...

The company should create the following documents:

1) Credit Note (Mutual Settlements Adjustment) на сумму списываемой задолженности Credit Note in the mount of written off debt.

2) Output VAT Transaction (Transaction Type = Invoice, Adjustment Type = Decrease, Prices Include VAT установлен) на сумму списываемой задолженностиin the same amount.

3) Tax Credit Note на основании base on the Output VAT Transaction.

How to process

1) Create a Credit Note (with Mutual Settlements Adjustment as transaction type) in the amount of the written off customer debt.

...

Where: Accounting > Value Added Tax > Output VAT Transactions

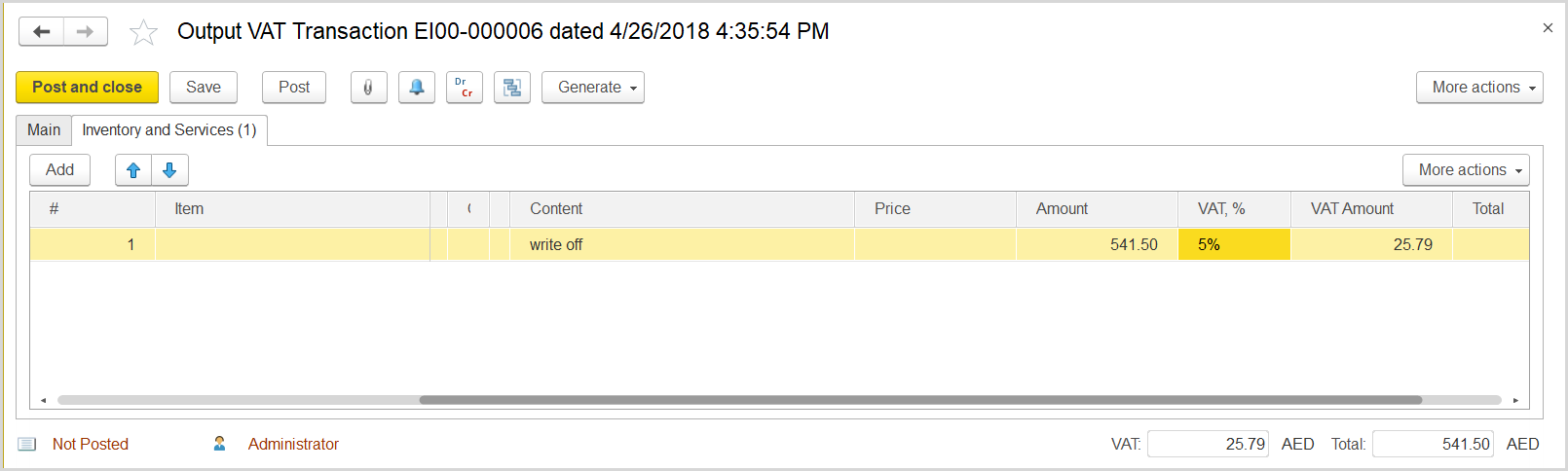

Create an Output VAT Transaction in the written off amount to decrease the total output VAT .Where: Accounting > Value Added Tax > Output VAT Transactionsas follows:

- Click Create to create a new Output VAT Transaction.

- In the Company box, select the customer.

- In the Transaction Type field, select Invoice.

- In the Adjustment Type field, select Decrease.

- Make sure the link below the fields contains Prices Include VAT. Otherwise, click the link to open the Prices and Currency dialog box, select the Prices Include VAT check box there, and close the dialog box.

- Click Save to assign the number to this document.

- On the Inventory/Services tab, click Add to append a new line.

- In the Contents column enter any comment for the transaction, for instance Debt writeoff.

- In the Amount column, enter the written off amount about which your company has notified the customer.

- In the VAT, % column, select the standard rate, 5% Rate.

- Click Post to register the document in the system.

...

Where: Sales > Sales Documents > Tax Credit Notes

Create a Tax Credit Note bases based on the the Output VAT Transaction.

Where:

...

Accounting > Value Added Tax > VAT Return

Update the VAT Return report for the appropriate tax period, make sure the adjusted VAT amount appears under the VAT on Sales and All Other Inputs section, in the Adjustments column for the customer's emirate line.