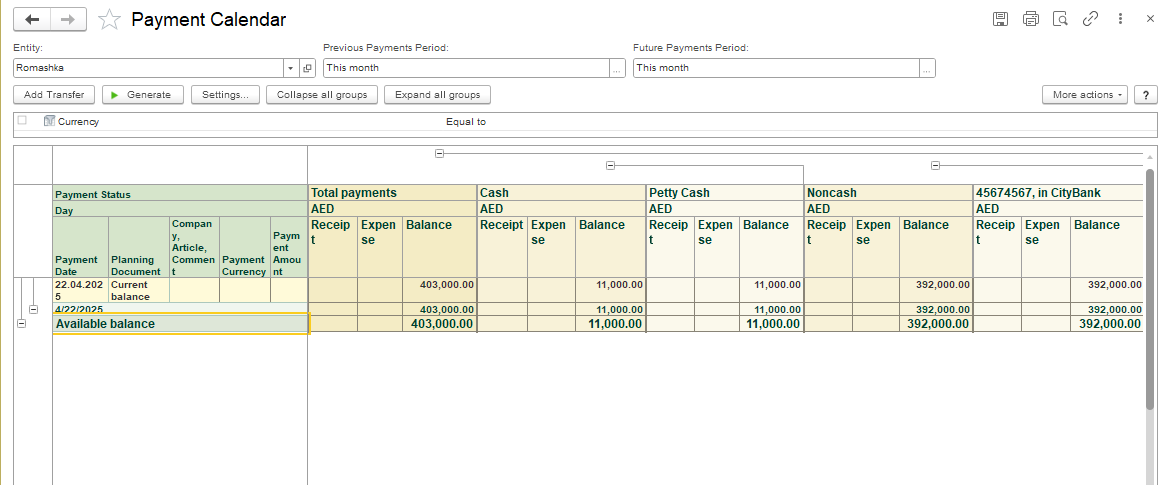

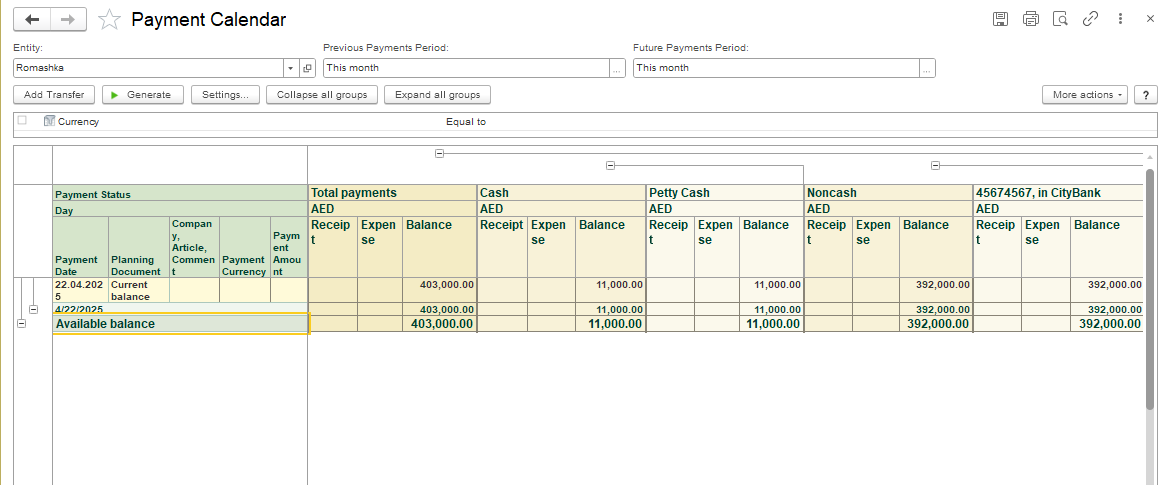

The payment calendar is an operational plan, a table of receipts and disbursements of funds for any period, with details by day, week or month. It helps you see at what point you may run out of money so that you can arrange in advance with customers and suppliers to postpone dates or change payment terms.

As an interactive report, it shows you the automatically generated cash flow forecast versus actual documents for the specified period and allows you to add certain documents for more correct cash balances.

To view and run the reports of the Money module, go to: Money > Reports of Money.

To start using the "Payment Calendar" feature, please check the settings, go to Administration → Money → put a check mark in the field "Cash Flow Forecasting"

There are two ways to plan cash flow:

- "by orders" — based on orders from the customer and supplier. The following documents are used to plan the cash flow "by orders" → Customer Order, Purchase Order, Proforma Invoice, Proforma Invoice Received.

To include planned payments from the customer/supplier in the payment calendar as planned payments of the selected payment type, select the Add to Payment Calendar option on the Payment Terms tab . By default, the "Add to payment Calendar" field is not active. In order to activate it, the document status must be "In Proсess". This setting is valid for the documents CustomerOrder and Purchase Order.

For Proforma Invoice and Proforma Invoice Received documents, tick the "Add to Payment Calendar" field on the Main tab.

Example Workflow

You’ll see the expected cash/ cashless inflow from the order.

- "according to planning documents" — creation of planning documents, the following documents are used → Money Payments (Plan), Money Receipts (Plan).

If you work with regular customers and suppliers, it is more convenient to plan receipts and payments in orders.

Cash Gap and How the Payment Calendar Helps

The Payment Calendar is a tool for planning payments that helps you avoid cash gaps.

Example:

You ship goods to customers, but the payment is received later — sometimes with a delay.

At the same time, your suppliers may require advance payment.

As a result, you may face a cash gap — when you don’t have enough money on your accounts to make the necessary payments.

And don't forget about regular expenses like salaries, rent, communications, and other recurring costs.

In FirstBit, the Payment Calendar clearly shows this situation - when the daily balance becomes negative (displayed in red), it means a cash gap is forecasted for that day.

This allows you to:

hhjkhhjjhkjhh