...

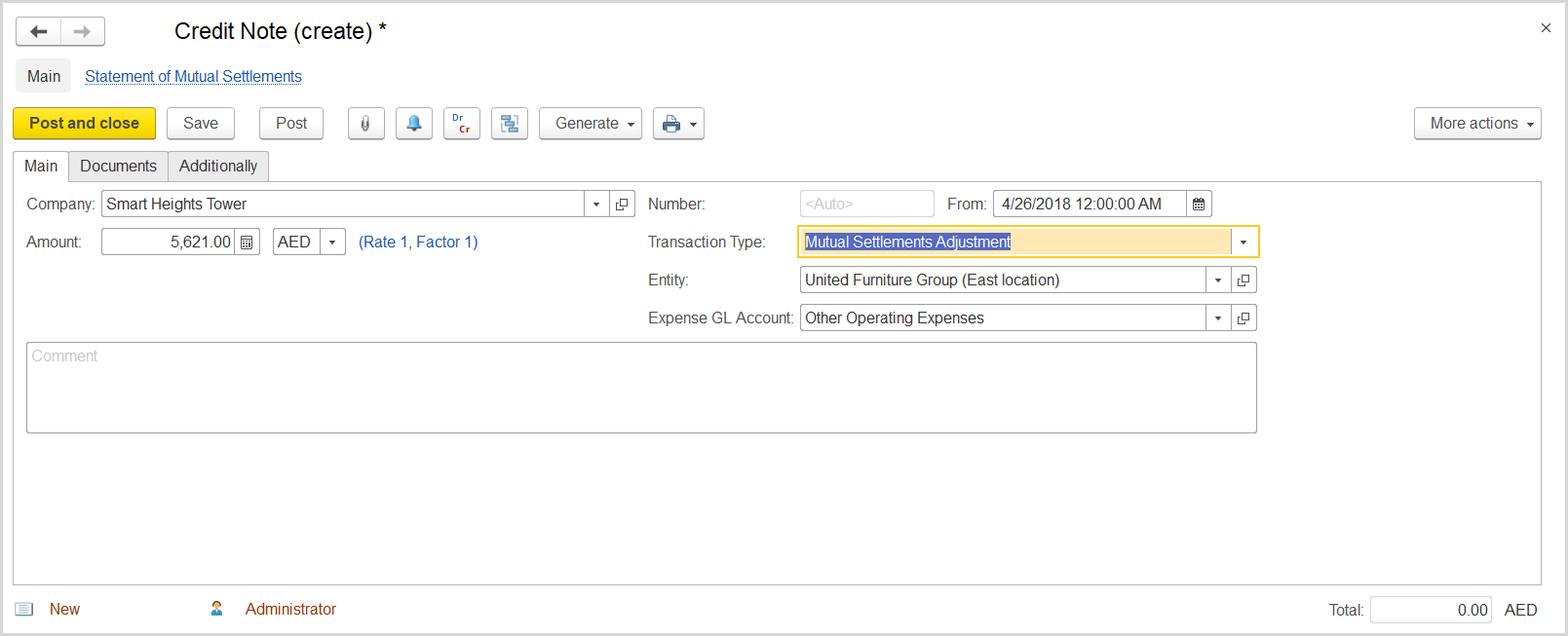

Create a credit note for the written off customer debt as follows:

- Select the customer company in a no-name field in the upper area of the form and On the list of existing credit notes, click Create. The Credit Note (Create) form opens.

- On the Main tab , in the Amount field, specify the written off amountin the Company field, select the customer company.

- In the Type field, select select Mutual Settlements Adjustment.

- In the Amount field, specify the written off amount.

- Click Save to save the document and to assign it the number.

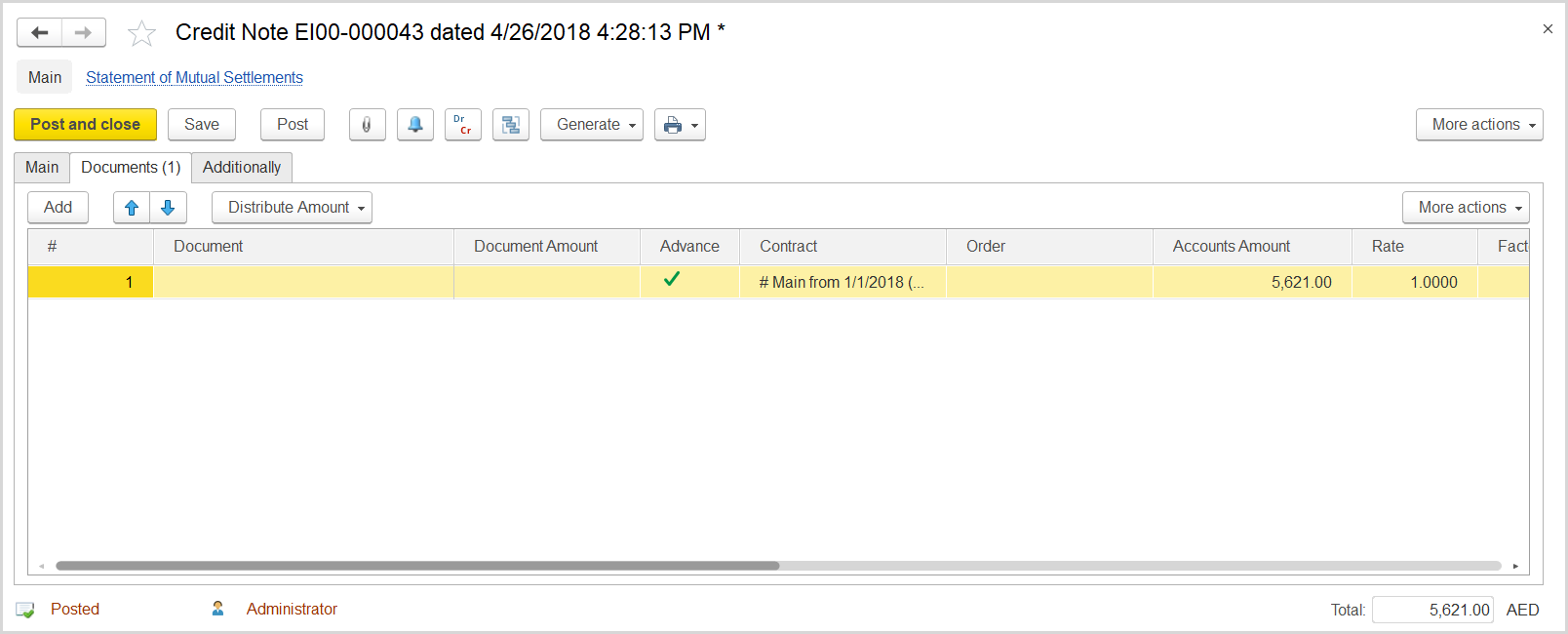

- On the the Documents tab, select the Advance check box.click Add to append a line.

- In the Advance column, make sure a check box is selected.

- In the Contract column, specify the contract with customer for which this writeoff was done.

- In the Accounts Amount column, enter the writeoff amount.

- Click Save and then Post.

...

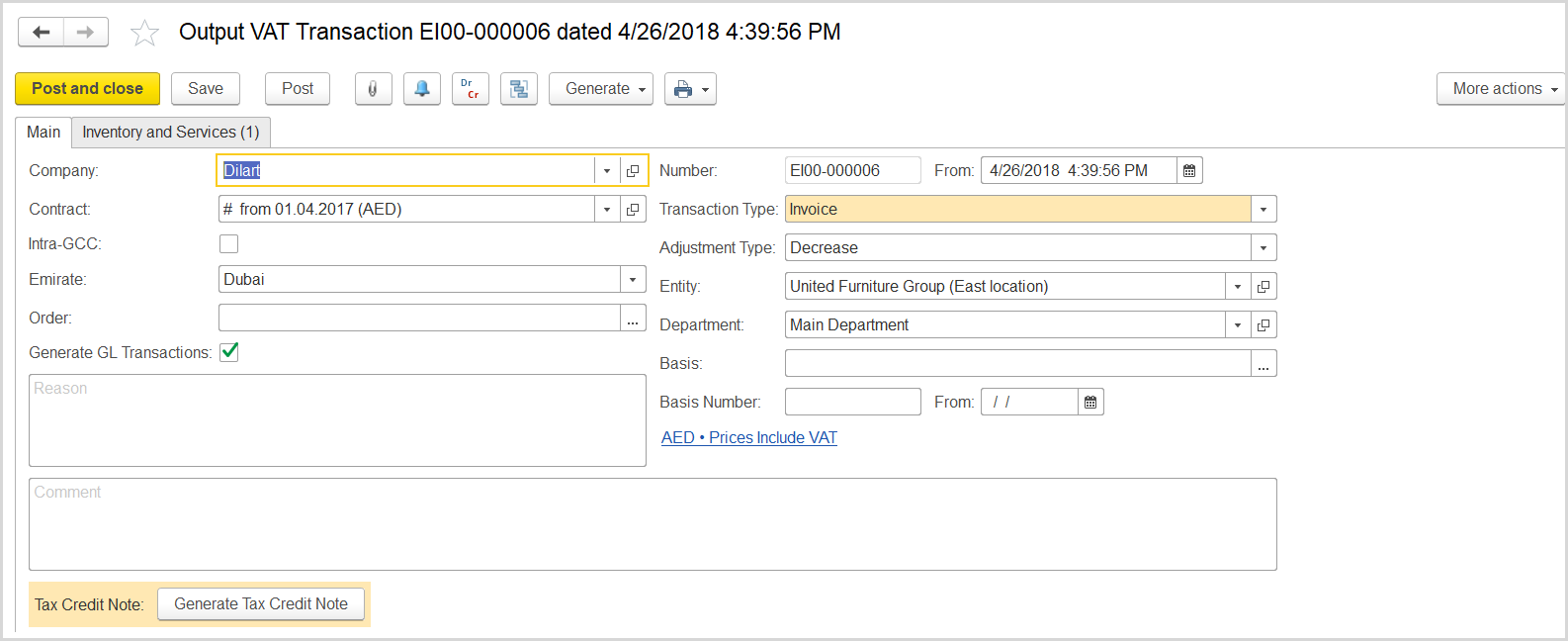

- Click Create to create a new Output VAT Transaction.

- In the Company box, select the customer.

- In the Transaction Type field, select Invoice.

- In the Adjustment Type field, select Decrease.

- Make sure the link below the fields contains Prices Include VAT. Otherwise, click the link to open the Prices and Currency dialog box, select the Prices Include VAT check box there, and close the dialog box.

- In the Basis field, select the credit note with writeoff.

- Click Save to assign the number to this document.

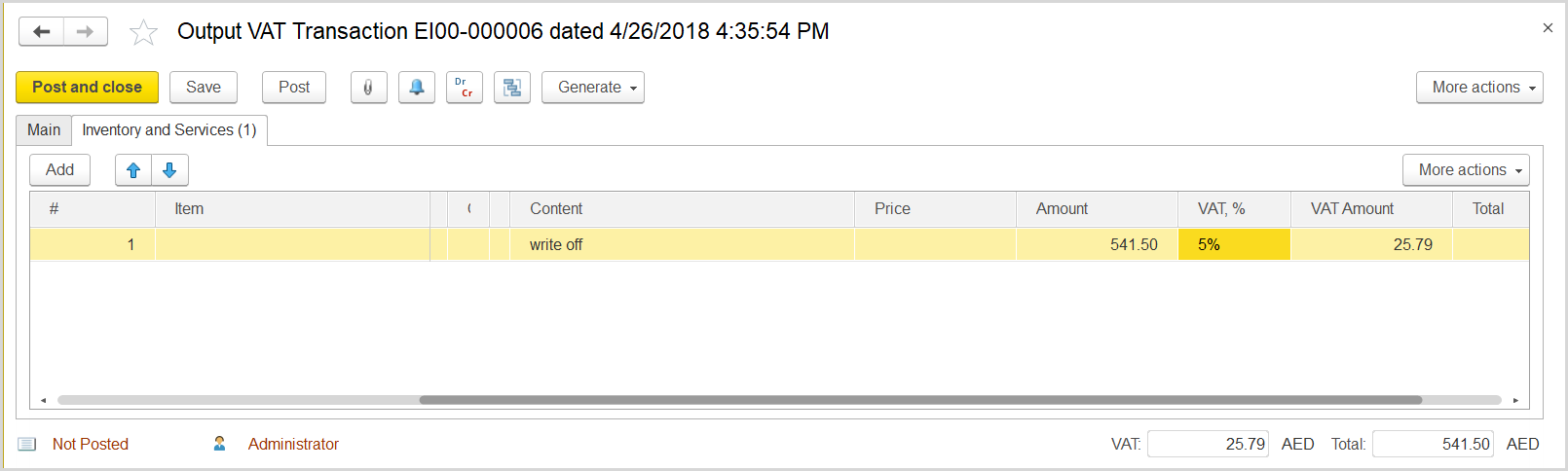

- On the Inventory/Services tab, click Add to append a new line.

- In the Contents column enter any comment for the transaction, for instance Debt writeoff.

- In the Amount column, enter the written off amount about which your company has notified the customer.

- In the VAT, % column, select the standard rate, 5% Rate.

- Click Post to register the document in the system.

...