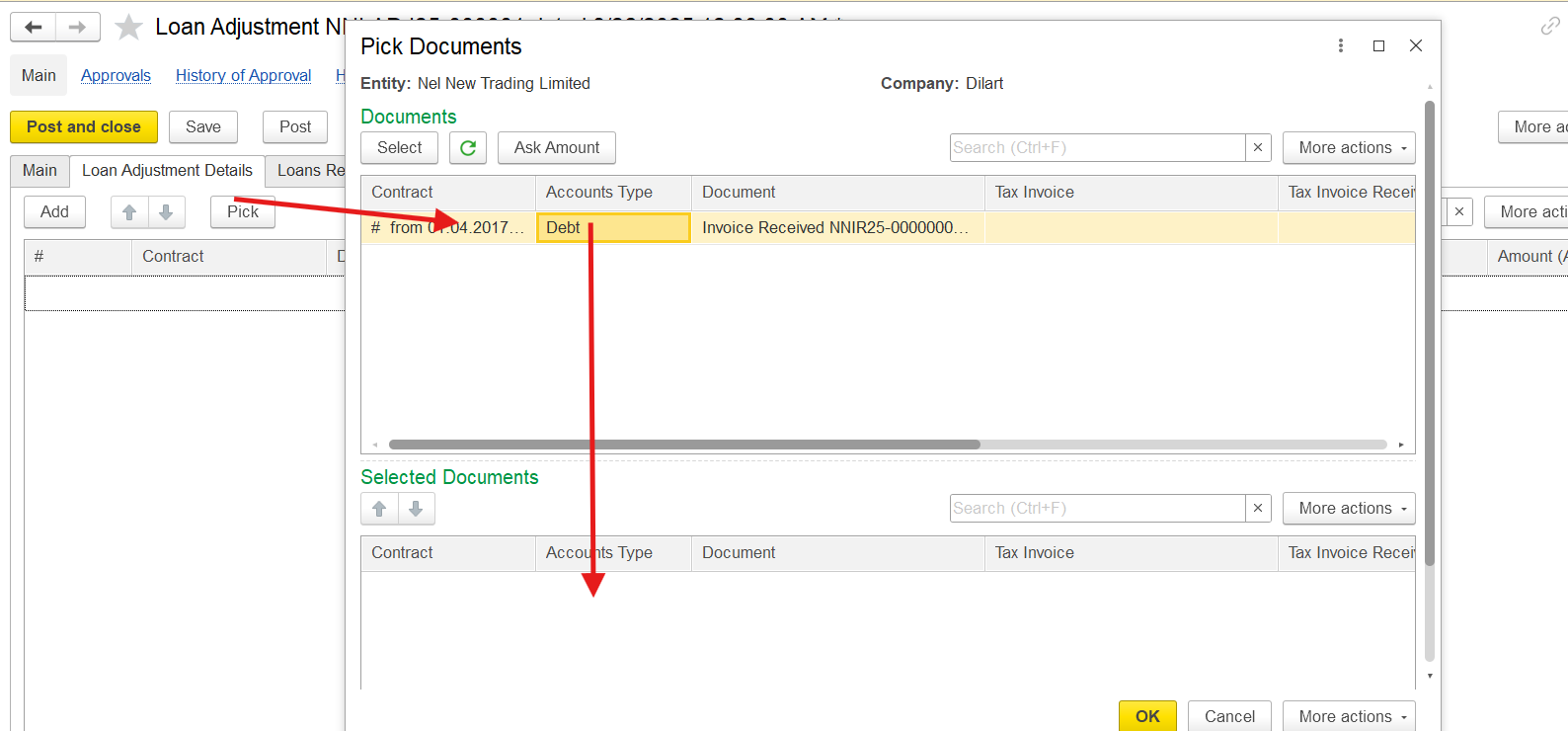

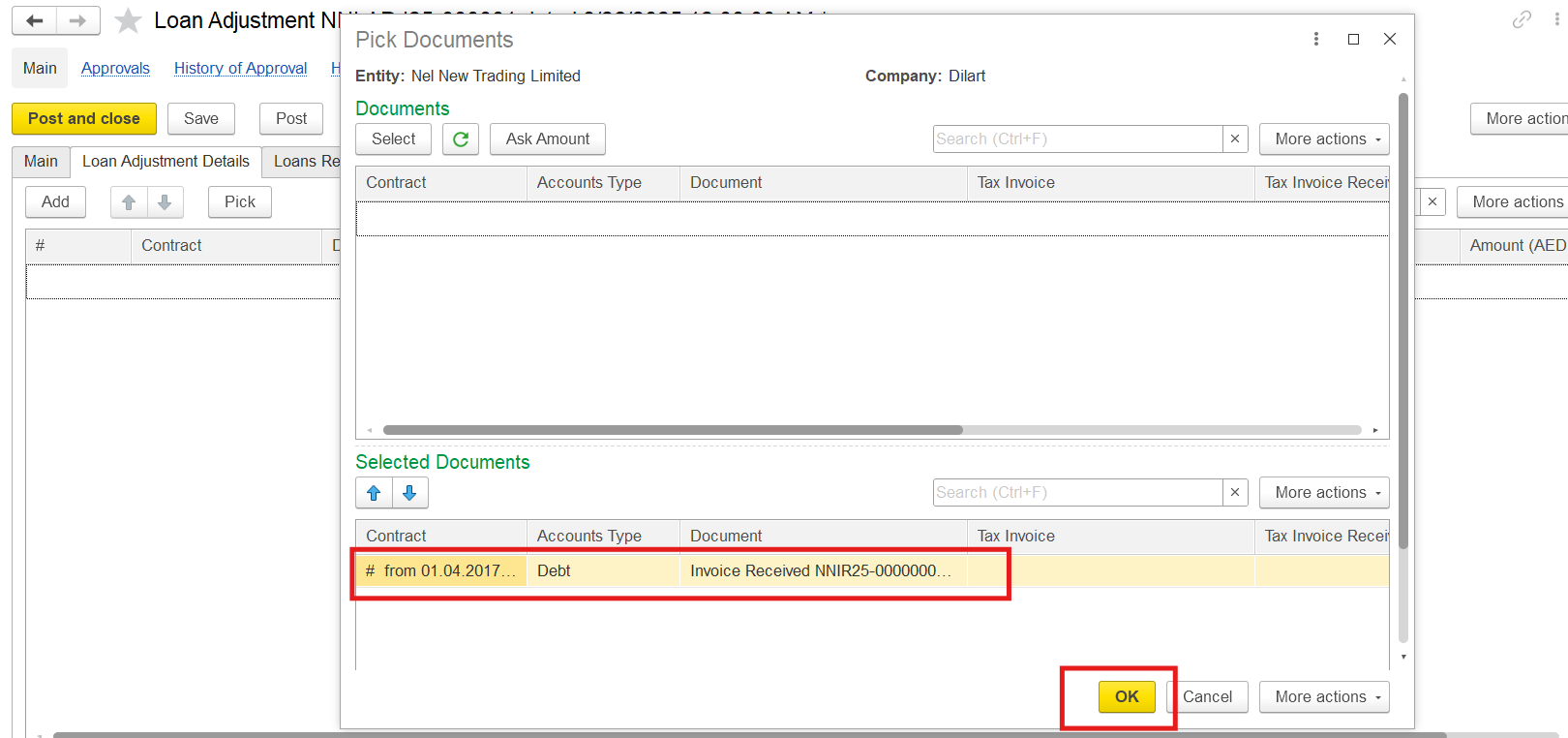

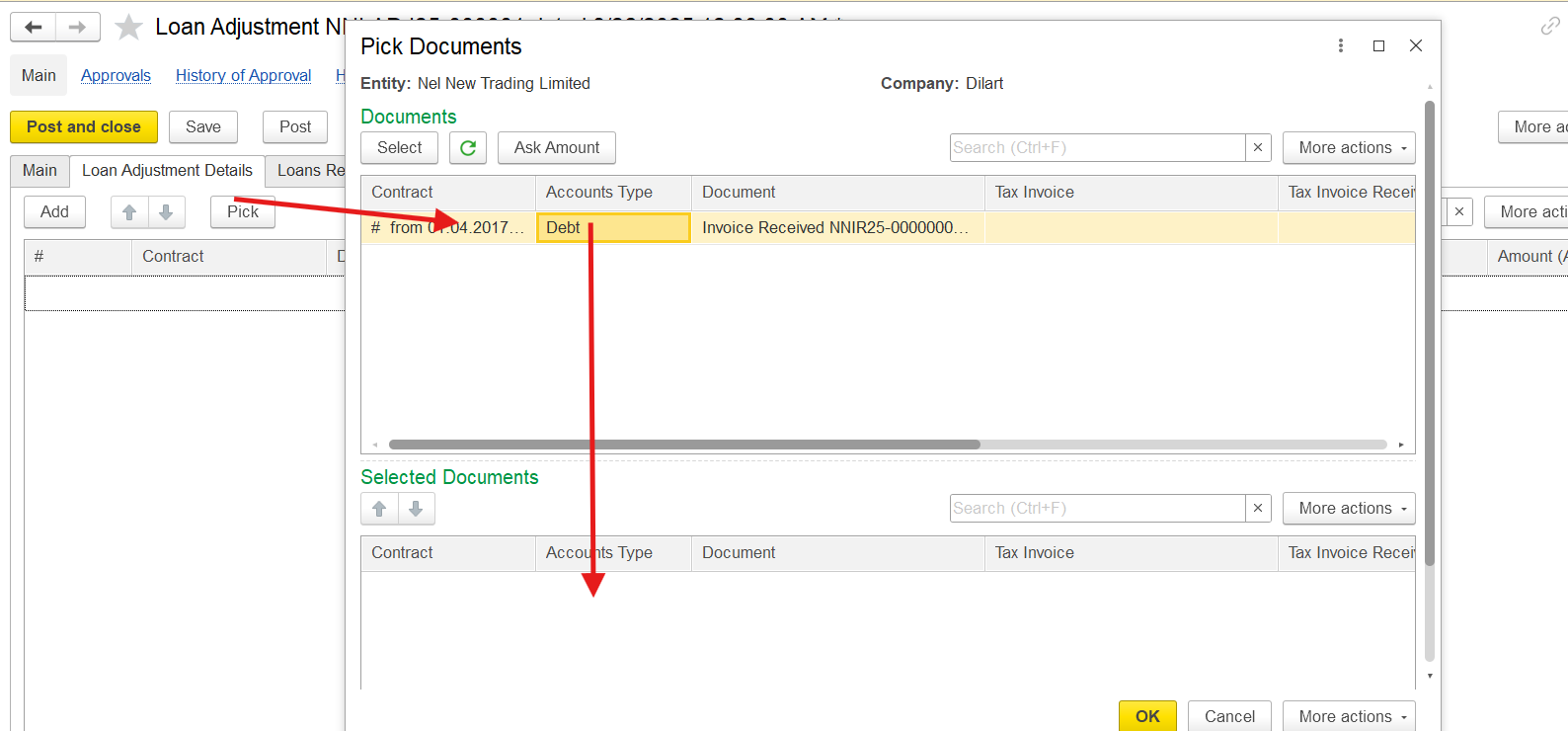

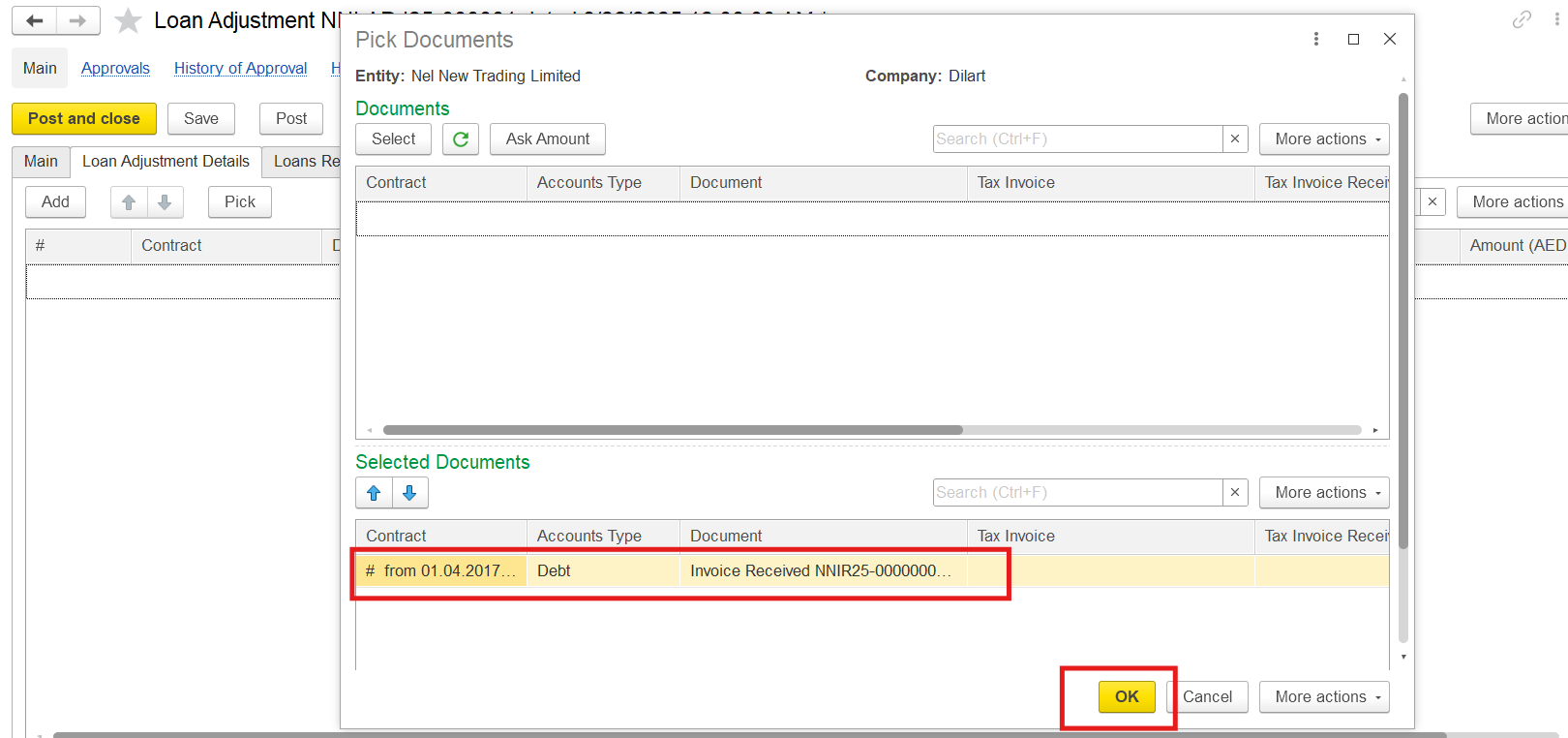

- On the Loan Adjustment Details tab, clicking the Pick button. Double-click the specific unpaid supplier invoice that are being converted into a loan to trasfer it to the lower section of the window. Press ok.

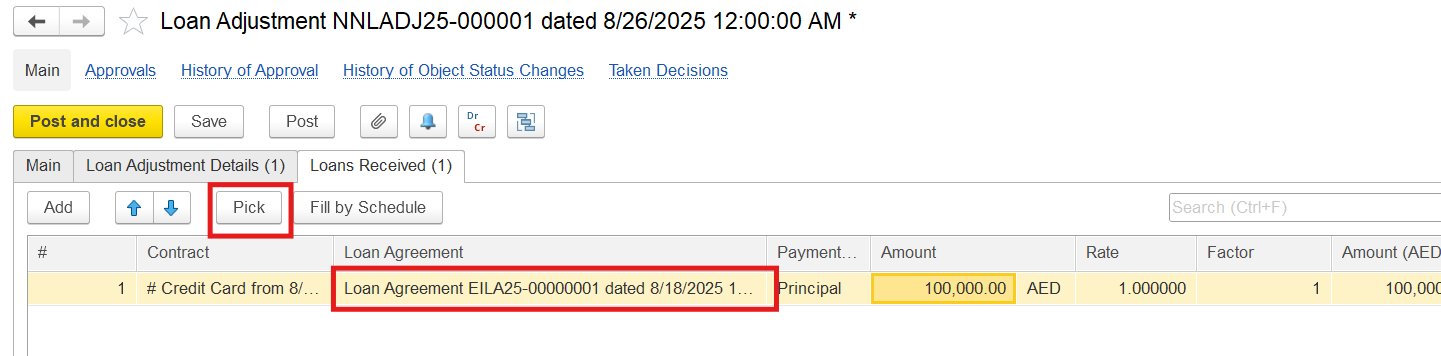

- On the Loans Received tab, click the Pick button and select the loan from the bank.

- Post and close the document to shift from accounts payable to a loan received.

See also: 7.5.9.12. Loan Adjustments (Conversion of Accounts Payable to Loan Received) - FirstBit User Guide - FirstBit User Guide

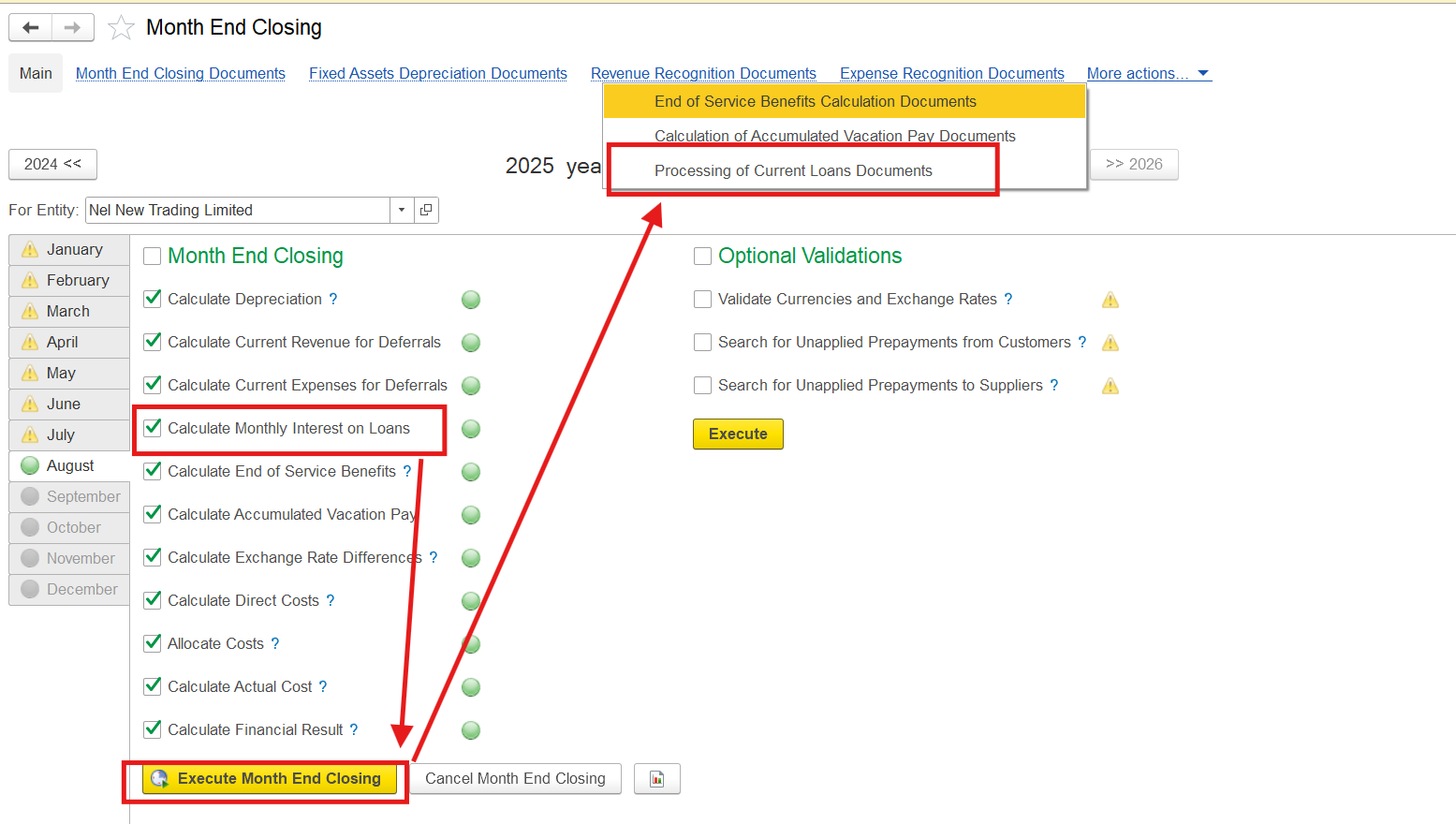

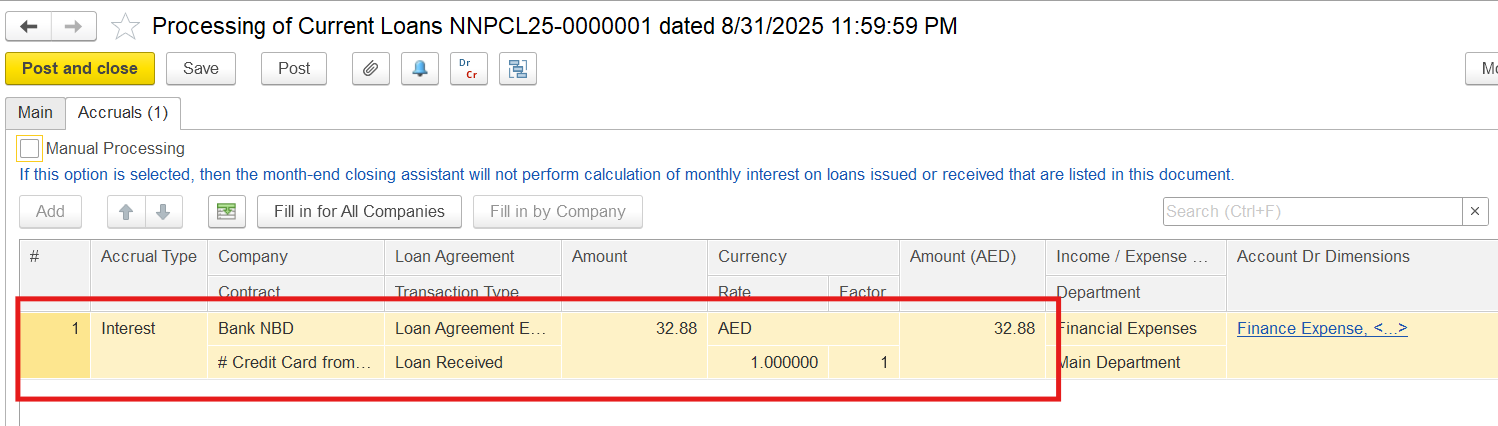

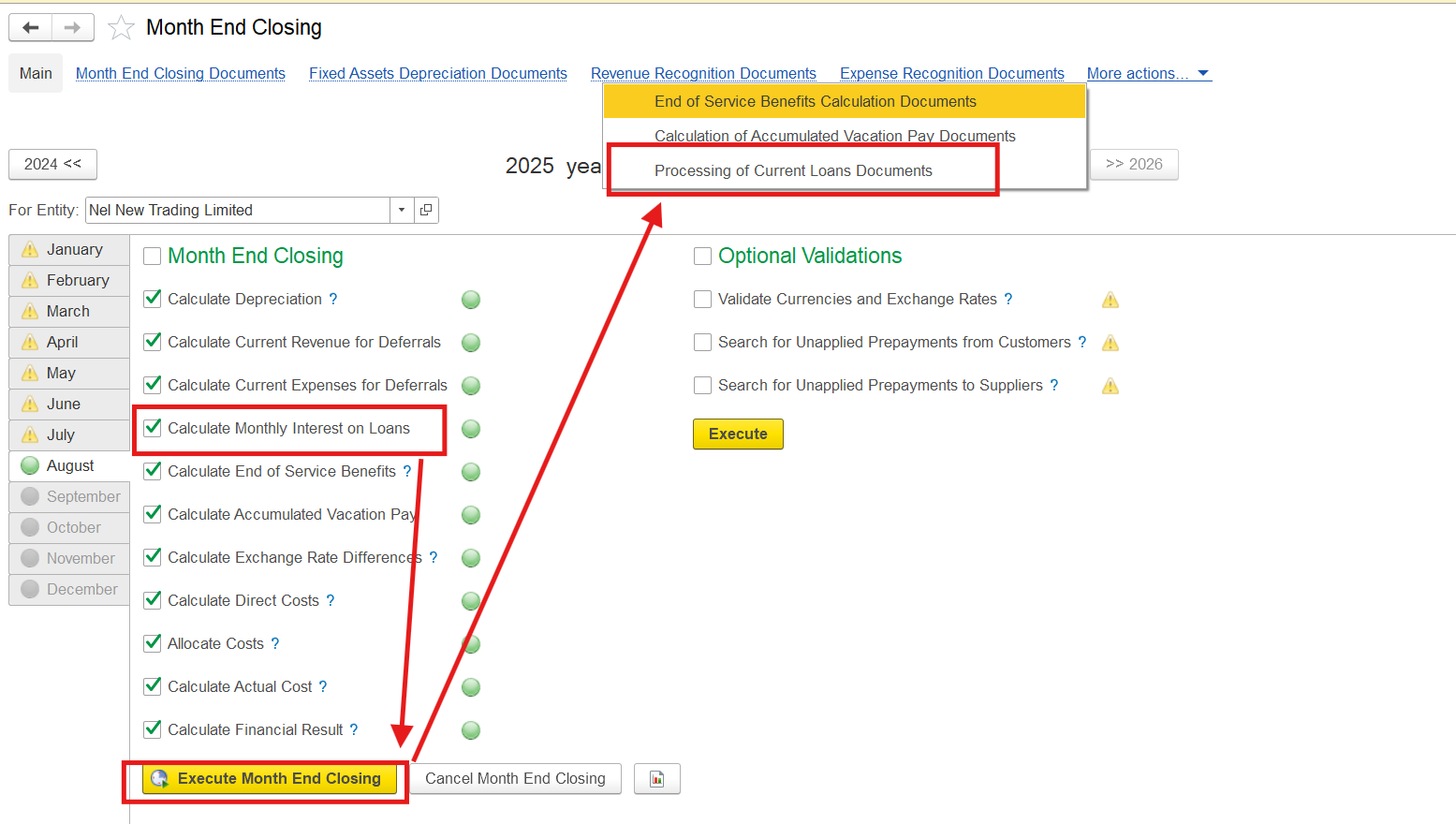

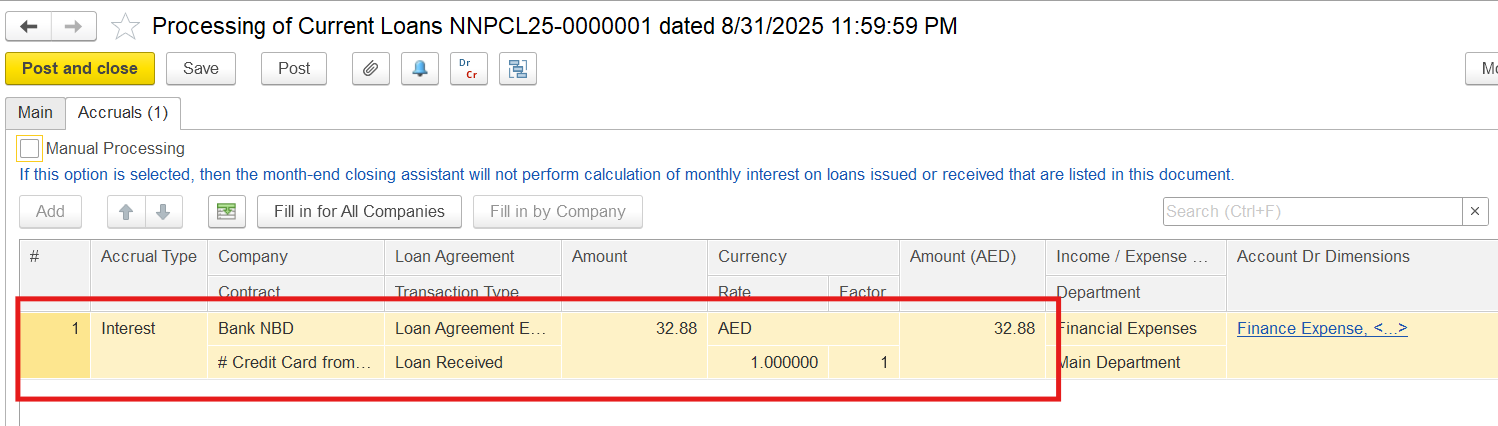

5. During month-end closing, interest on the loan will be calculated and posted automatically if set up correctly.

- Include the interest calculation in month-end closing procedures by selecting the Calculate Monthly Interest on Loans option on the form of the assistant.

- In the document Processing of Current loans a monthly interest from the Loan Agreement and the Bank’s repayment schedules must be entered

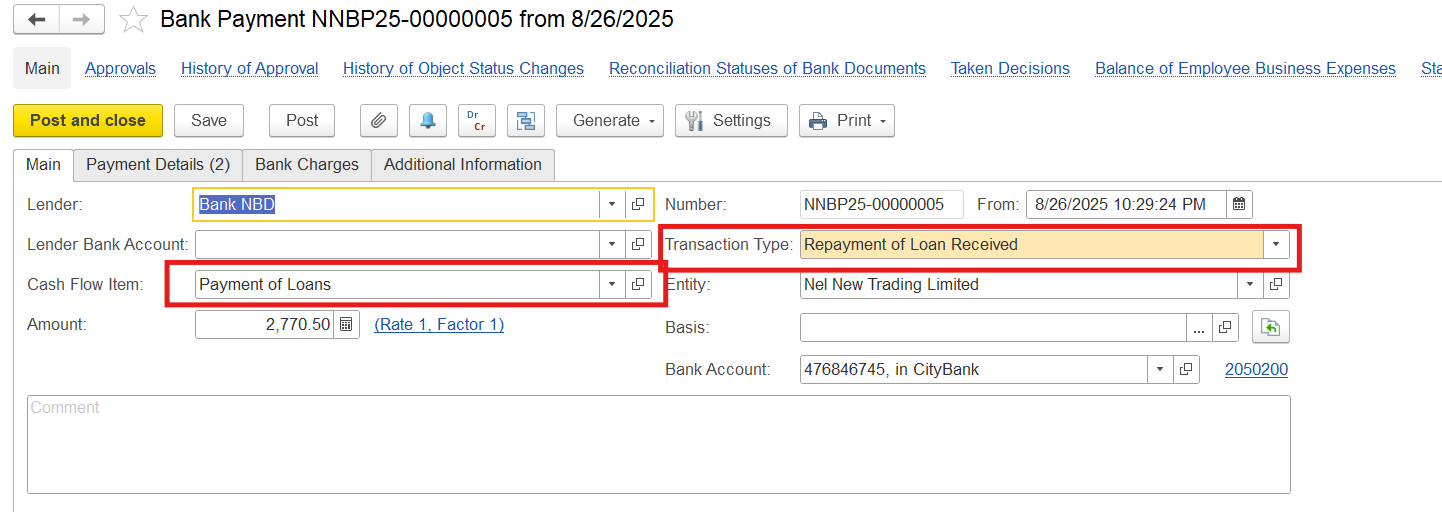

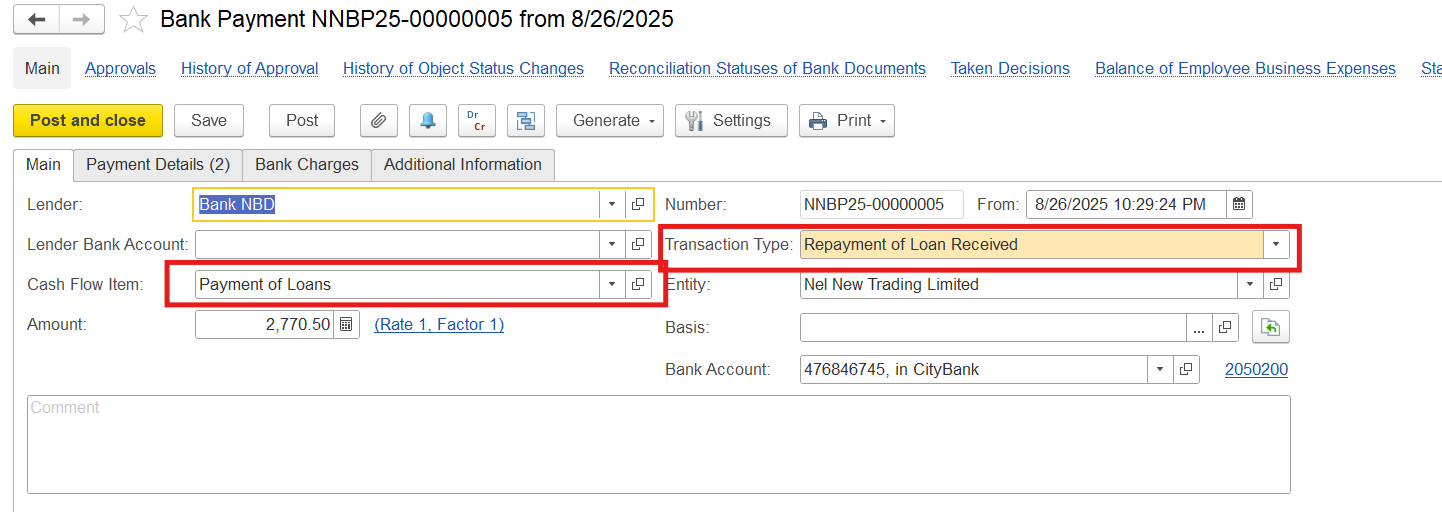

6. Pay for the loan by creating a document Bank receipt with the type of Loan Payment transaction:

- On the main tab select Payment of Loans in Cash Flow Item. Also specify Repayment of Loan Received as Transaction Type

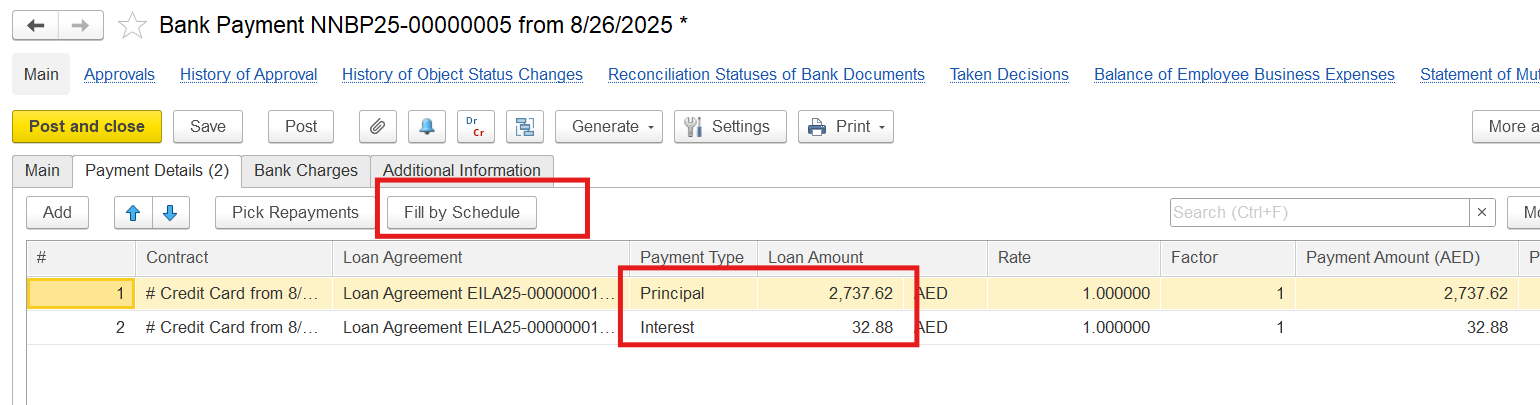

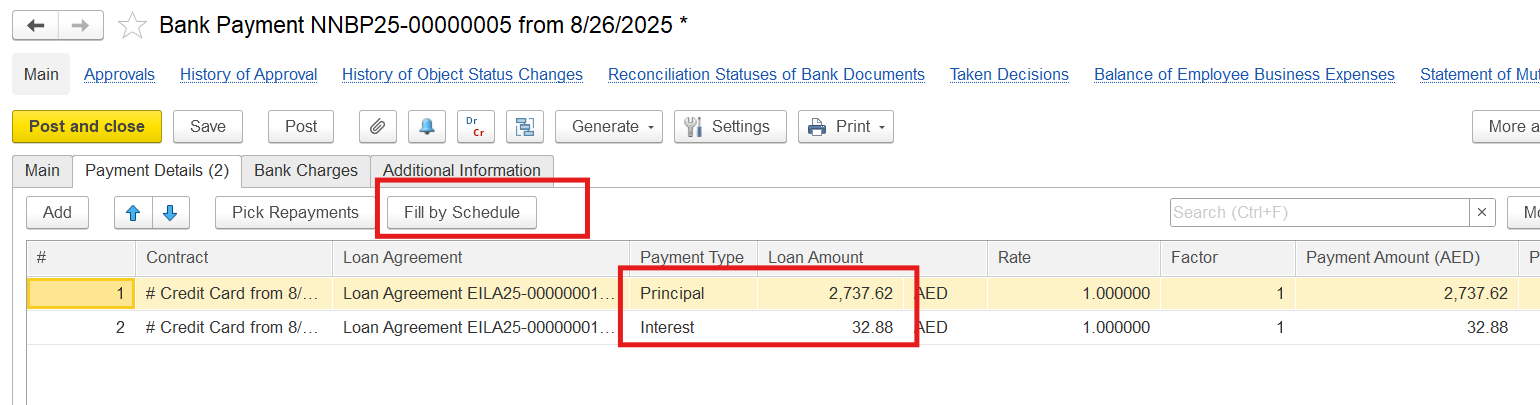

- On the Payment Details tab click Fill by Schedule to receive amounts from the Loan Agreement

See also 6.2.2.7.1. Creating a Bank Payment. The Main tab - FirstBit User Guide - FirstBit User Guide

Thanks for being a Firstbit Customer! #PurchaseOnBankCreditTransfer