We The company registered the shipment with an invoice which indicated VAT rate at 0%; however, cannot , when filing VAT Return for the period, the company was not able to confirm the rate with all the required documents. On the VAT Return, we the company must reflect the following adjustments: decrease of the 0%-rated sales, increase of 5%-rated sales, and increase in the input VAT amount.

...

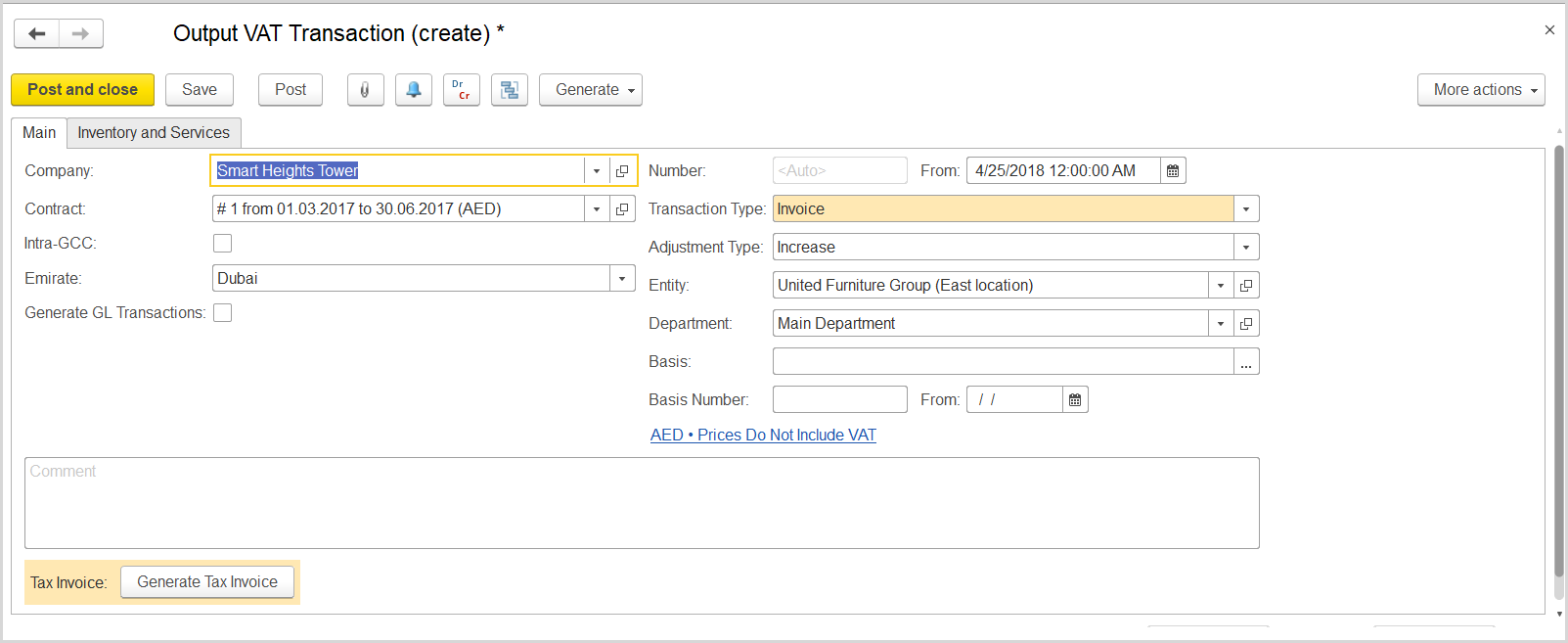

- Click Create to create a new Output VAT Transaction.

- In the Company box, select the customer.

- In the Transaction Type field, select Invoice.

- In the Adjustment Type field, select Increase.

- Make sure the link below the fields contains Prices Do Not Include VAT. Otherwise, click the link to open the Prices and Currency dialog box, clear the Prices Include VAT check box, and close the dialog box.

- Click Save to assign the number to this document.

- On the Inventory/Services tab, click Add to append a new line.

- In the Contents column enter any comment to the transaction, for instance Applying 5% Rate.

- In the Amount column, enter the amount from the original invoice.

- In the VAT, % column, select the 5% Rate option.

- Click Post to register the document in the system.

Where: Accounting > Value Added Tax > Output VAT Transactions

To reflect the increase of 5%-rated sales and generate a corresponding tax invoice, do the following:

...