Problem: How to issue a tax invoice for an advance payment and close it at the time of invoicing

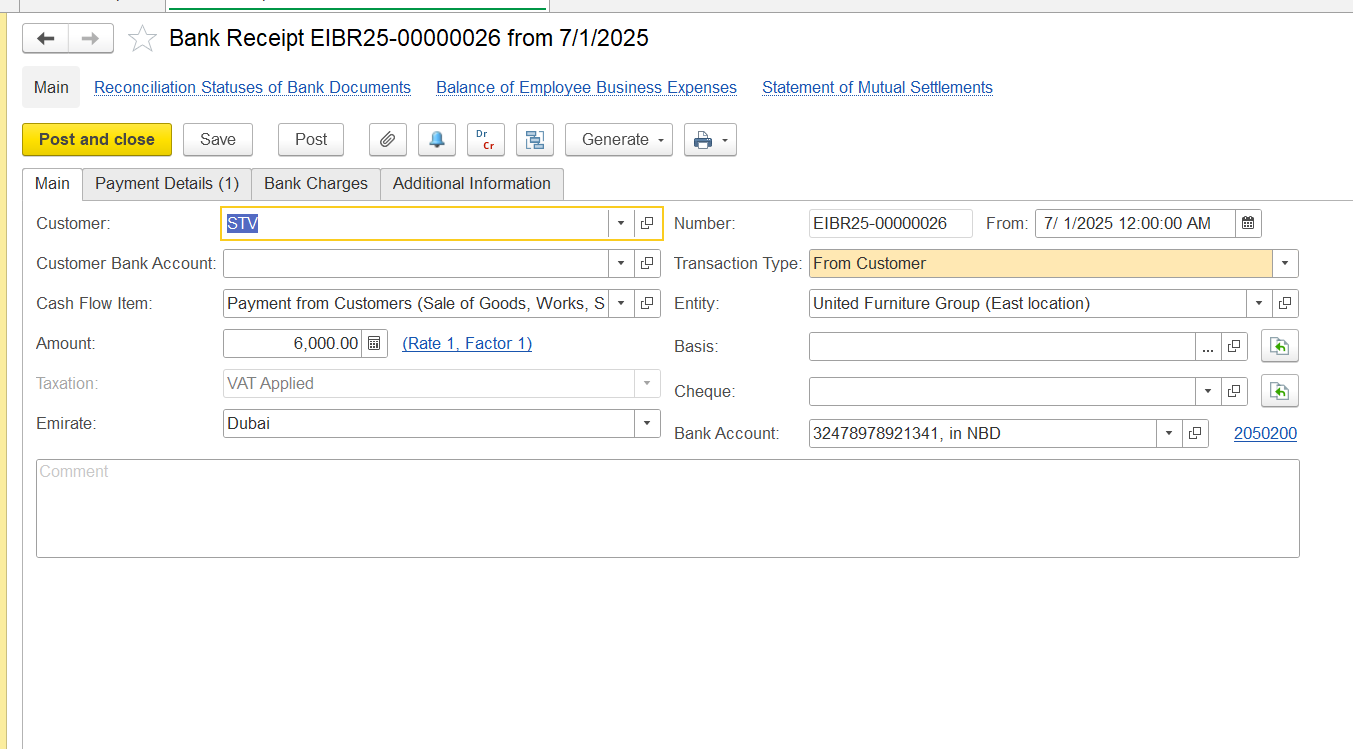

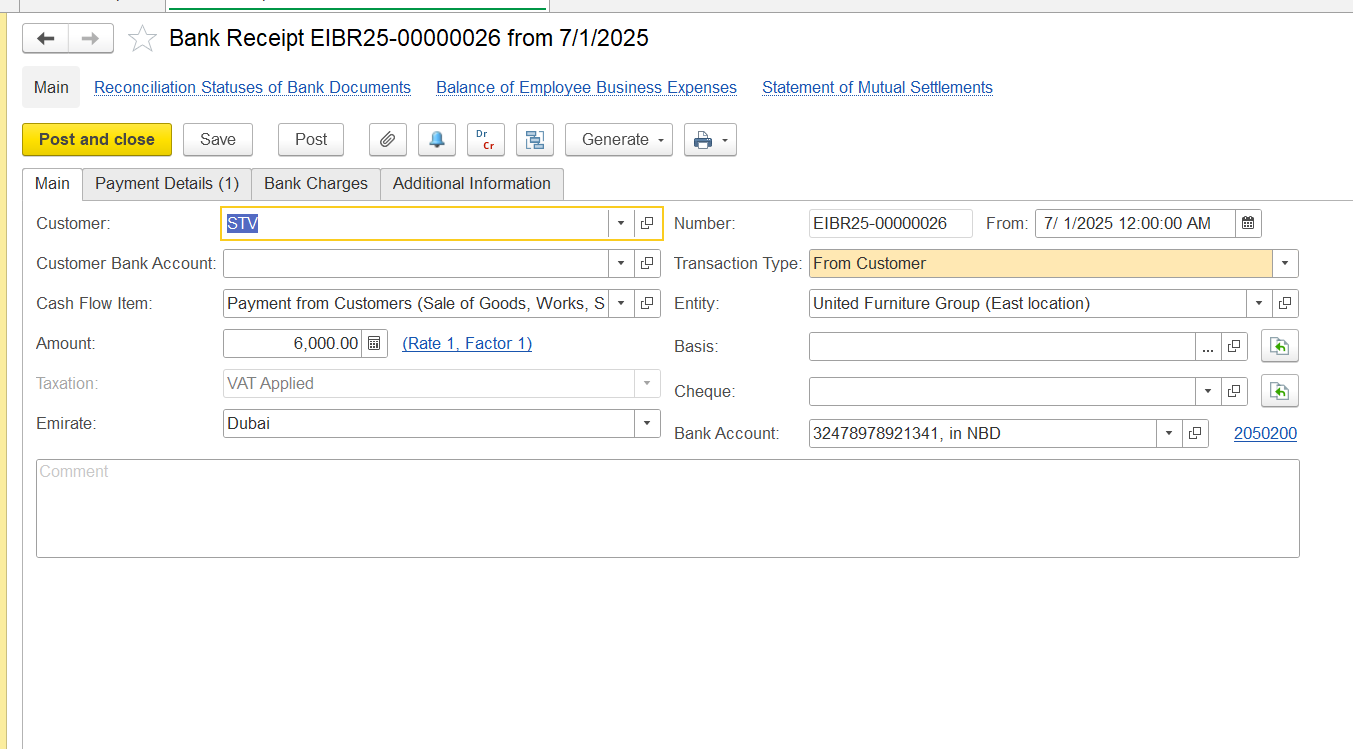

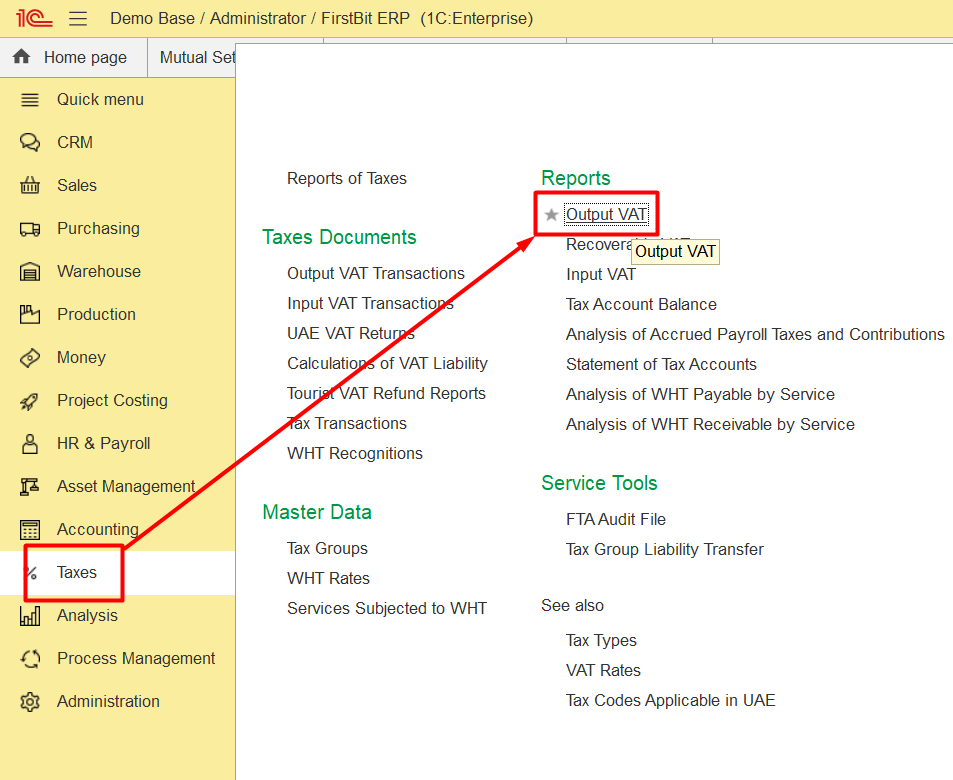

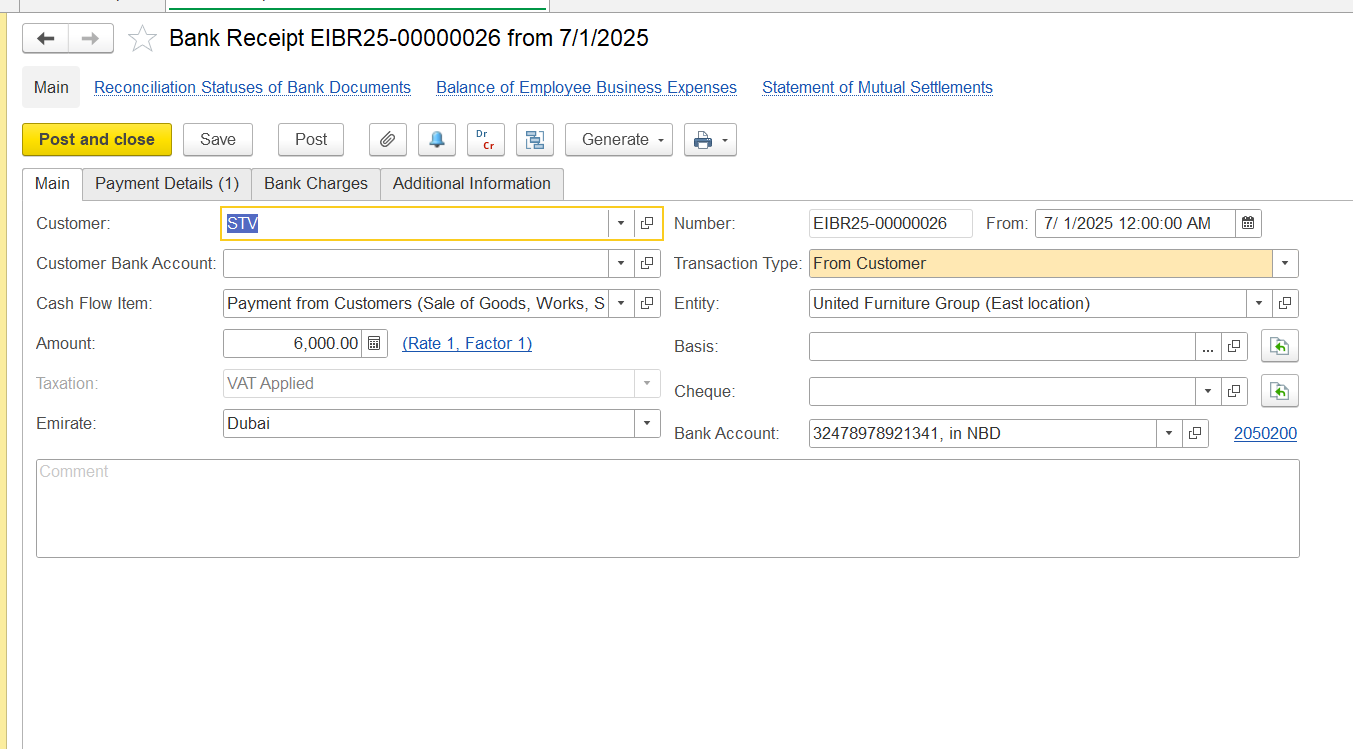

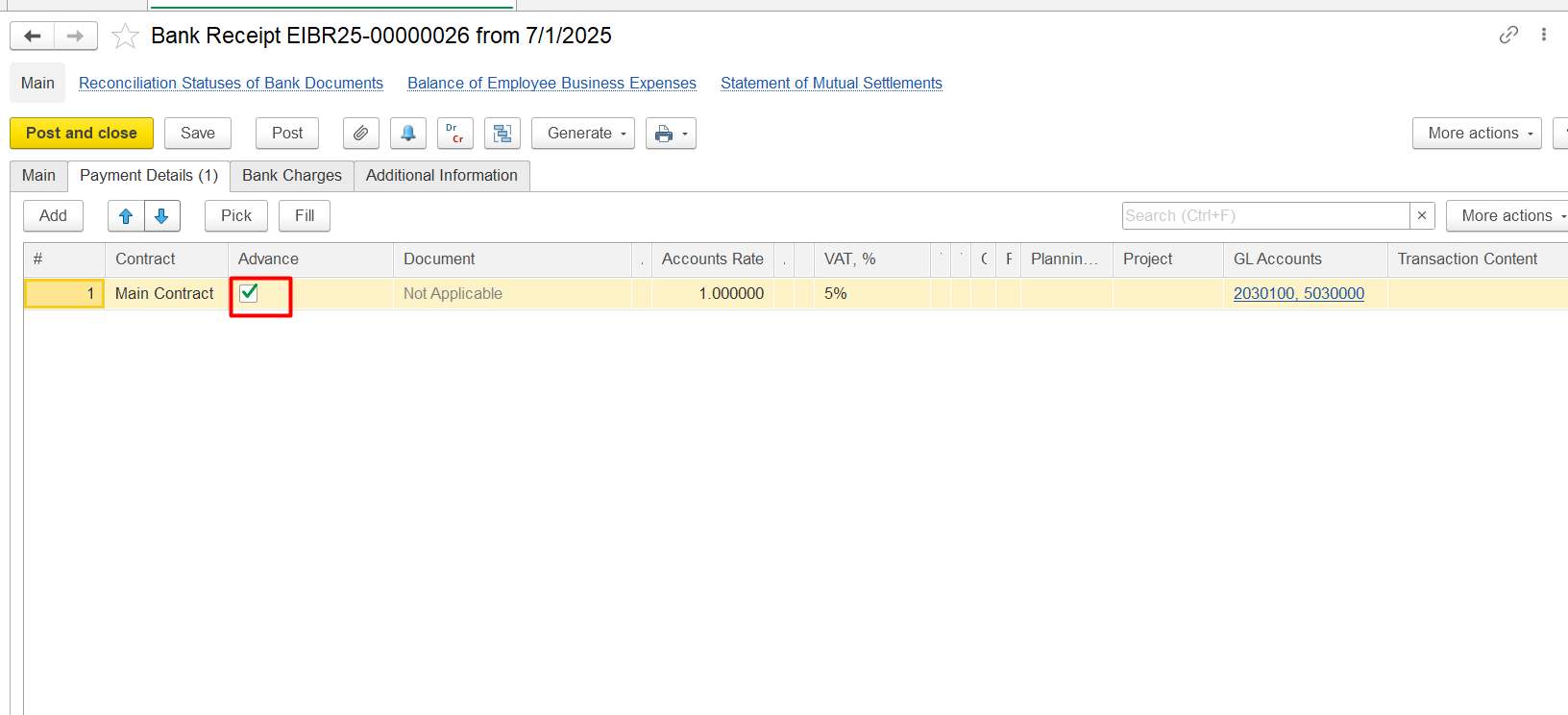

Solution: To avoid double-counting VAT when you receive an advance payment and later issue a final invoice, you should follow these steps:

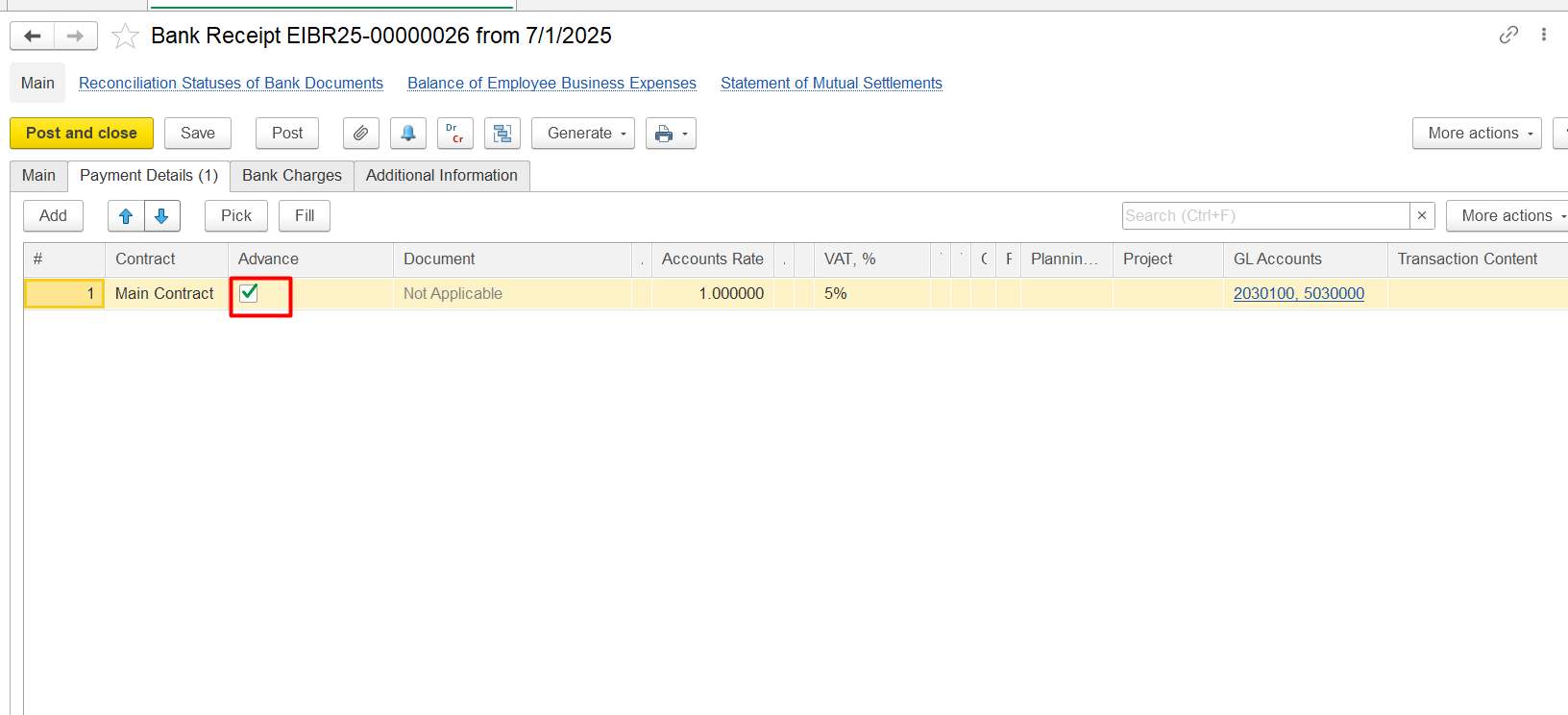

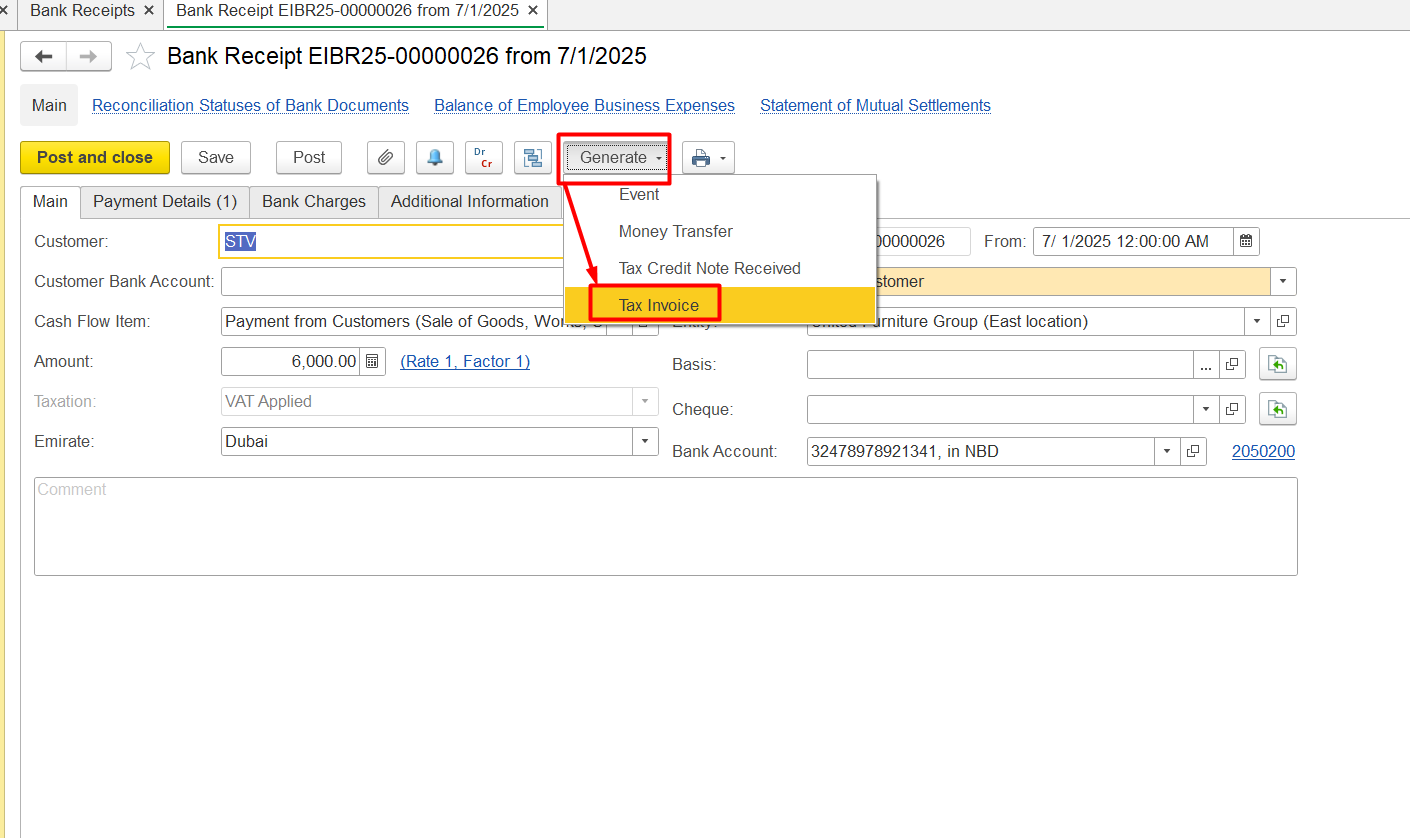

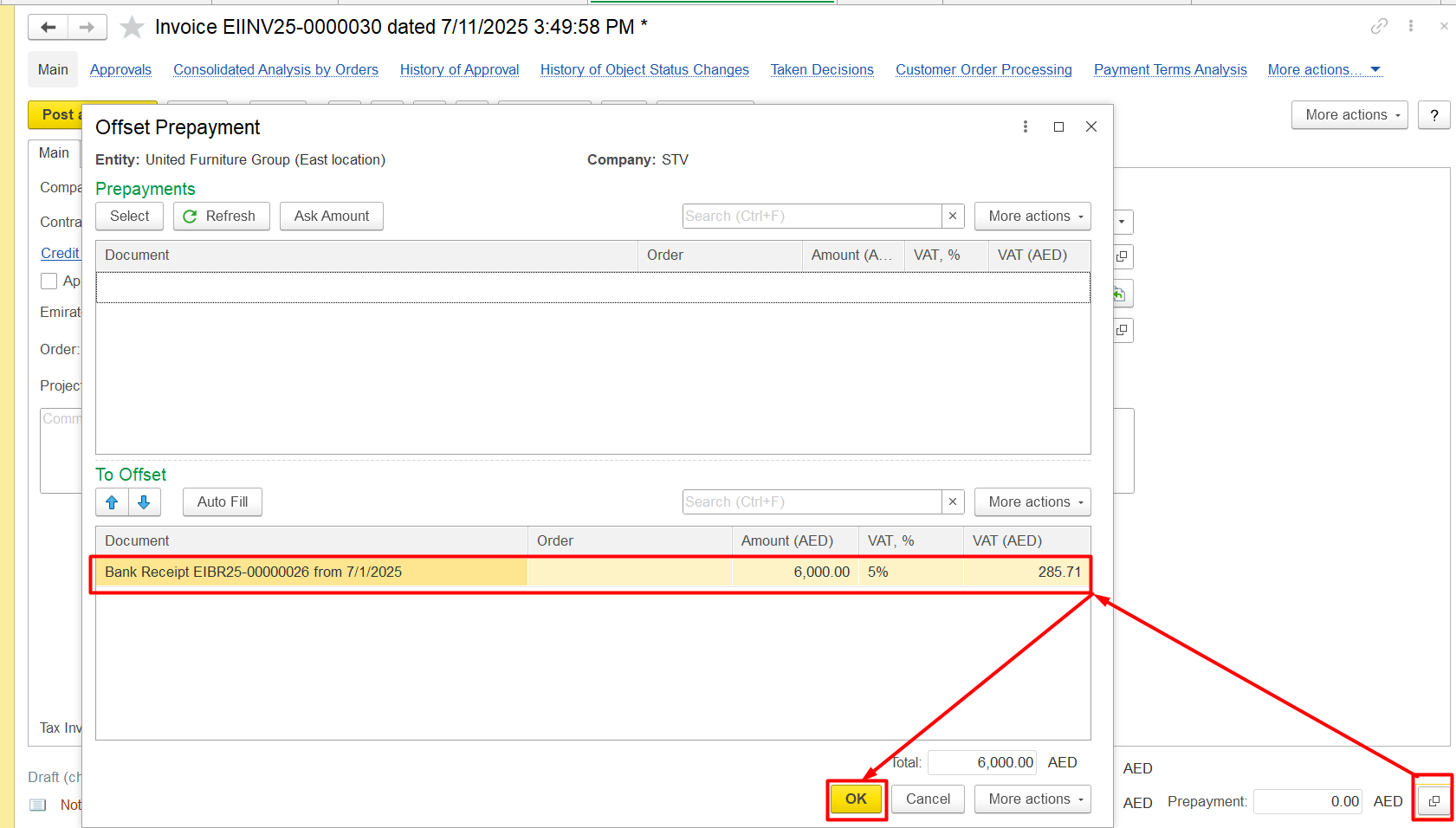

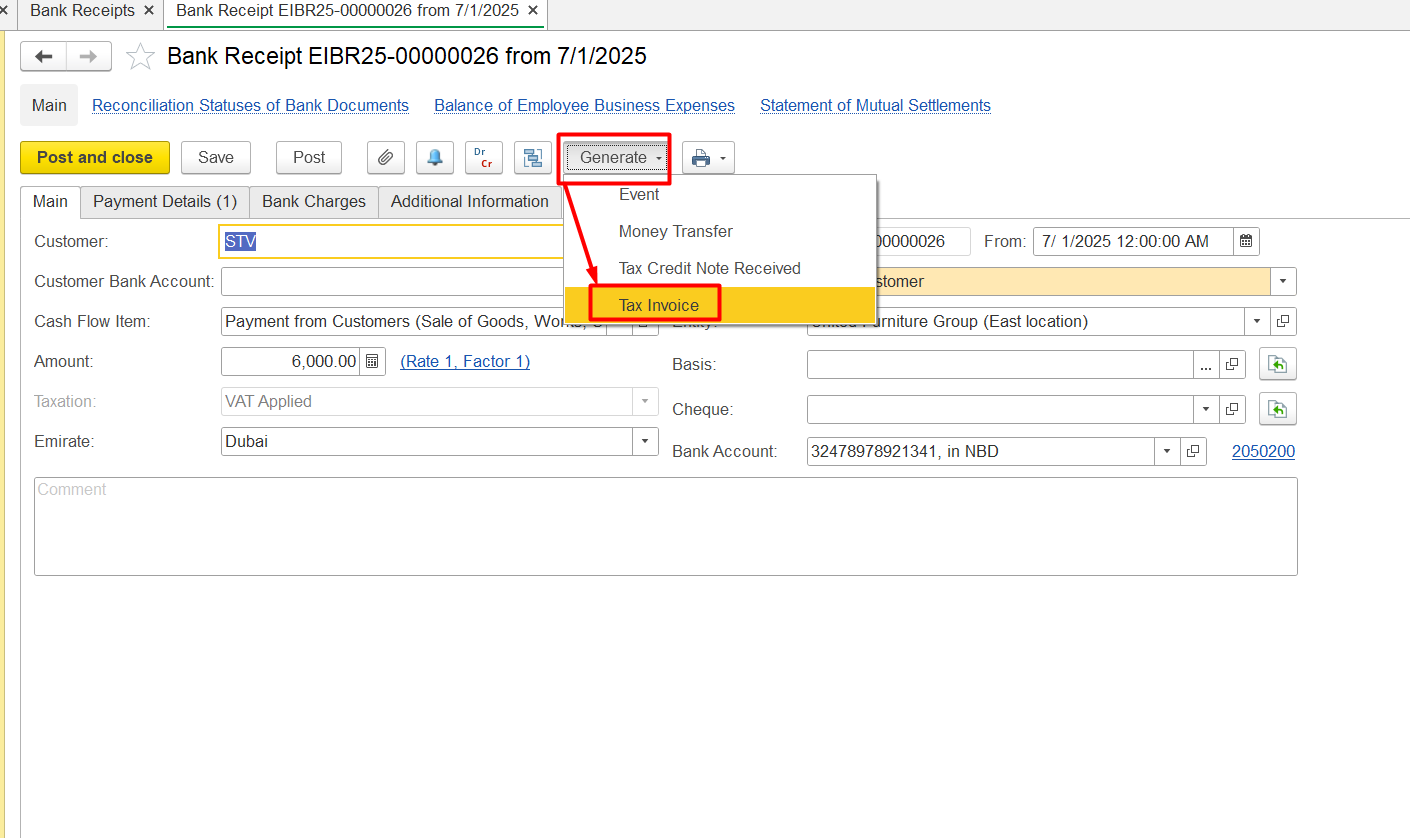

2) Create Tax Invoice for the Bank receipt:

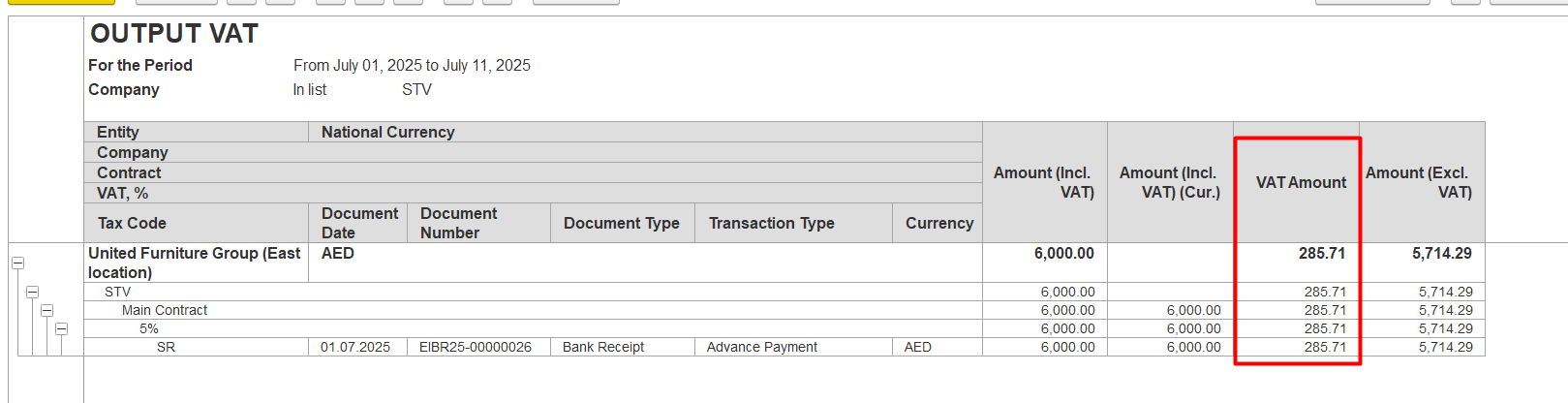

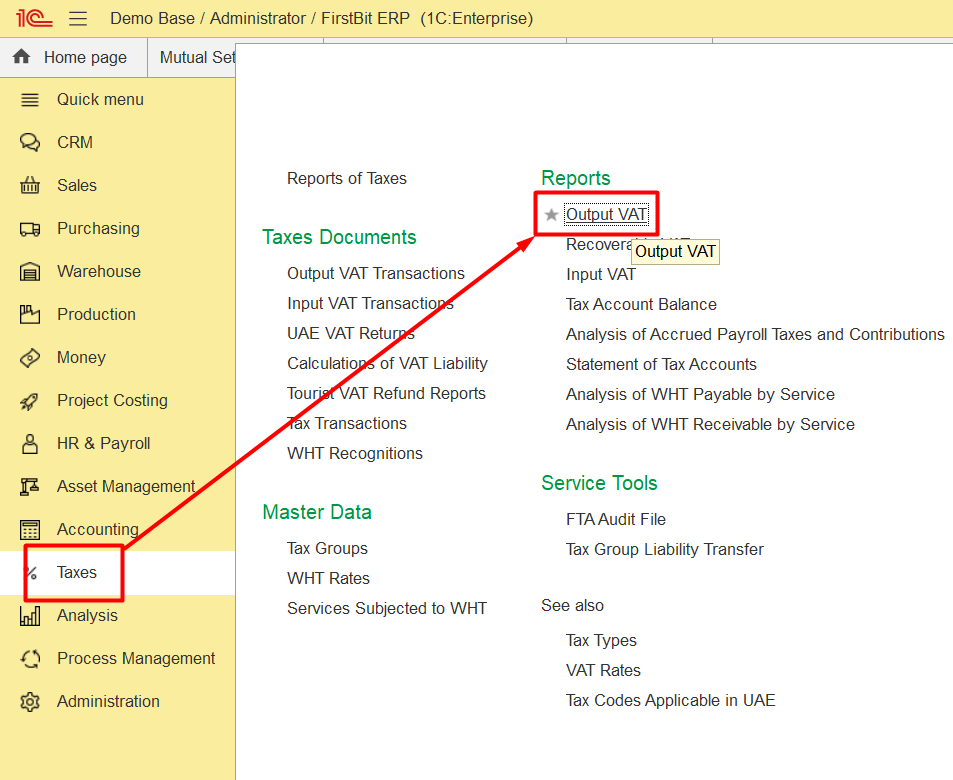

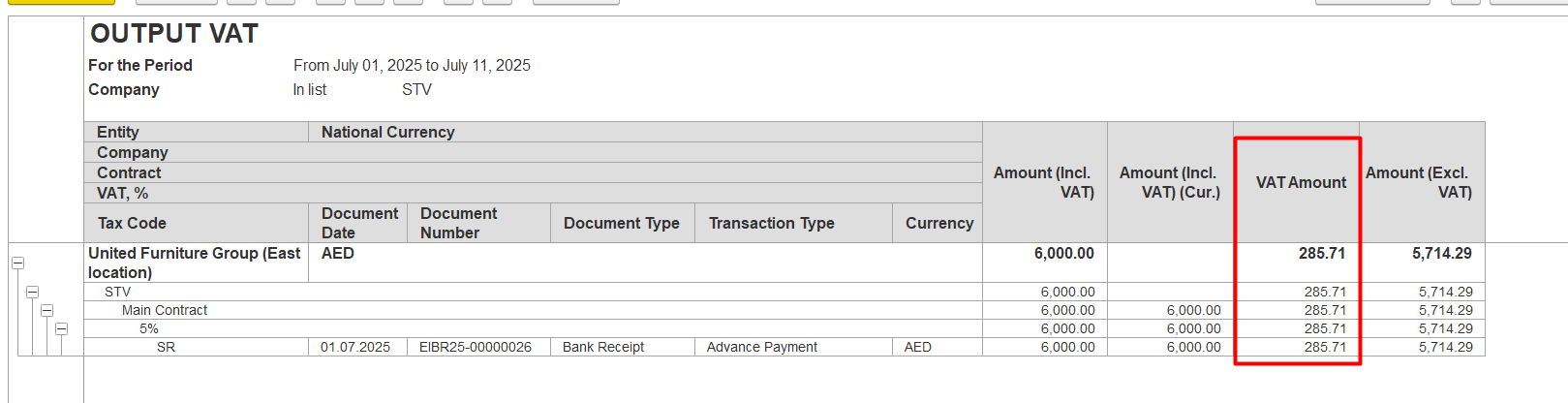

In the Output VAT report, it is possible to see that the VAT has been calculated:

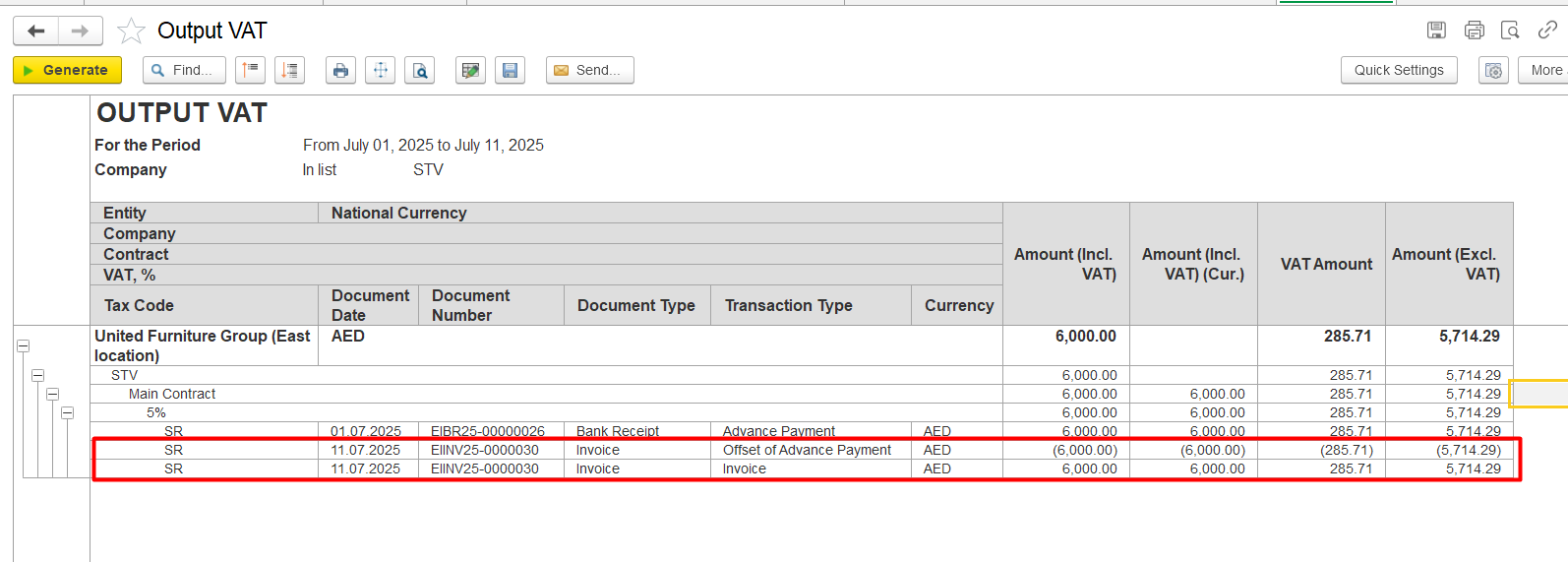

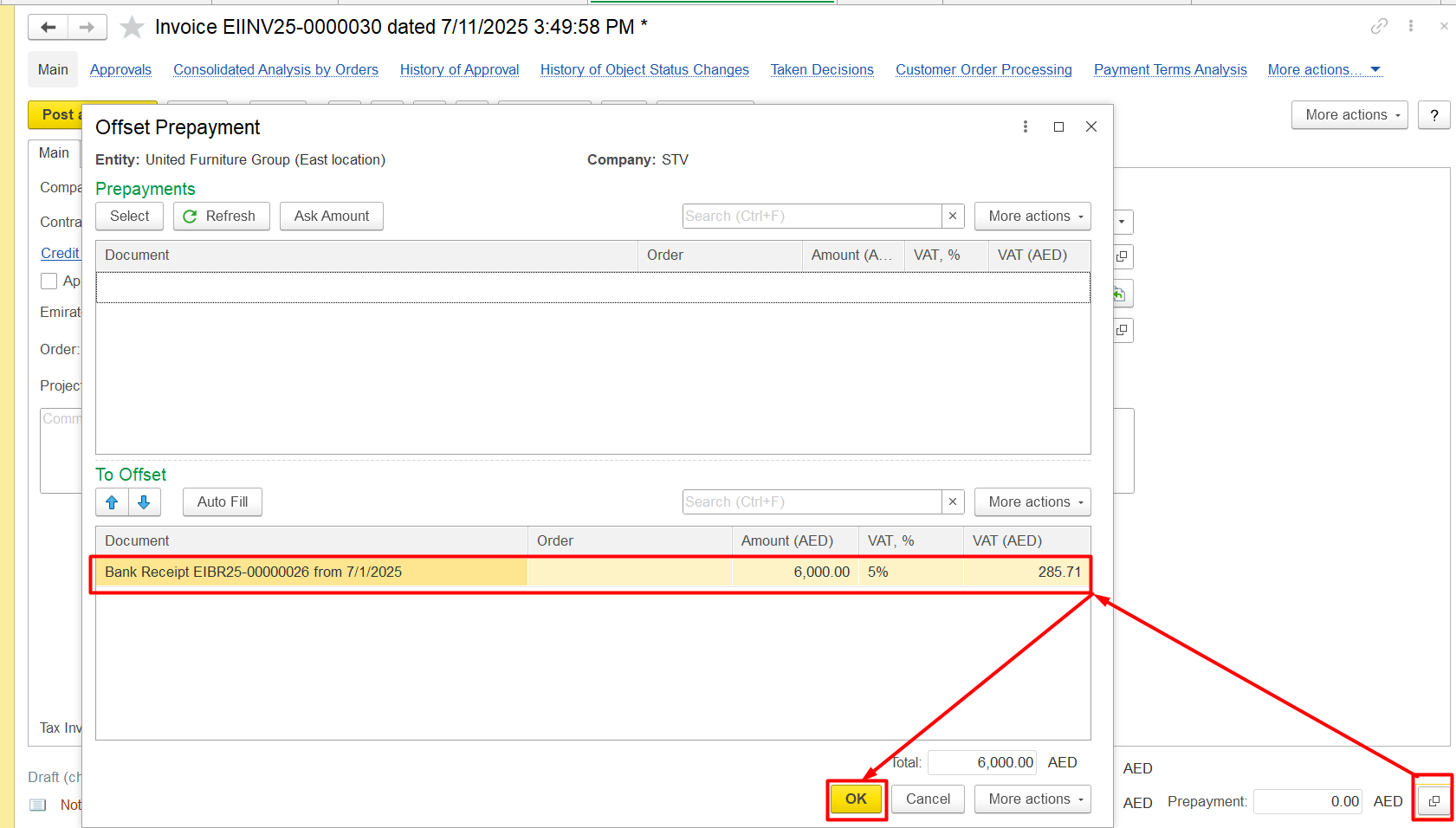

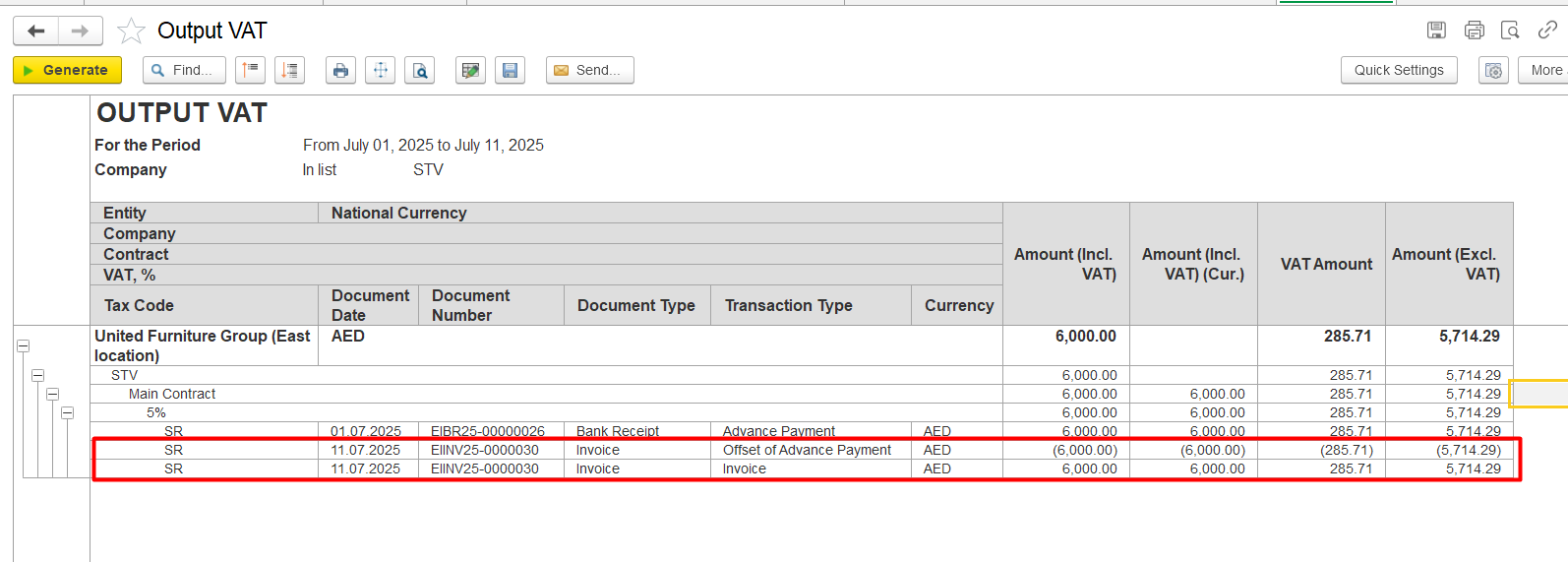

Offset will deduct the VAT on the advance, and the invoice will calculate the final VAT.:

Thank you for being a FirstBIT customer!