If a bonus/rebate amount is greater than the amount that the entity owes to the supplier, then the difference might be considered an advance payment. If the supplier provided the entity with a proper tax invoice, the company can adjust the recoverable VAT according to the resulted advance amount by creating the following documents:

- Debit noteNote for the rebate (bonus) applied

- Input VAT Transaction to register the resulted taxable advance amount and corresponding VAT amount

- Tax Invoice Received to register the tax invoice received from the supplier

...

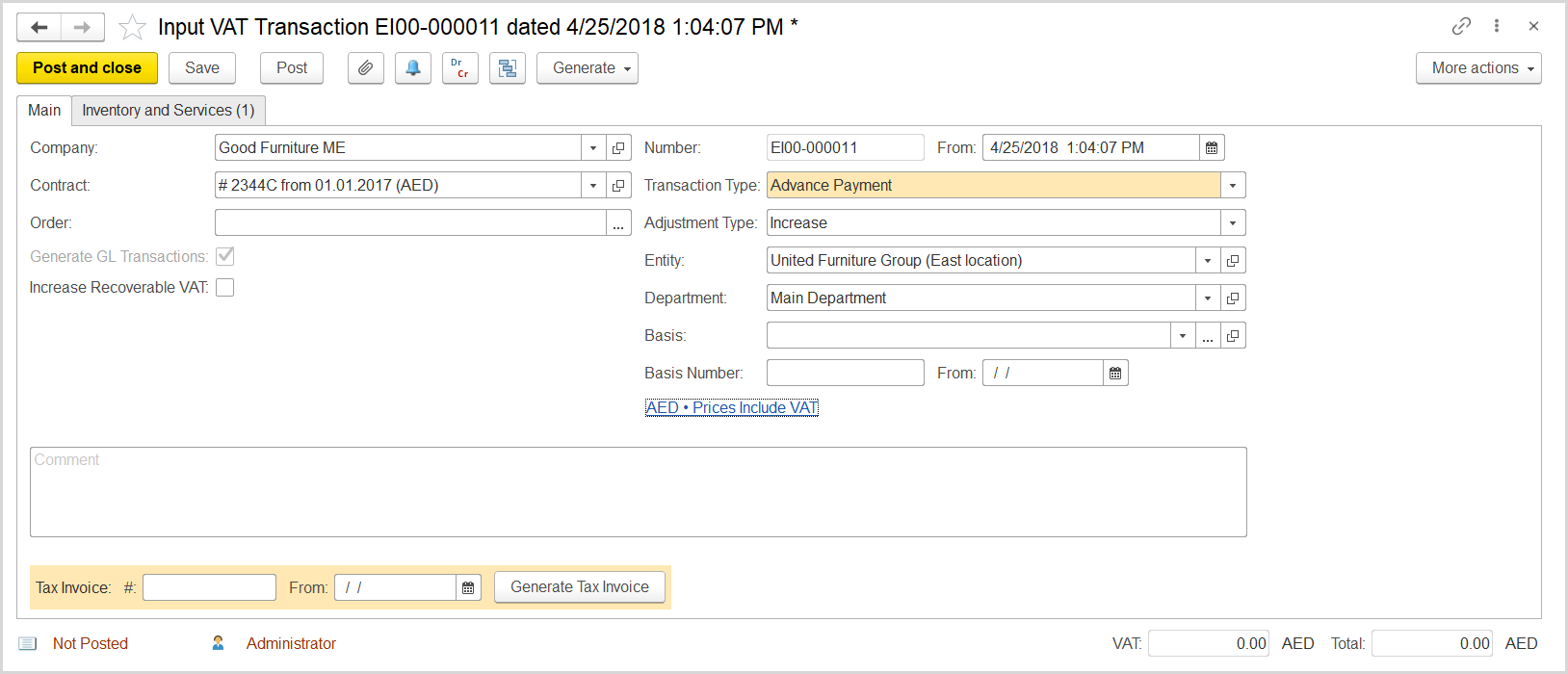

- Click Create to create a new Input VAT Transaction.

- In the Company box, select the supplier.

- In the TransactionType field, select Advance Payment.

- In the AdjustmentType field, select Increase.

- Make sure the link below the fields contains PricesInclude VAT. Otherwise, click the link to open the Prices and Currency dialog box, select the PricesInclude VAT check box there, and close the dialog box.

- Optionally, in the Basis field, select the debit note with rebate.

- Click Save to assign the number to this document.

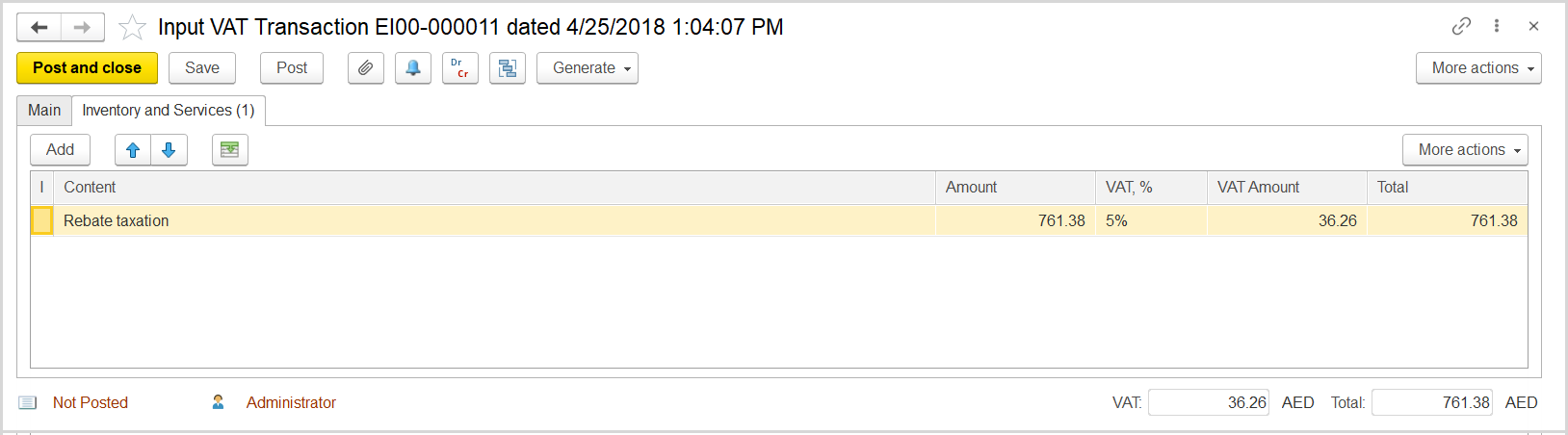

- On the Inventory/Services tab, click Add to append a new line.

- In the Contents column enter any comment to the transaction, for instance rebate taxation.

- In the Amount column, enter the rebate (bonus) amount minus the amount that the company currently owes to the supplier.

- Click Post to register the document in the system.

- At the bottom of the Main tab, enter the number and date of the tax invoice received from the supplier.

- Click the Generate Tax Invoice button. A link to the generated Tax Invoice Received appears.

- Review the generated Tax Invoice Received, save, and post it.