If the amount of bonus/rebate earned by a customer is greater than the balance of the accounts receivable for this customer, then the difference might be considered an advance payment from the customer. Some of the auditors believe that the entity must generate a tax invoice to the customer in the amount of such advance payment.

How to process

Where: Sales > Sales Documents > Credit Notes

Create a credit note for the rebate earned by the customer. For details on filing out the document, refer to Creating a Credit Note.

In brief, follow the steps below:

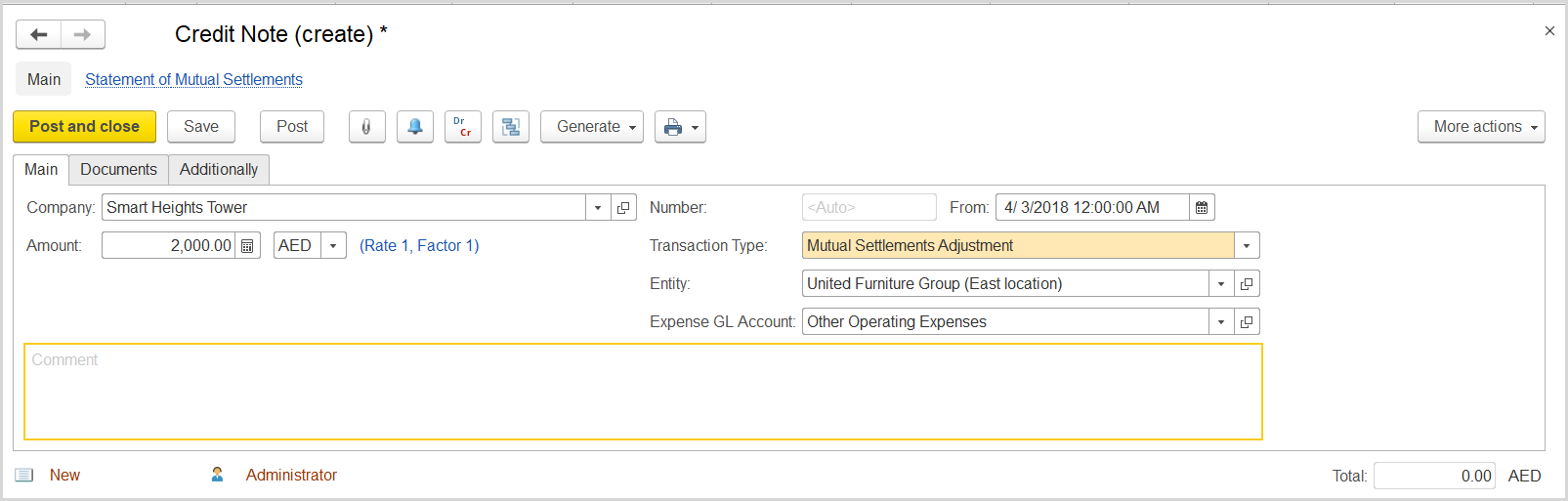

- On the list of existing credit notes, click Create. The Credit Note (Create) form opens.

- On the Main tab in the Company field, select the customer.

- In the Type field, select Mutual Settlements Agreement.

- In the Amount field, specify the rebate amount.

- Click Save to save the document and to assign it the number.

- On the Documents tab, click Add to append a line.

- In the Advance column, make sure a check box is selected.

- In the Contract column, specify the customer contract which is associated with this rebate.

- In the Accounts Amount column, enter the rebate amount.

- Click Post and close on the toolbar to save, post, and close the document.

Where: Accounting > Value Added Tax > Output VAT Transactions

- Click Create to create a new Output VAT Transaction.

- In the Company box on the Main tab, select the customer.

- In the Transaction Type field, select Advance Payment.

- In the Adjustment Type field, select Increase.

- Select the Generate GL Transactions check box.

- Make sure the link below the fields contains Prices Include VAT. Otherwise, click the link to open the Prices and Currency dialog box, select the Prices Include VAT check box there, and close the dialog box.

- Optionally in the Basis field, select the credit note with the rebate amount.

- Click Save to save the data and assign the number to this document.

- On the Inventory/Services tab, click Add to append a new line.

- In the Contents column, enter any comment to the transaction, for instance rebate as advance payment.

- In the Amount column, enter the rebate amount minus the amount that the customer owes to the entity.

- In the VAT,% column. select the rate applicable to the advance payment.

- Click Post to save and register the document in the system.

- On the Main tab at the bottom, click the Generate Tax Invoice button. A link to the generated Tax Invoice appears.

- Click the link to review the Tax Invoice.

- Save and post the Tax Invoice.