If the return (adjustment) amount is greater than the customer debt, then the company owes the difference to the customer. Some auditors believe that in this case the company must charge VAT on this resulting amount.

How to process

Where: Sales > Sales Documents > Credit Notes

- Select the customer company in a no-name field in the upper area of the form and click Create.

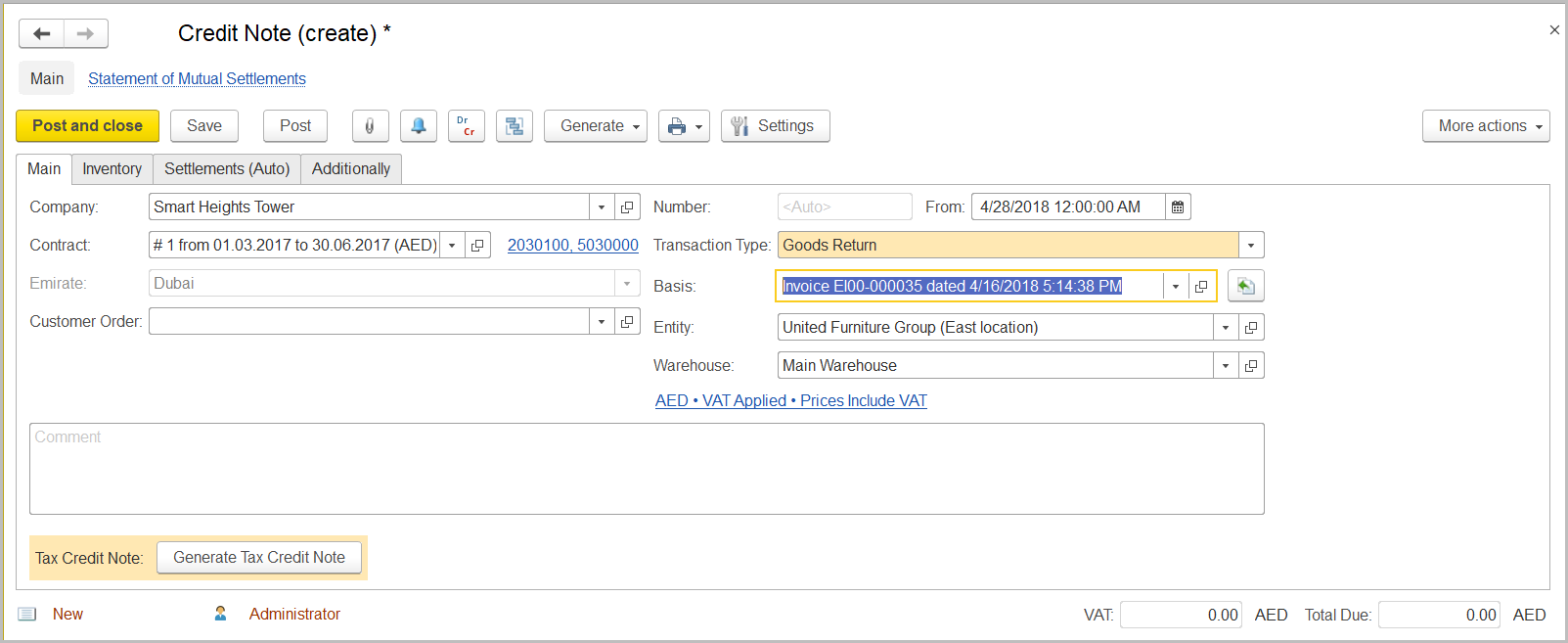

- The Credit Note (Create) form opens.

- On the Main tab, in the Amount field, specify the return amount.

- In the Type field, select Goods Return or Invoice Correction.

- Make sure the link below the fields contains Prices Include VAT. Otherwise, click the link to open the Prices and Currency dialog box, select the Prices Include VAT check box there, and close the dialog box.

- In the Basis field, select the invoice for which return is being recorded. Click the Fill in by Basis button to the right of the field.

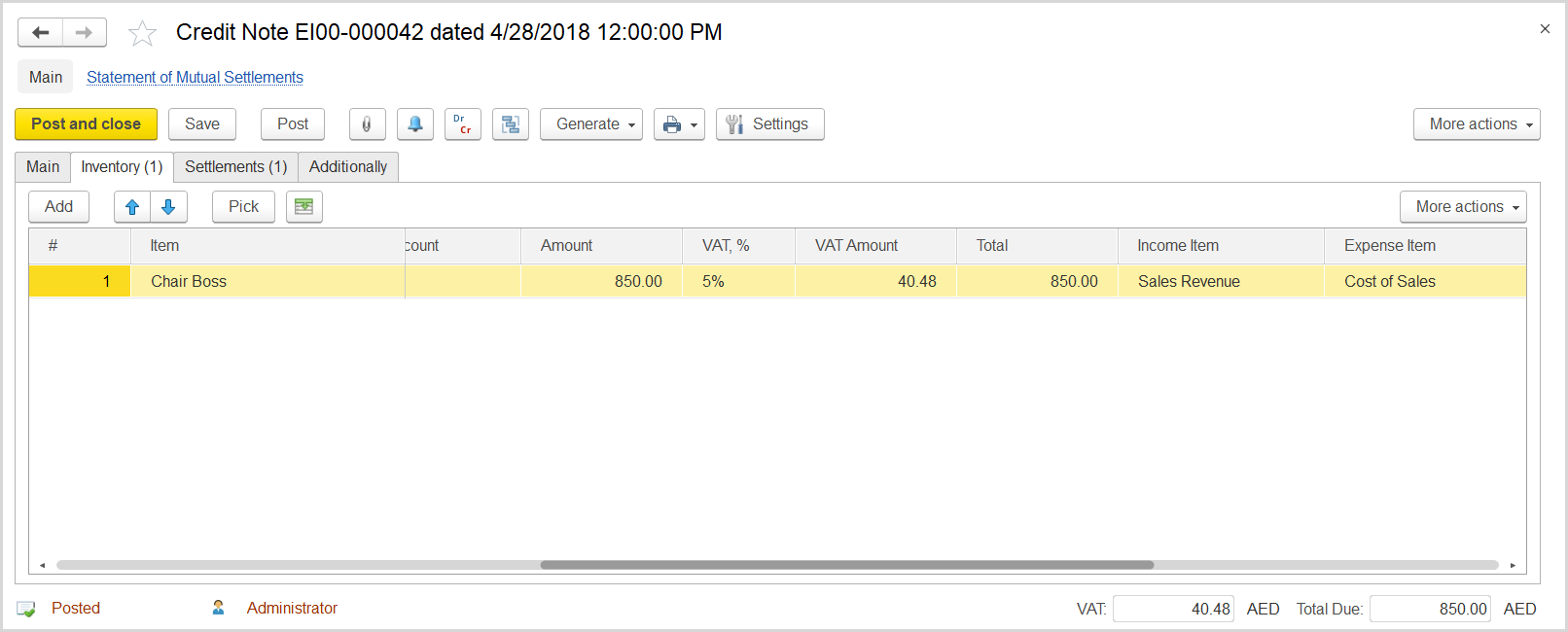

- On the Inventory tab, review the lines from the original invoice. Specify the quantities of the items returned and delete the lines (if any) for which there are no returns.

- In the VAT, % column, make sure the correct VAT rate is specified.

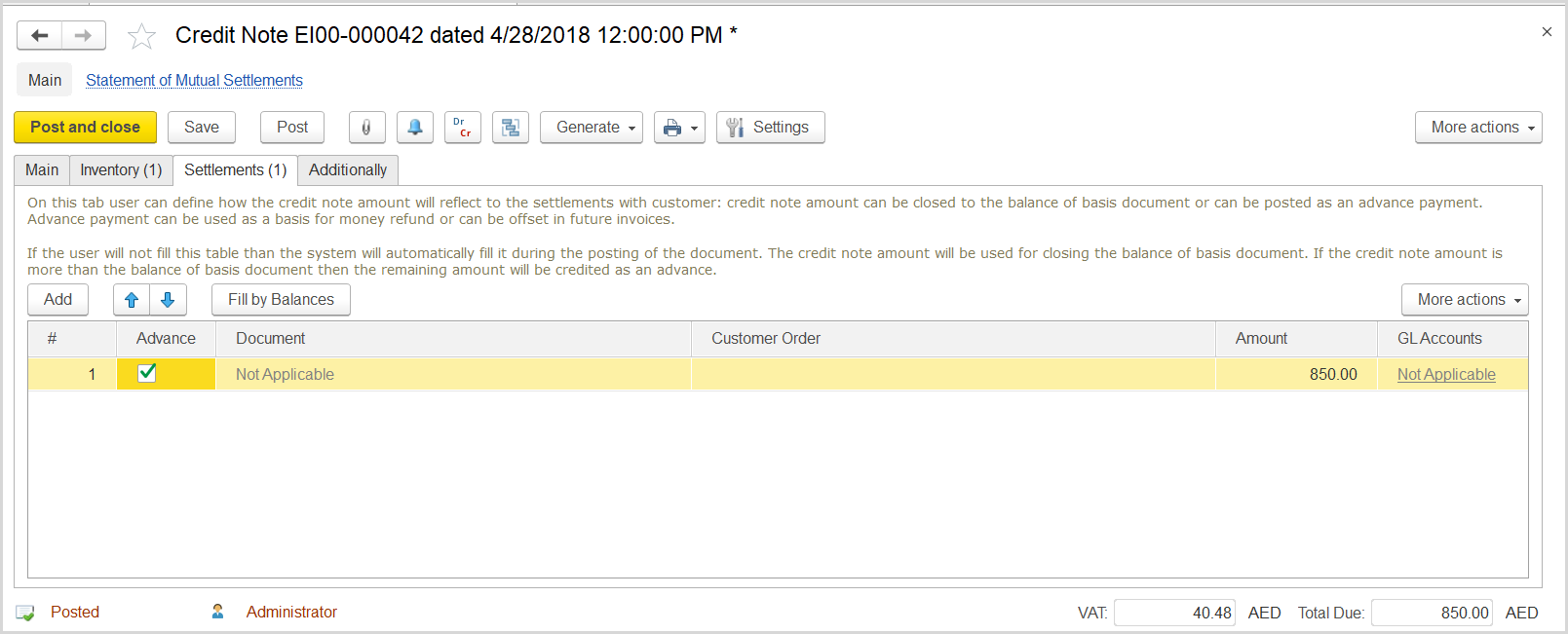

- On the Settlements tab, select the Advance check box.

- Click Save and then Post.

Where: Accounting > Value Added Tax > Output VAT Transactions

...