Versions Compared

Key

- This line was added.

- This line was removed.

- Formatting was changed.

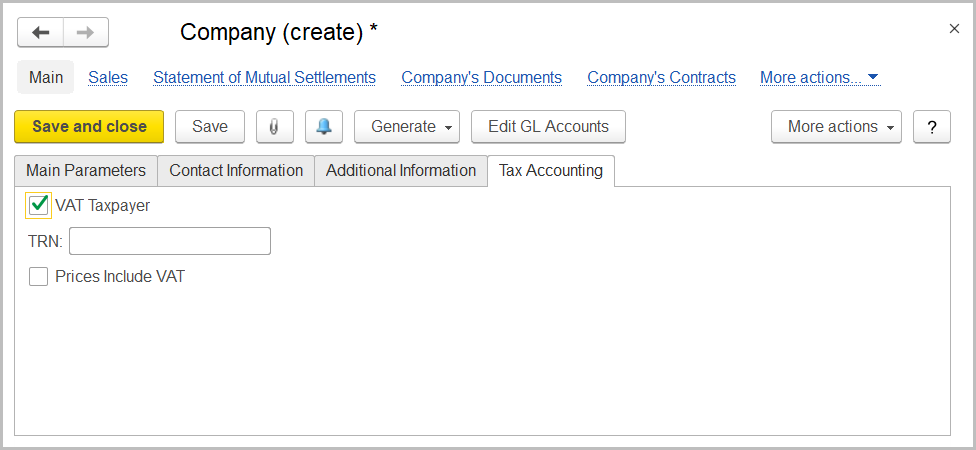

By using this tab, you can specify whether this company is a VAT taxpayer and provide the VAT-related information.

If you leave the VAT Taxpayer check box cleared, the company will be considered as not registered for VAT or as located outside of the VAT scope. The Out of Scope taxation option will be applied by default to documents associated with the company.

Once you select

...

the VAT Taxpayer

...

check box, other fields that are related to taxes appear.

...

Image Added

Image Added

The "Company (create)" form. The Tax Accounting tab

In

...

the TRN

...

field, enter the registration number assigned by the Tax Authority to this company.

If the prices used by this company include VAT, select

...

the Prices Include VAT

...

check box. This option will be used as the default option for purchasing documents if no supplier price type is specified (otherwise, the option associated with the price type will be used).