A company The entity can adjust (decrease) the accrued output VAT amount if the following happens:

...

- The goods / services were received by the customer.

- No payment was received after more than 6 months from the shipment date.

- The entity writes off the customer bad debt and notifies the customer about it by sending a Tax Credit Note.

The company entity should create the following documents:

- Credit noteNote in the amount of the written off debt.

- Output VAT transaction in the same amount.

- Tax credit noteCredit Note based on the output Output VAT transactionTransaction.

How to process

Where: Sales > Sales Documents > > Credit Notes

Create a credit note for the written off customer debt as follows:

...

Where: Accounting > Value Added Tax > Output VAT Transactions

Create an output VAT transactionCredit Note with Mutual Settlements Adjustment as transaction type for the written off customer debt amount. For details, refer to Creating a Credit Note.

Where: Taxes > Tax Documents > Output VAT Transactions

Create an Output VAT Transaction in the written off amount to decrease the total output VAT as follows:

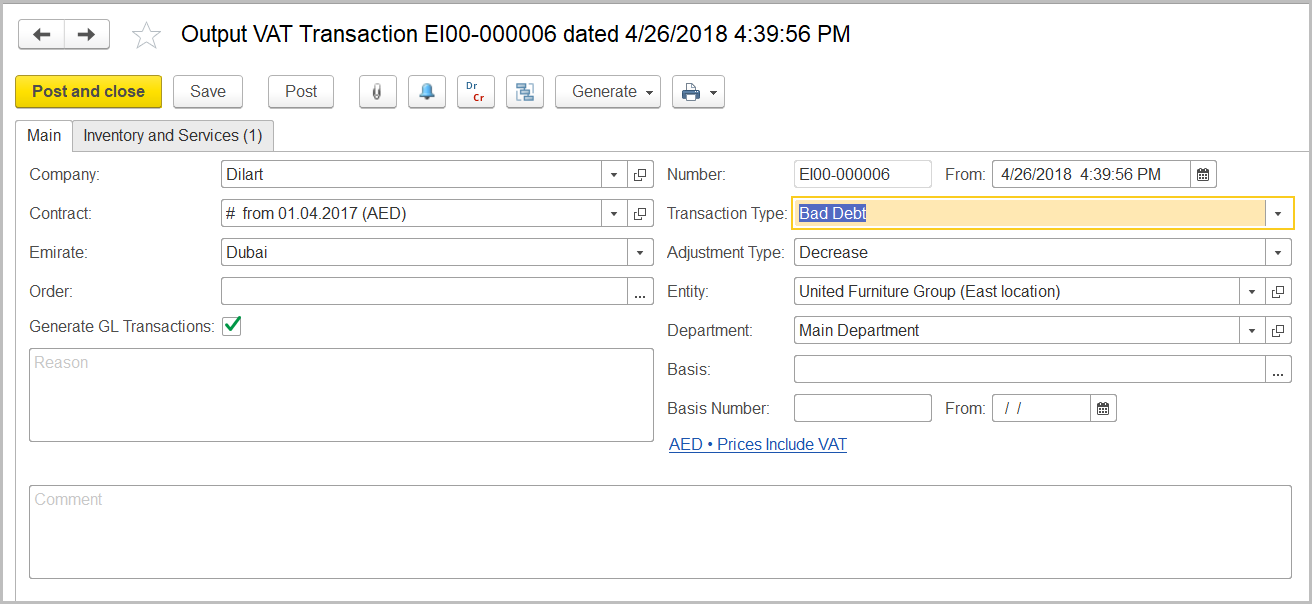

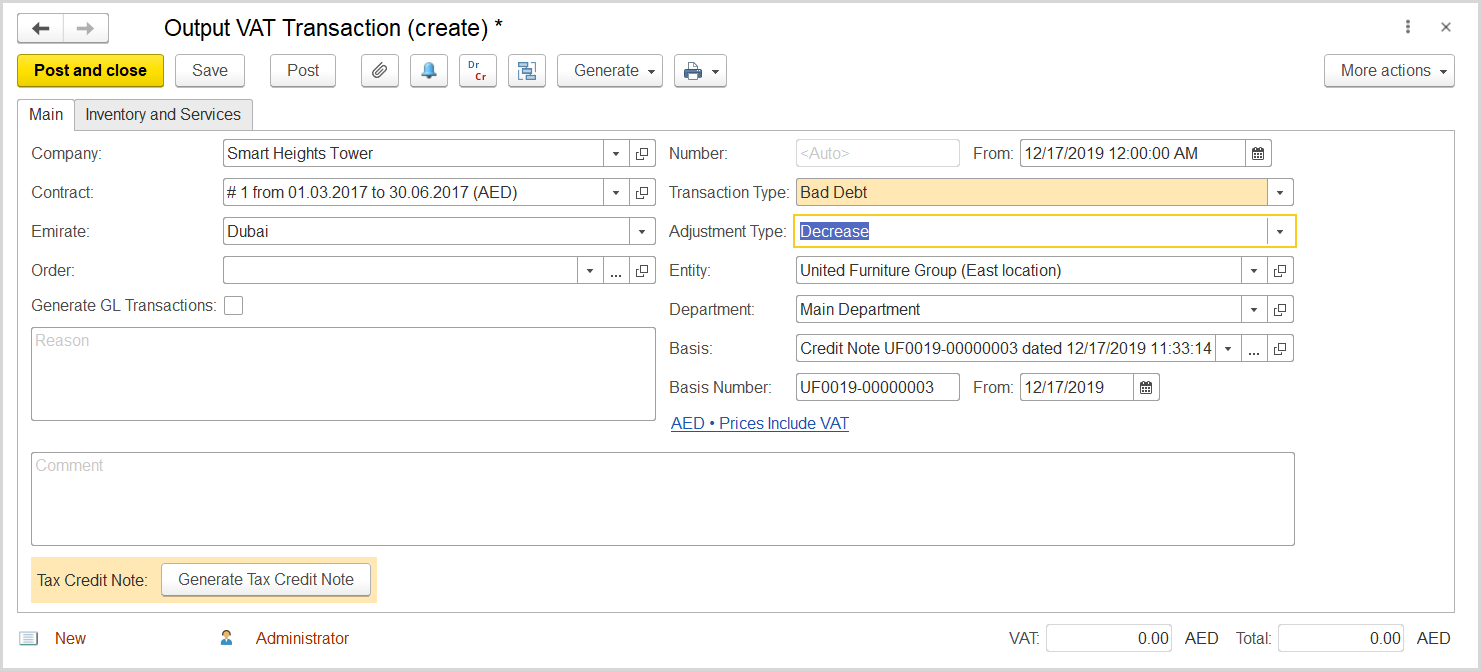

- Click Create to create a new Output VAT Transaction.

- In the Company box, select the customer.

- In the Transaction Type field, select Bad Debt.

- In the Adjustment Type field, select Decrease.

- Make sure the link below the fields contains Prices Include VAT. Otherwise, click the link to open the Prices and Currency dialog box, select the Prices Include VAT check box there, and close the dialog box.

- Optionally, in the Basis field, select the credit note with writeoff.

- Click Save to save the data and assign the a number to this document.

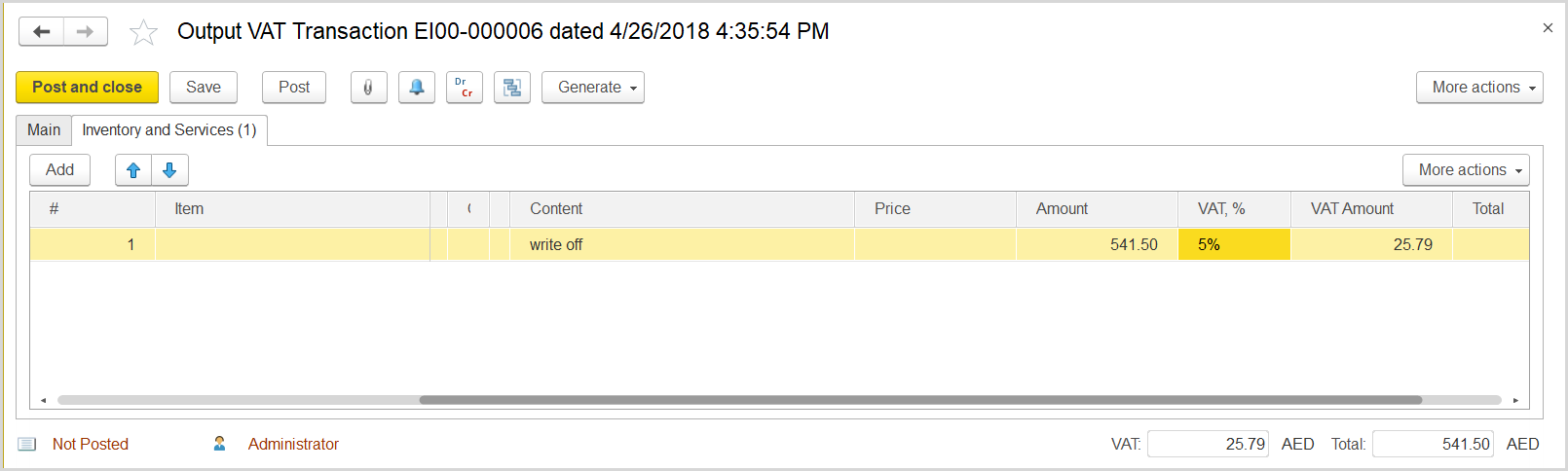

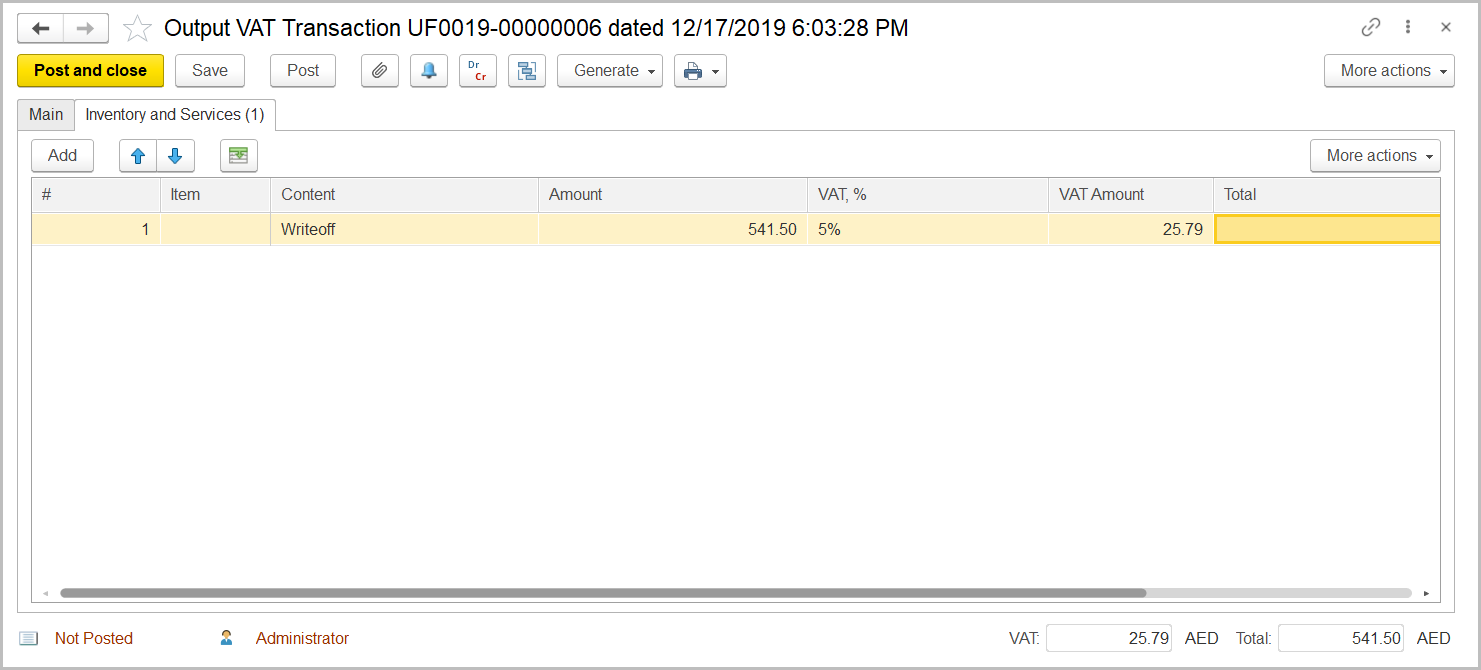

- On the Inventory/Services tab, click Add to append a new line.

- In the Contents column enter any comment for the transaction, for instance Debt writeoff.

- In the Amount column, enter the written off amount about which your company has notified the customer.

- In the VAT, % column, select the standard rate, 5% Rate.

- Click Post to register the document in the system.

...