An advance holder had purchased specific services from outside UAE (a foreign country service provider or supplier) and specified this purchase on the advance report. The company can recover the input VAT on this service according to the Reverse Charge Mechanism. For this, the company has to create the following documents:

- Advance report which reflects the purchase

- Input VAT transaction based on the advance report

- Output VAT transaction based on the advance report

How to process

Where: Money > Cash Documents > Advance Reports

Prepare an advance report for the employee who has received an advance amount intended for purchasing outside of UAE. On the new advance report created for the employee with payment expense as a basis, make sure the sure Out of Scope is selected as Taxation option is selected. For more details on creating advance reports, see the Using Advance Reports section.

...

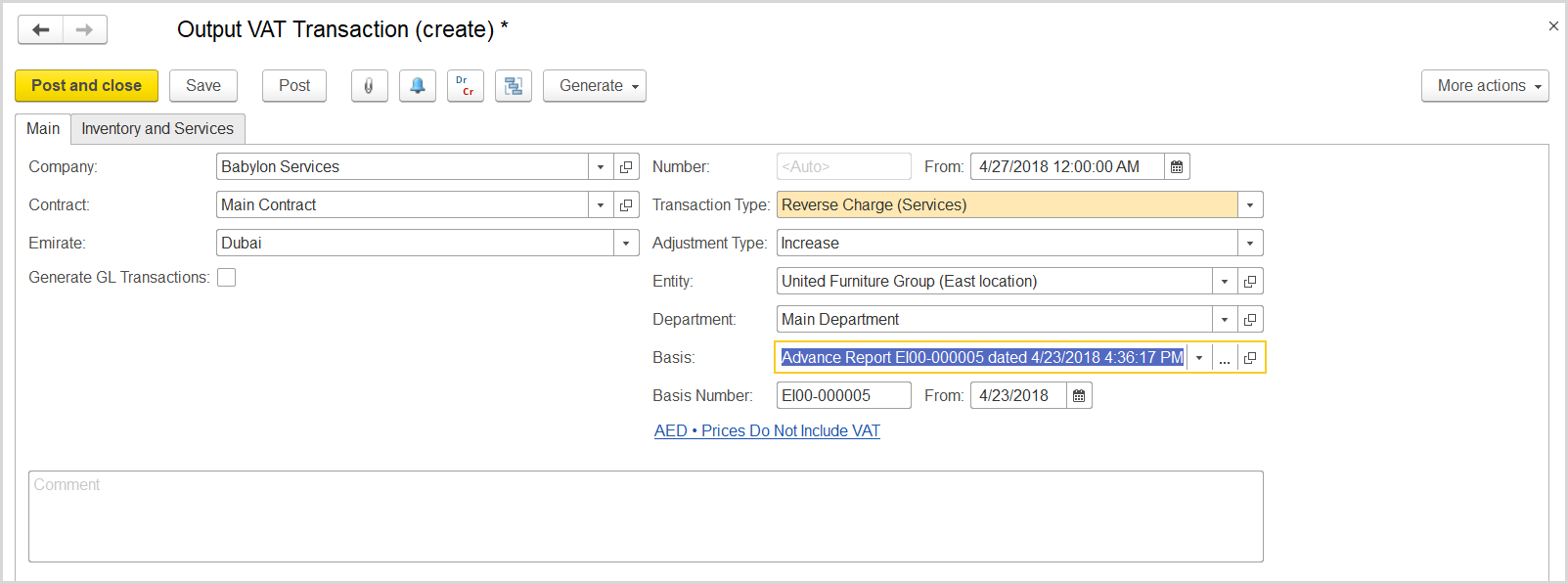

- Click Create to create a new Output VAT Transaction.

- In the Company box, select the company from which the service was purchased.

- In the Transaction Type field, select Reverse Charge (Services).

- In the Adjustment Type field, select Increase.

- Make sure the link below the fields contains Prices Do Not Include VAT. Otherwise, click the link to open the Prices and Currency dialog box, clear the Prices Include VAT check box there, and click OK to close the dialog box.

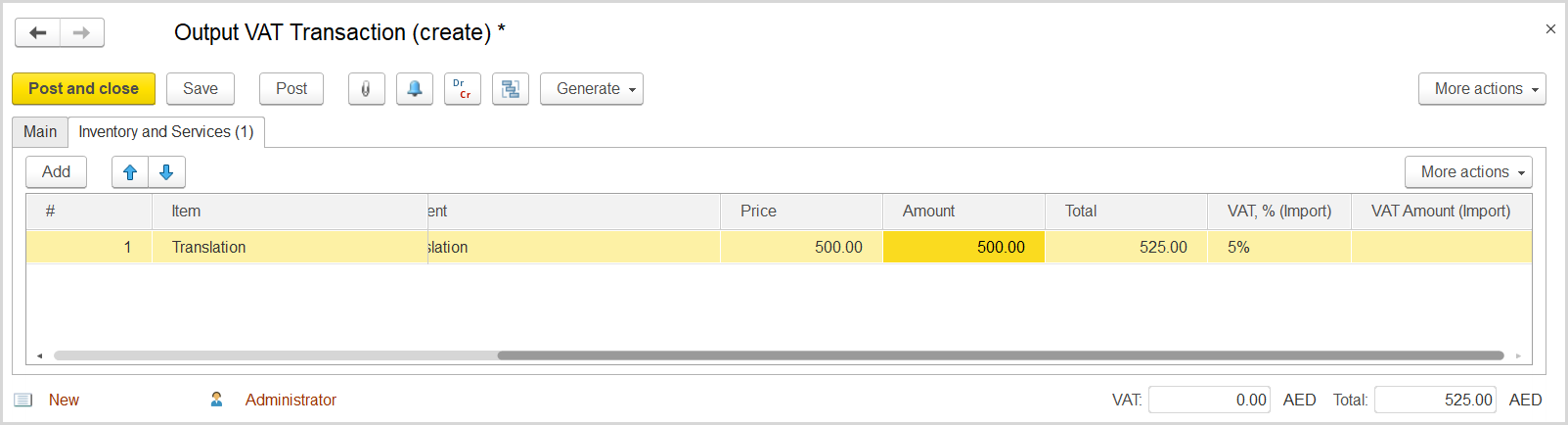

- On the Inventory/Services tab, click Add to append a new line.

- In the Contents column enter any comment to the transaction, for instance Reverse Charge on service.

- In the Amount column, enter the service amount from the advance report.

- In the VAT, % column, select the standard rate, 5%.

- Click Post to register the document in the system.

- On the Main tab on the command bar, click the Generate Tax Invoice button. A link to the generated tax invoice received appears.