In case when the buyer of commercial property paid the VAT on this purchase directly to the FTA, the entity must reverse the output V AT specified in the invoice. Note, that these VAT amounts should be reported separately for each Emirate where the property being sold is located.

In FirstBIT ERP, you need to account for the sales of a commercial property as follows:

...

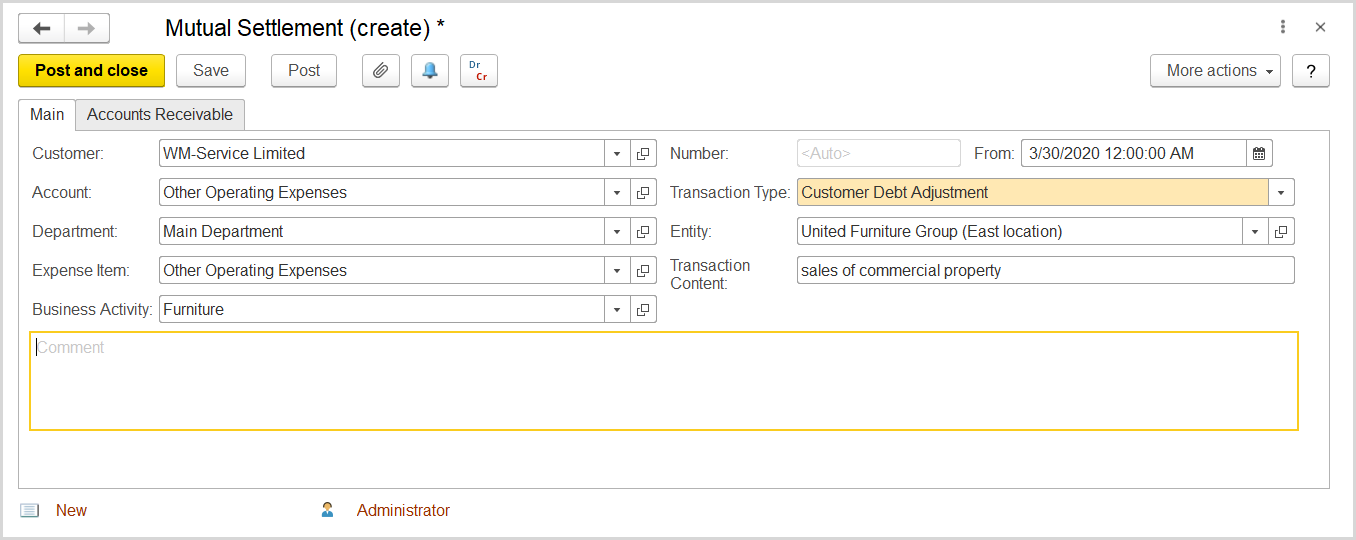

- Click Create to create a new Mutual Settlements document.

- In the Customer box, select the buyer of the commercial property.

- In the Account field, select an expense account to record the amount.

- In the Department field, select the department to which the property sales is related.

- Make sure to clear the Generate GL Transactions check box.

- The document number will appear in the Number field when the document will be saved.

- In the Expense Item field, select an expense item associated with the sales.

- In the Transaction Type field, select Customer Debt Adjustment.

- In the Entity field, make sure the correct entity is selected.

- In the Transaction Content field, provide a brief description of the transaction.

- Click Save to save the date.

- On the Inventory and Services tab, click Add to append a new line to the document.

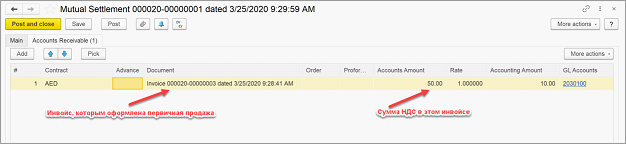

- In the Contract column, select the contract of the customer to which the sales is related.

- In the Document column, select the invoice registering the sales.

- In the Account Amount column, specify the VAT amount paid by the customer directly to the FTA.

- In the Income/Expense Account select an appropriate expense account to record the reduction of the debt in the amount of VAT.

- In the Income/Expense Item select an expense item to associate with the sales.

- Click Save to save the document, post, and close it.

...