An advance holder had purchased specific services from a foreign country service provider or supplier and specified this purchase on the advance report. The company can recover the input VAT on this service as the reverse VAT. For this, the company has to create the following documents:

- Advance report which reflects the purchase

- Input VAT Transaction based on the advance report

- Output VAT Transaction (Transaction Type = Reverse Charge (Services), Adjustment Type = Increase, Prices Include VAT не установлен) на сумму услуги.

How to process

I. Prepare an advance report as follows:

...

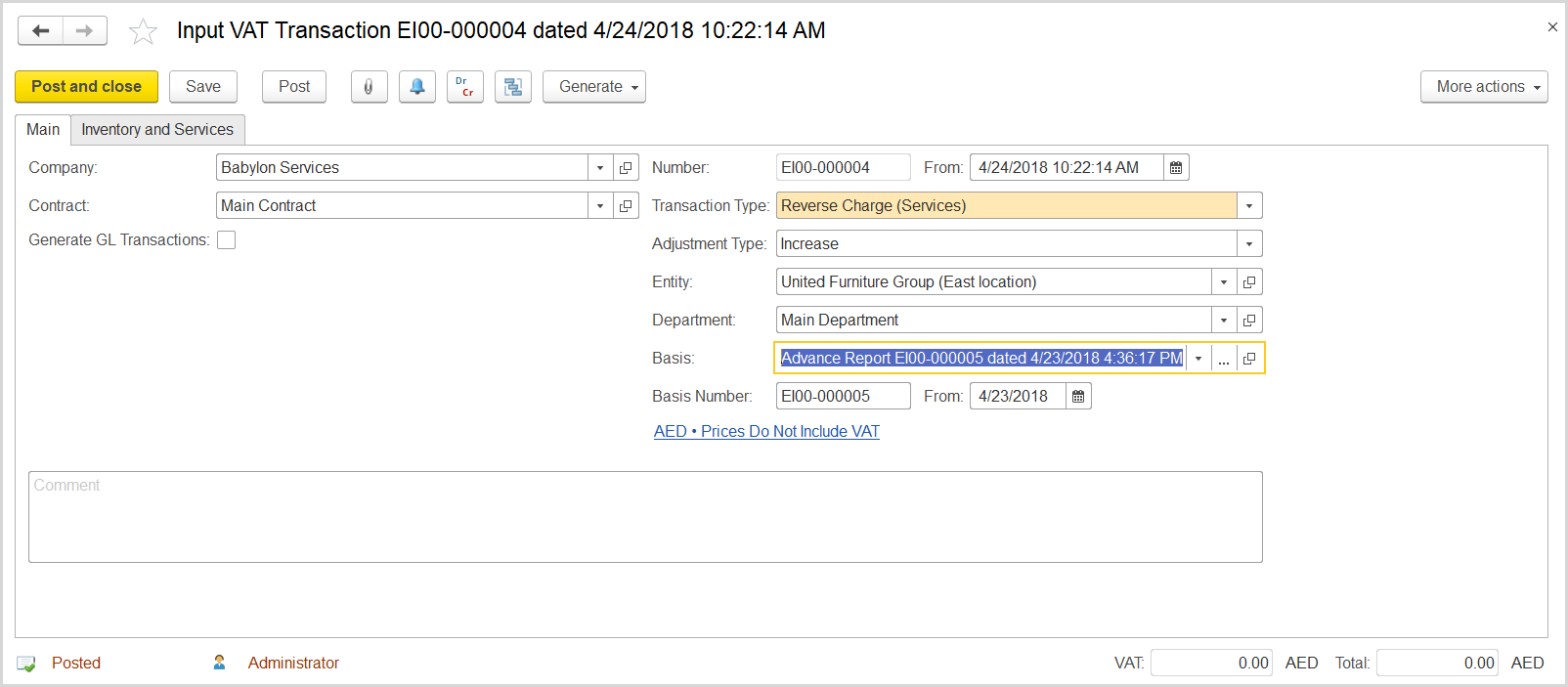

- Click Create to create a new Input VAT Transaction.

- In the Company box, select the supplier.

- In the Transaction Type field, select Reverse Charge (Services).

- In the Adjustment Type field, select Increase.

- Make sure the link below the fields contains Prices Do Not Include VAT. Otherwise, click the link to open the Prices and Currency dialog box, clear the Prices Include VAT check box there, and close the dialog box.

- In the Basis field, select the advance report.

- Click Save to assign the number to this document.

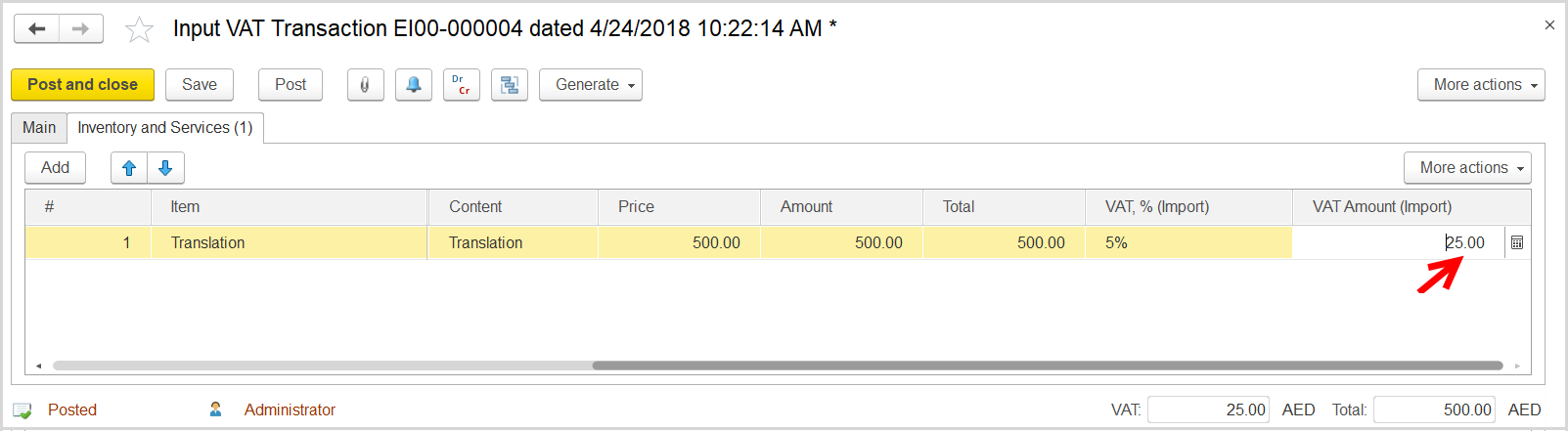

- On the Inventory/Services tab, click Add to append a new line.

- Select a service purchased by the employee.

- In the Amount column, enter the service amount.

- In the VAT Amount (Import) column, notice the reverse tax amount calculated on the service amount.

- Click Post to register the document in the system.

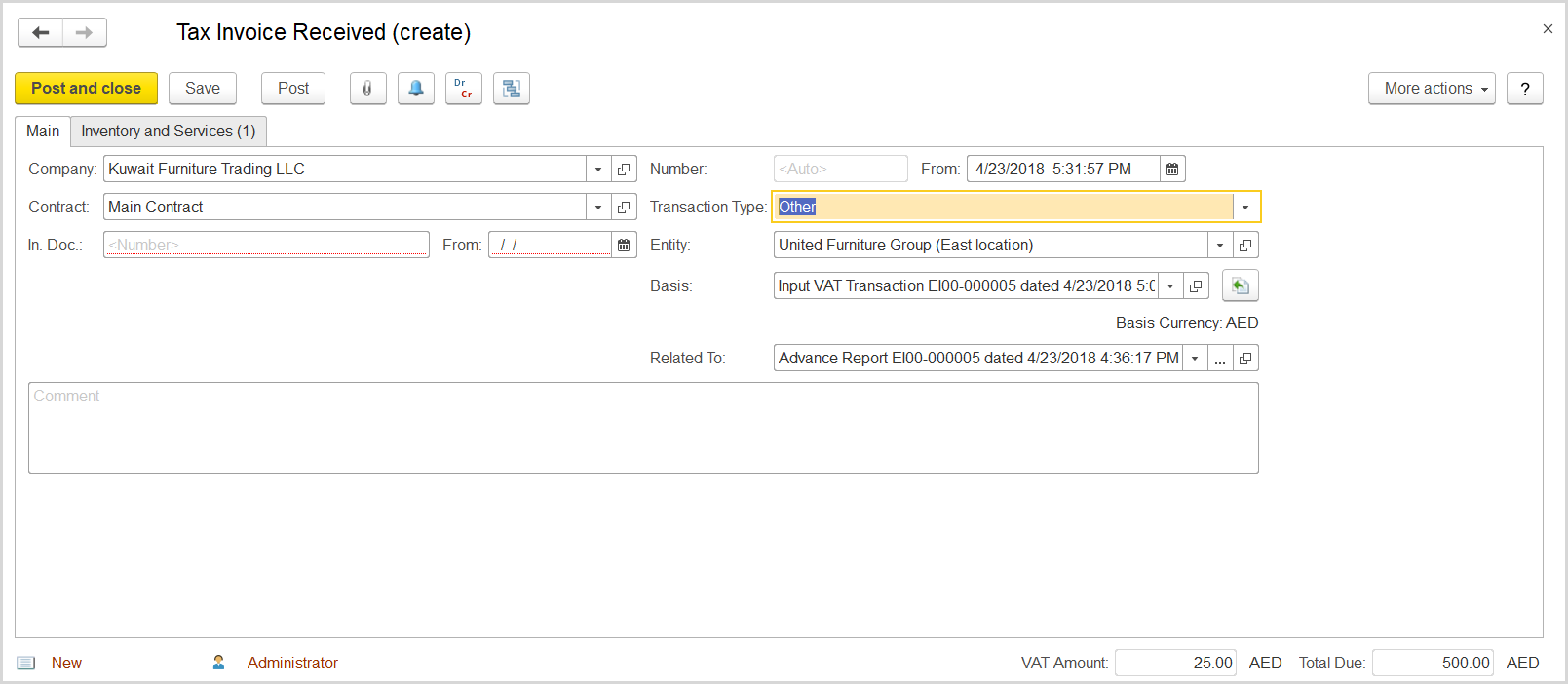

- Click the Generate button to open the drop-down list of options. Select Tax Invoice Received. The newly generated tax invoice received opens. It contain all the information from the input VAT transaction.

- Click Save and close to register in the system and close the document.