...

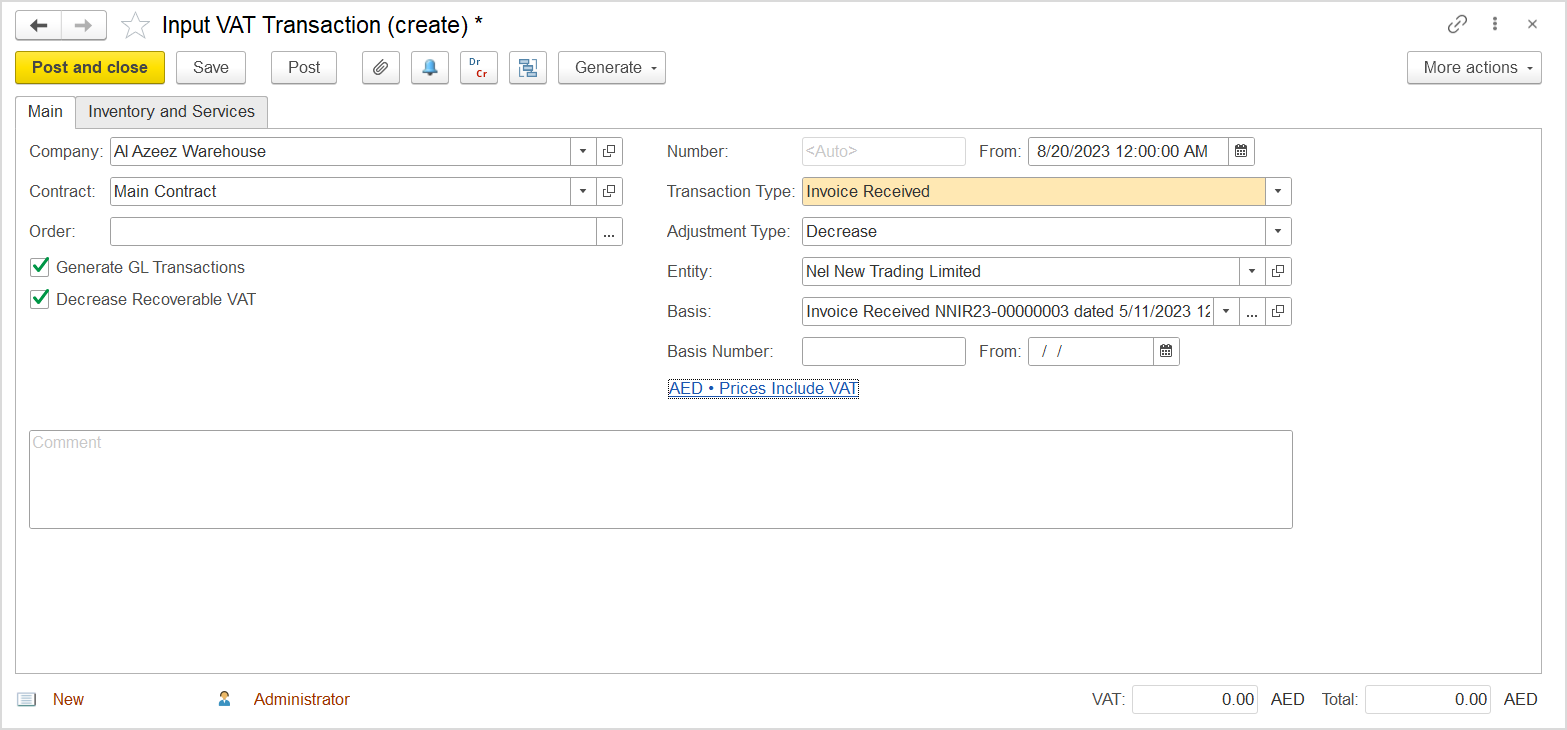

- Click Create to create a new Input VAT Transaction.

- In the Company box, select the supplier.

- In the Transaction Type field, select Invoice Received.

- In the Adjustment Type field, select Decrease.

- Select the Generate GL Transactions check box.

- Make sure the tax settings match those in the original Invoice Received.

- If the standard VAT rate was used in the original document, select the Decrease Recoverable VAT check box.

- In the Basis field, select the original Invoice Received with incorrect VAT rate.

- Click Save to assign the number to this document.

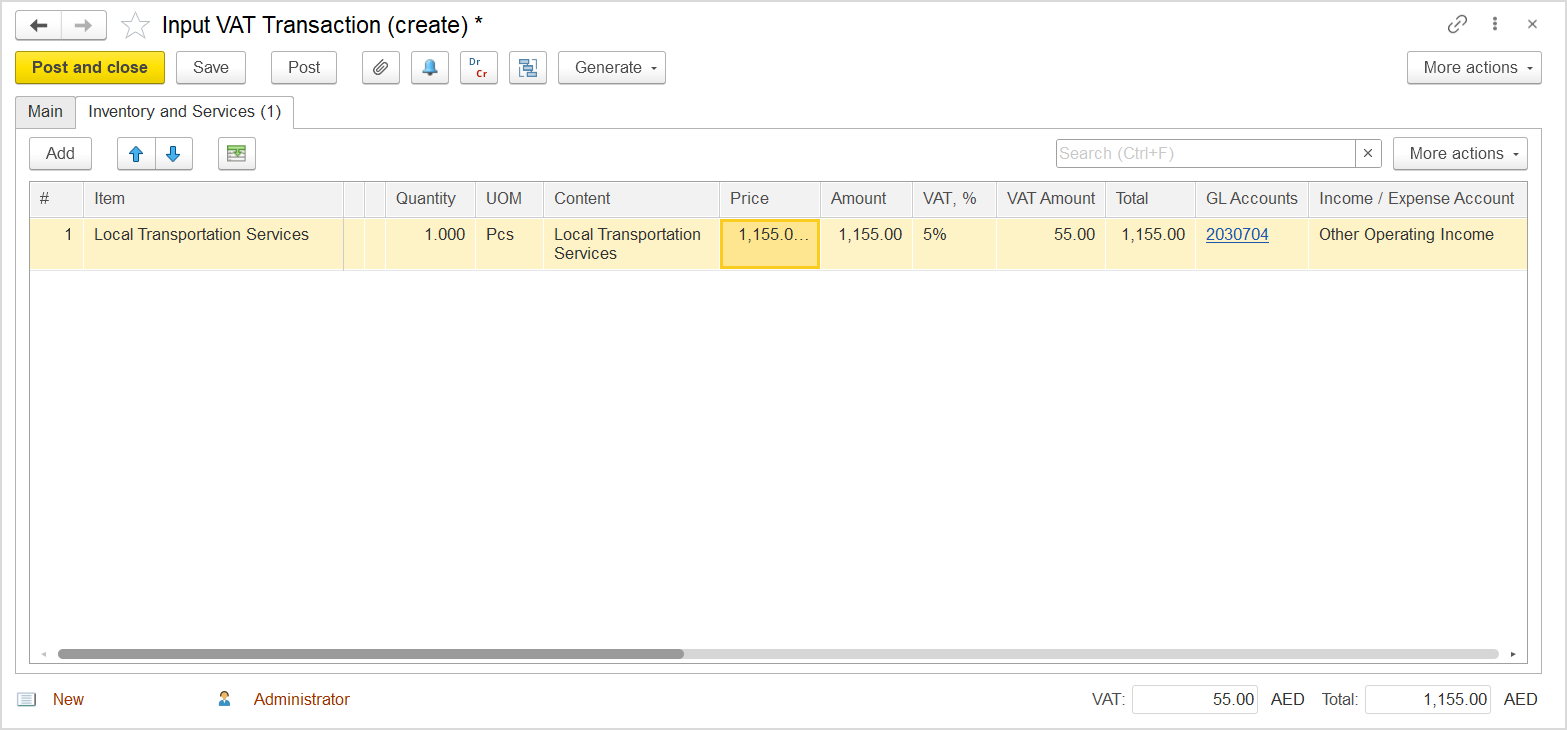

- On the Inventory/Services tab, click Add to append a new line.

- In the Content column enter any comment to the transaction, for instance VAT Rate correction.

- In the Amount column, enter the amount from the original Invoice Received.

- In the VAT, % column, select the rate that was used in the original document.

- In the Income / Expense Account column, select the expense account from the original document.

- Click Post to register the document in the system.

- If the standard or other non-zero rate was used in the original document, click the Generate Tax Credit Note Received button at the bottom of the Main tab and enter the date of the tax note, or click Generate > Tax Credit Note Received on the toolbar.

II. Where: Taxes > Tax Documents > Input VAT Transactions

...

If the original incorrect rate was zero rate or exempt and was replaced with the standard rate, then at the bottom of the Main tab, enter the number and date of the Tax Invoice Received from the supplier. Click the Generate Tax Invoice Received button. A link to the generated Tax Invoice Received appears.

...