On sales documents, an incorrect VAT rate was used, and now, when it has been found out, there is no possibility to change the invoice−for example, the VAT Return report for the period to which this invoice belongs was already submitted. We must reflect the corresponding adjustments on VAT Return for the current tax period.

There might be the following two subcases:

A. The original rate was 0% or exempt and must be changed to 5%. To increase the output VAT accordingly, we create an Output VAT Transaction with Increase as the adjustment type. Then, we must create a tax invoice for the increased VAT amount based on this transaction.

B. The original rate was 5% and must be changed to 0% or exempt. To decrease the output VAT accordingly, we create an Output VAT Transaction with Decrease as the adjustment type. Then, we must create a tax credit note based on this transaction.

How to process subcase A

Where: Accounting > Value Added Tax > Output VAT Transactions

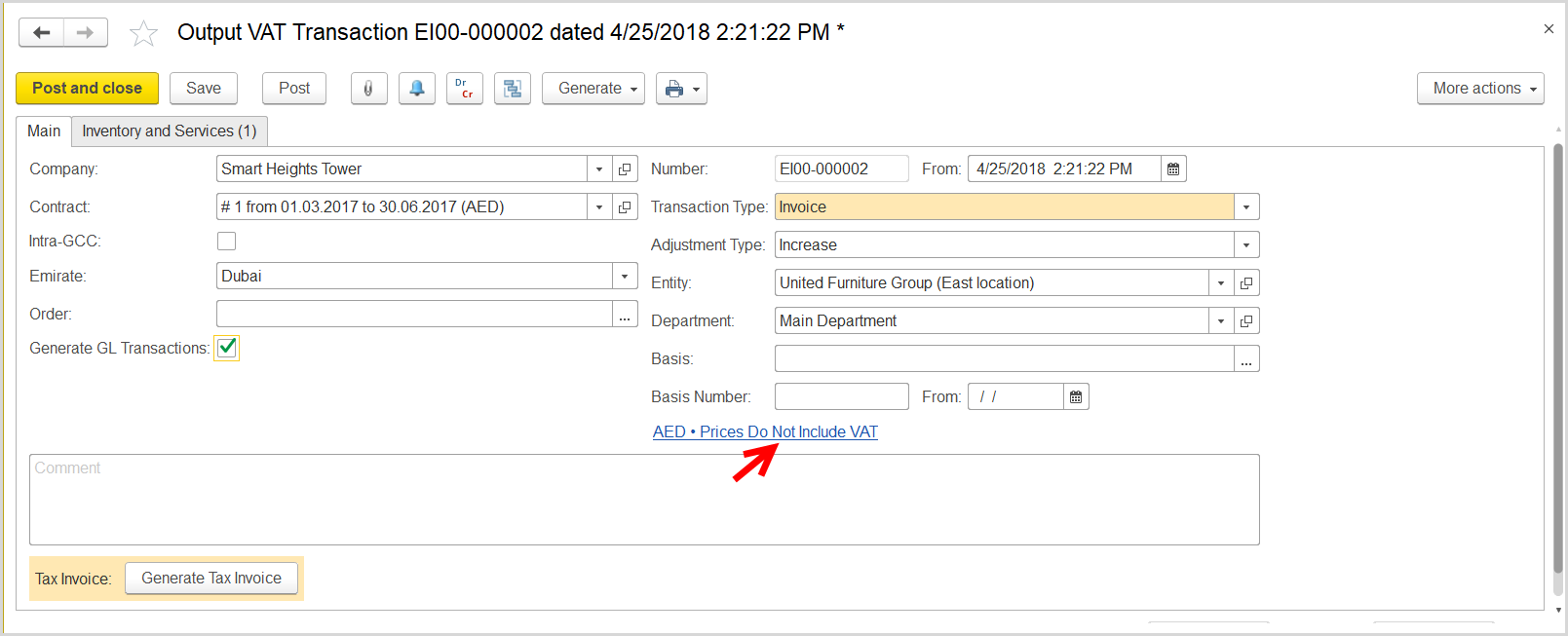

- Click Create to create a new Output VAT Transaction.

- In the Company box, select the customer.

- In the Transaction Type field, select Invoice.

- In the Adjustment Type field, select Increase.

- Select the Generate GL Transactions check box.

- Make sure the link below the fields contains Prices Do Not Include VAT.

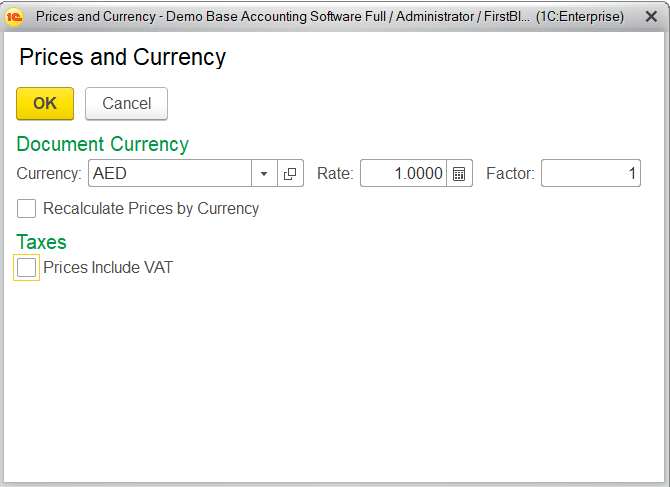

Otherwise, click the link to open the Prices and Currency dialog box, clear the Prices Include VAT check box there, and click OK to close the dialog box. - Click Save to assign the number to this document.

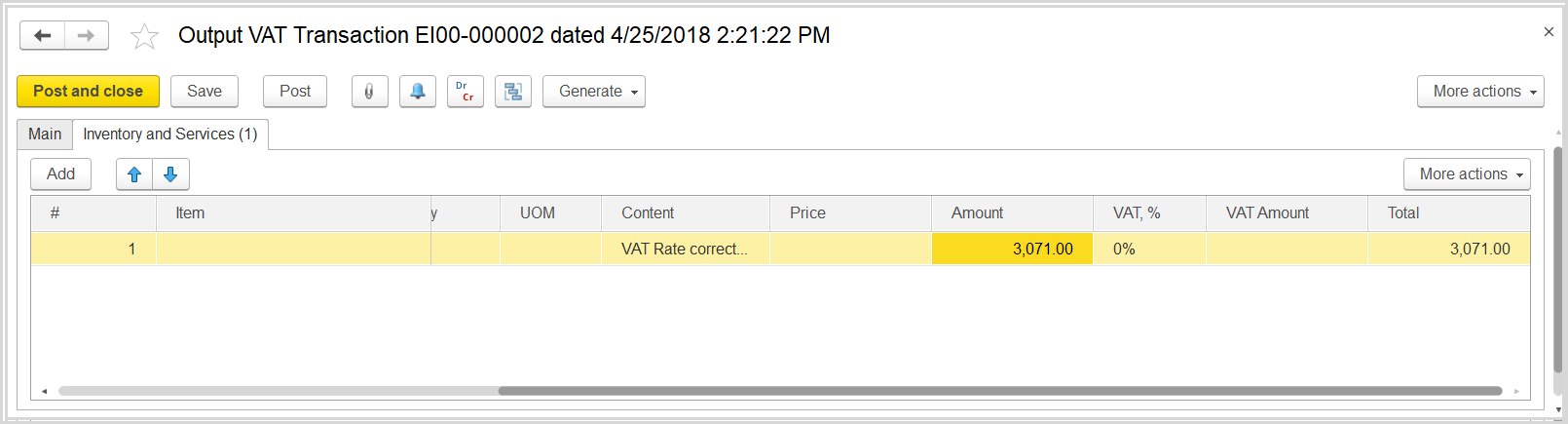

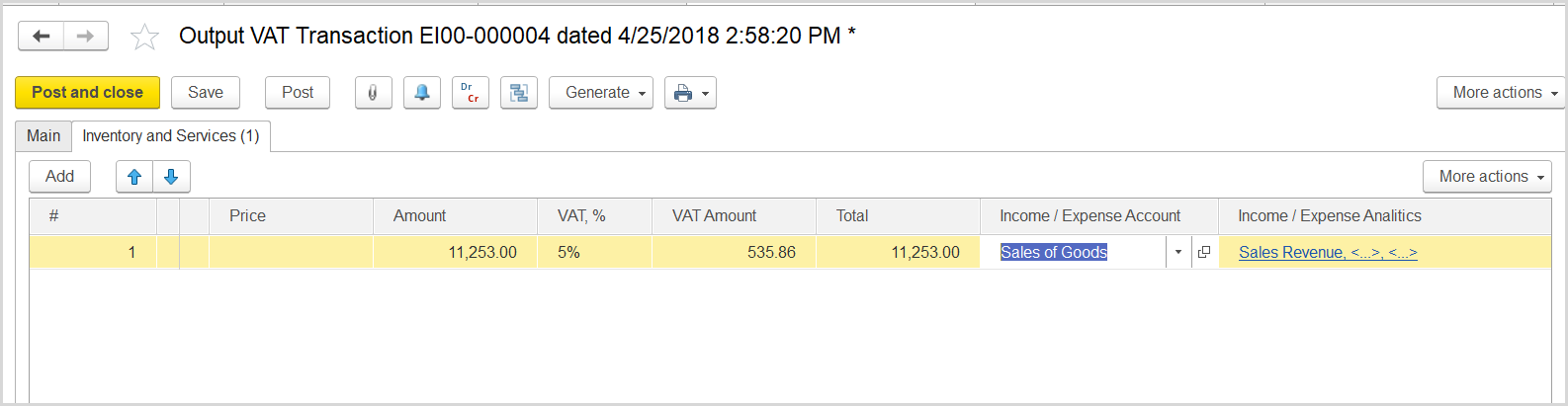

- On the Inventory/Services tab, click Add to append a new line.

- In the Contents column enter any comment to the transaction, for instance VAT Rate correction.

- In the Amount column, enter the amount from the original invoice.

- In the Income / Expense Account column, select the income account from the original invoice.

- In the VAT, % column, select the correct rate, 0%.

- Click Post to register the document in the system.

- On the Main tab at the bottom, click the Generate Tax Invoice button. A link to the generated tax invoice appears.

How to process subcase B

Where: Accounting > Value Added Tax > Output VAT Transactions

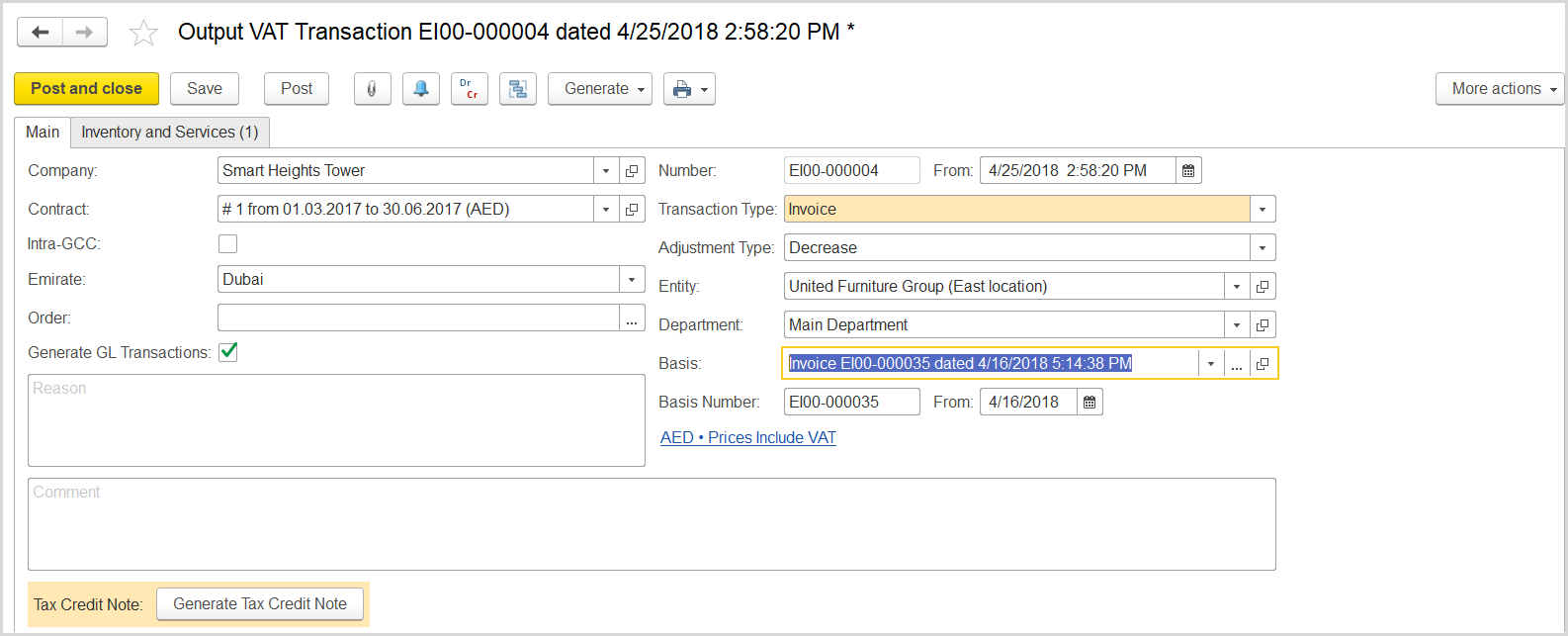

- Click Create to create a new Output VAT Transaction.

- In the Company box, select the customer.

- Select the Generate GL Transactions check box.

- In the Transaction Type field, select Invoice.

- In the Adjustment Type field, select Decrease.

- Make sure the link below the fields contains Prices Include VAT. Otherwise, click the link to open the Prices and Currency dialog box, select the Prices Include VAT check box there, and close the dialog box.

- Click Save to assign the number to this document.

- On the Inventory/Services tab, click Add to append a new line.

- In the Contents column enter any comment to the transaction, for instance VAT Rate correction.

- In the Amount column, enter the amount from the original invoice.

- In the Income / Expense Account column, select the income account from the original invoice.

- In the VAT, % column, select the 5% rate that was used in the original invoice.

- On the Main tab, notice the Generate Tax Credit Note button. Click it to generate the tax document.

- Click Post to register the document in the system.