This guide outlines the steps necessary to complete the financial year closure in the system correctly.

...

Step 1-Perform Month-End Closing

Review all financial data and ensure everything is recorded accurately. Run the month-end closing in order (month by month) and confirm that each period is closed without any errors.

Please refer to the following guide for detailed instructions: Month-End Closing Service Tool Manual

It explains the process and steps required to run the month-end closing correctly within the system.

...

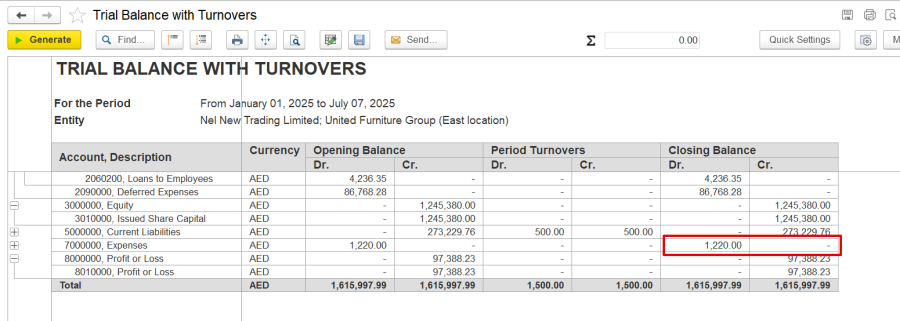

For example, the expense Gl has a closing balance of AED 1,222. When a detailed analysis is done, it shows it was created after the month-end closing.

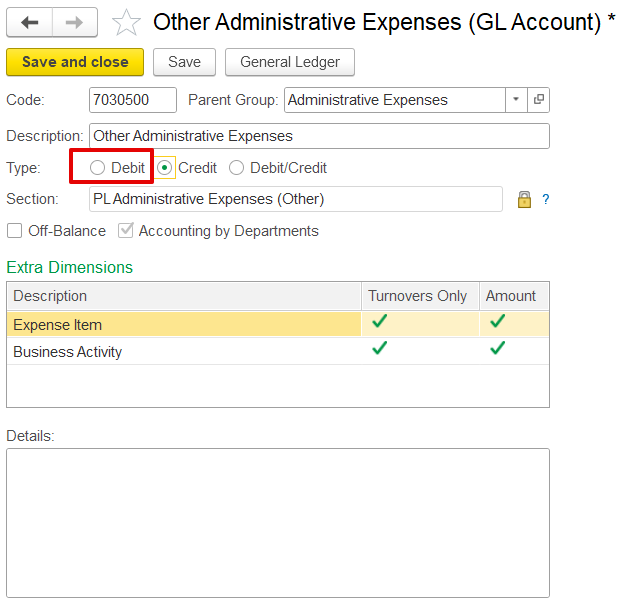

2. The incorrect GL Section selected indicates that the correct section type (Debit/Credit) was used when creating the GL account. If incorrect, fix it and re-run the month-end closing to reflect the proper balance.

...

Step 3- Check the Statement of Financial Position and verify the accounting equation:

Assets = Equity + Liabilities

If there is a mismatch:

...

Step 4 – Transfer Profit to Retained Earnings

After all periods are closed properly, manually transfer the net profit/loss to the Retained Earnings account or allocate the amount as Dividends, if applicable. Follow the official manuals for the process:

...