Problem: How to enter a purchase of fixed assets on bank credit

...

transfer?

Solution:Use a Loan Adjustment document with the transaction type Conversion of Accounts Payable to Loan Received.

An entity uses funds received as a loan to pay off its outstanding debt to a supplier by bank credit. This is typically formalized through a specific transaction type called Conversion of Accounts Payable to Loan Received.

1. Enter the Invoice Received from the Vehicle Supplier

- Go to Purchasing > Purchasing Documents > Invoices Received. Create a new document.

...

See also: 4.2.3.1. Invoices Received (Receipt From Supplier) - FirstBit User Guide - FirstBit User Guide

2. Record the Asset in Fixed Assets

- Go to Accounting > Fixed Assets and create a new asset entry for the vehicle.

...

See also: 12.2.1. Fixed Asset Entries - FirstBit User Guide - FirstBit User Guide

3. Create a loan agreement

- Enable Loan Agreements: Make sure the "Enable Long-Term Credits and Loans" option is selected in Administration > Settings > General Settings.

...

See also: 6.6.1. Loan Agreements - FirstBit User Guide - FirstBit User Guide

4. Create a Loan Adjustment document with the transaction type Conversion of Accounts Payable to Loan Received.

- Go to Accounting, in the Service tools section select Loan Adjustment. Create a Loan Adjustment document with Transaction Type: Converstion of Accounts Payable to Loan Received.

...

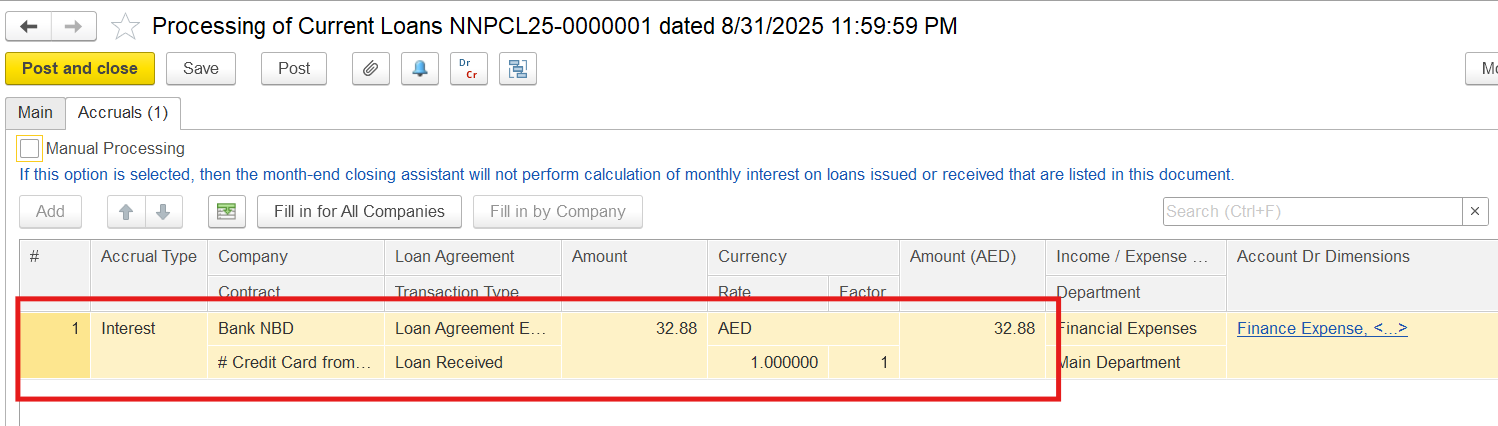

5. During month-end closing, interest on the loan will be calculated and posted automatically if set up correctly.

- Include the interest calculation in month-end closing procedures by selecting the Calculate Monthly Interest on Loans option on the form of the assistant.

...

- In the document Processing of Current loans a monthly interest from the Loan Agreement and the Bank’s repayment schedules must be entered

6. Pay for the loan by creating a document Bank receipt with the type of Loan Payment transaction:

- On the main tab select Payment of Loans in Cash Flow Item. Also specify Repayment of Loan Received as Transaction Type

...