In the UAE, most financial services are exempt from VAT, however, the customers are required to pay VAT at the 5% rate on bank charges and some services which involve are applying explicit fees, commissions, or charges. We should charges. The entity must report these input VAT amounts on our on VAT returns Returns only if the banks issued tax invoices in the a bank issues a Tax Invoice in the proper format.

How to process

...

Where:

...

Taxes >

...

Tax Documents > Input VAT Transactions

- Click Create to create a new Input VAT Transaction.

- In the Company box, specify the bank. If a company account already has been created for the bank, select it. Otherwise, create a folder for banks and create a new company with this bank’s information.

- In the TransactionType field, select Invoice Received.

- In the AdjustmentType field, select Increase.

- Make sure the correct entity is specified in the Entity field.

- In the Department field, specify the department involved.

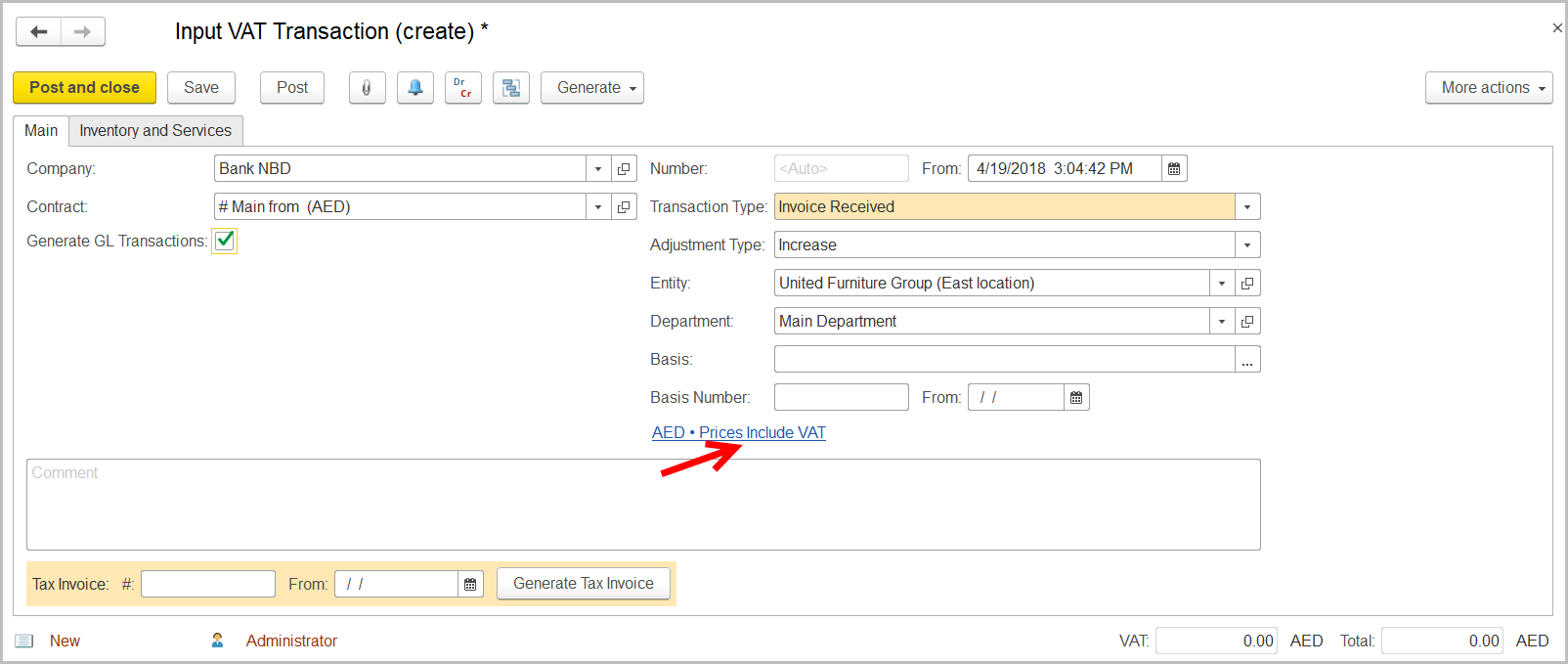

- Make sure the link below the fields contains PricesInclude VAT. Otherwise, click the link to open the Prices and Currency dialog box and select the PricesInclude VAT check box there.

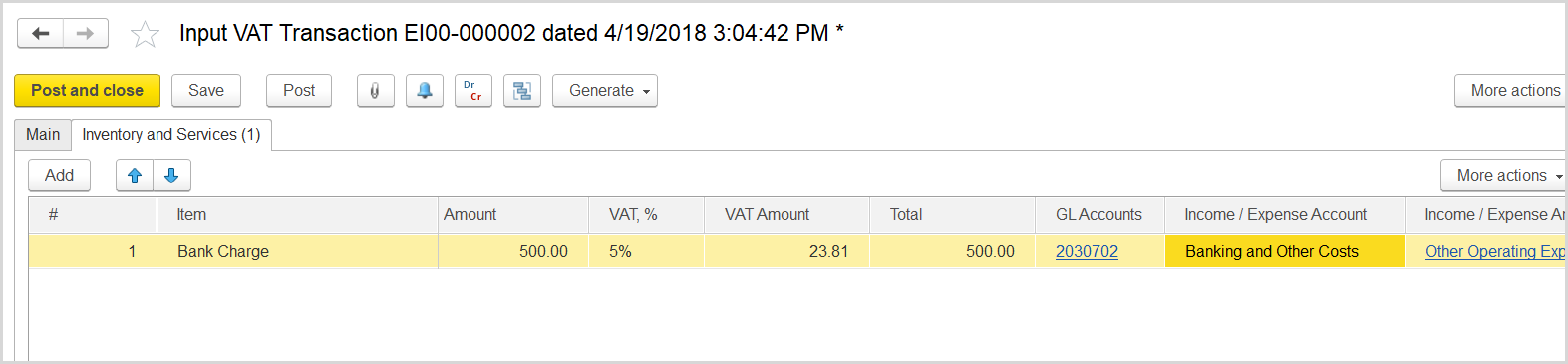

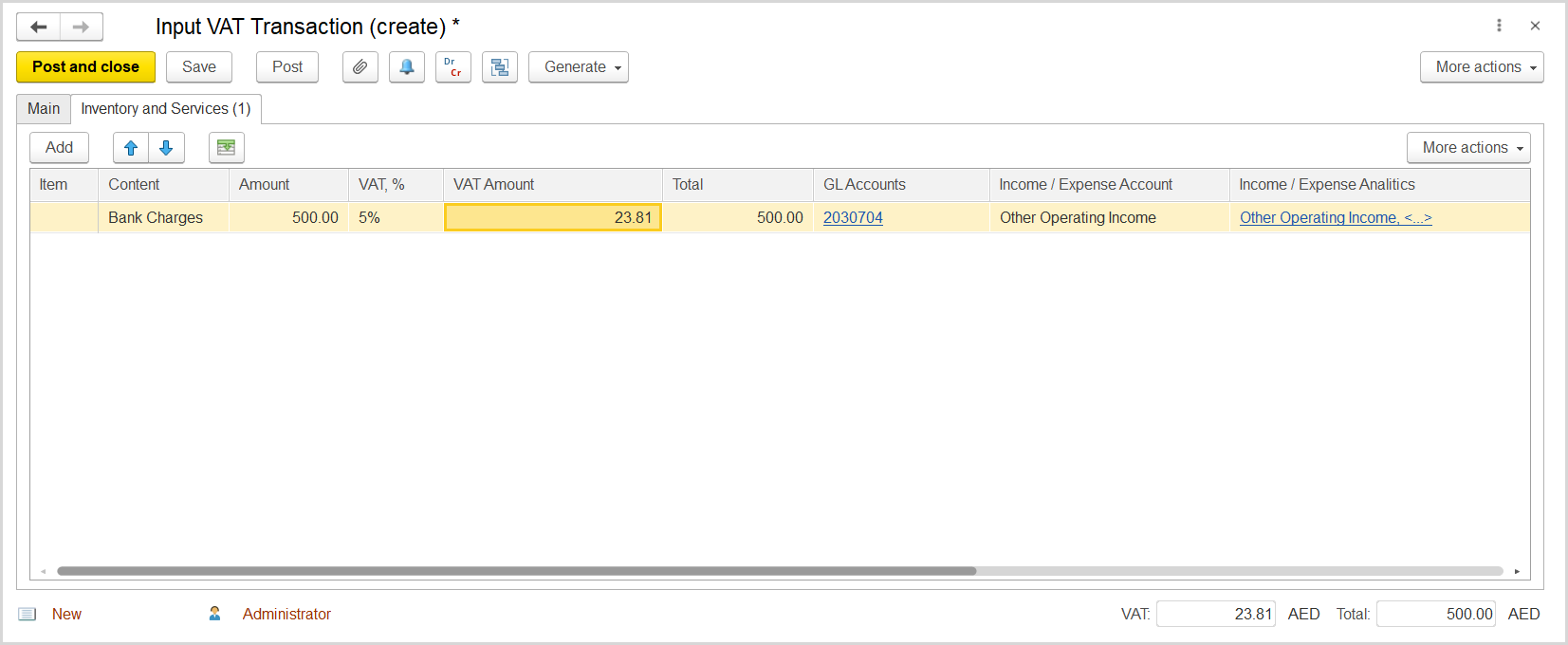

- On the Inventory /and Services tab, click Add to append a new line.

- Click in In the Item column to open a list of recently used items and click + (Create) to create a new item as follows:

- On the Create (Item) form that opens, create a Bank Charge service item as follows:

- Select the Service Item radio button.

- Make sure that the folder which contains service items is selected in the Folder field.

- In the Description field, type Bank Charges or other name which would stand for bank charges. Click Save and close to add the item to the document, select an item that is used for bank charges. If the item is not created, click Create to create a new item. For details, see Adding an Item.

- In the Amount column, for the bank charges item item enter the total on bank charges from the bank's tax invoice. Make sure the resulting VAT amount is equal to that on the bank's tax invoice.

- In the Income/Expense Account column, select an expense account generally used in the company entity for bank charges and other banking costs.

- Click Post to register the document in the system.

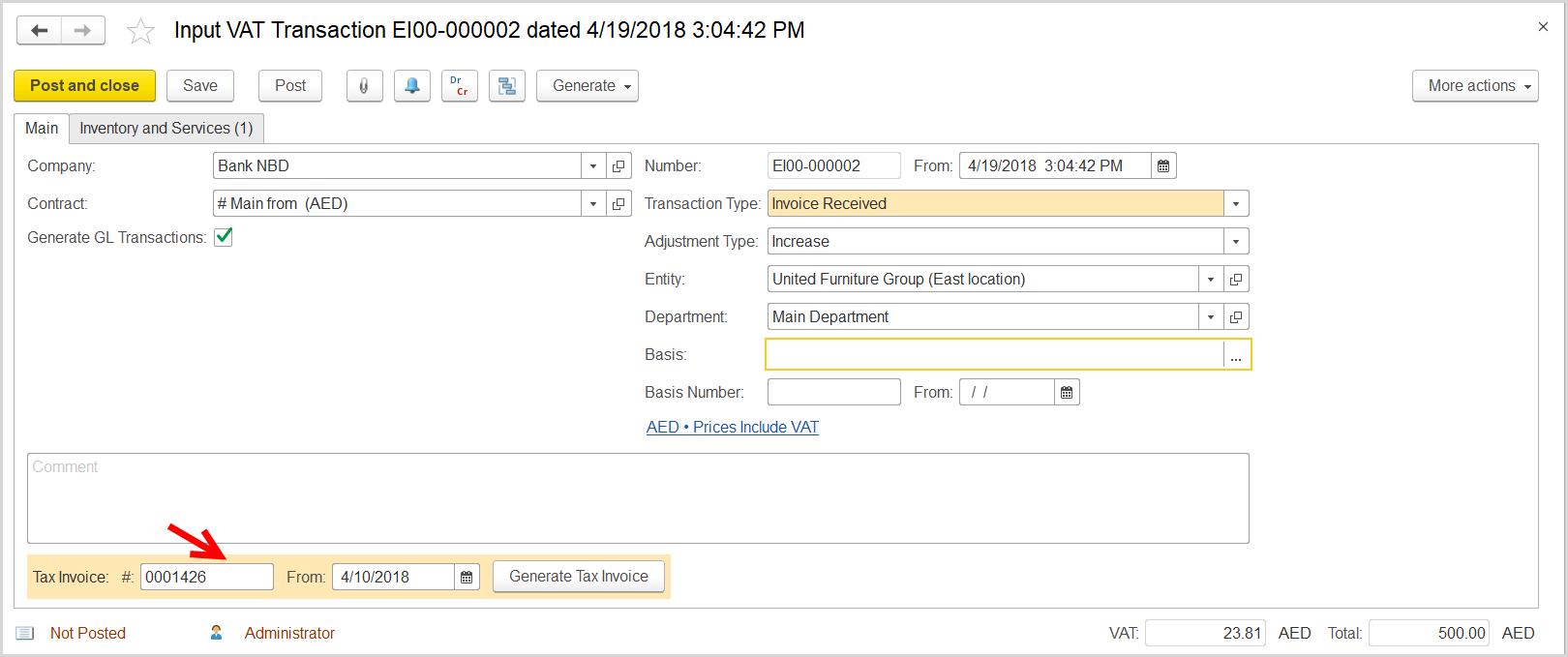

- On At the bottom of the Main tab at the bottom , enter the number and the date of the tax invoice received from the bank.

- Click the Generate Tax Invoice button. A link to the generated tax invoice received appears Tax Invoice Received appears at the bottom of the form.

- Click the link to review the tax invoicethe Tax Invoice Received.

- Save and post the Tax Invoice Received.