...

To create a deferred expense document

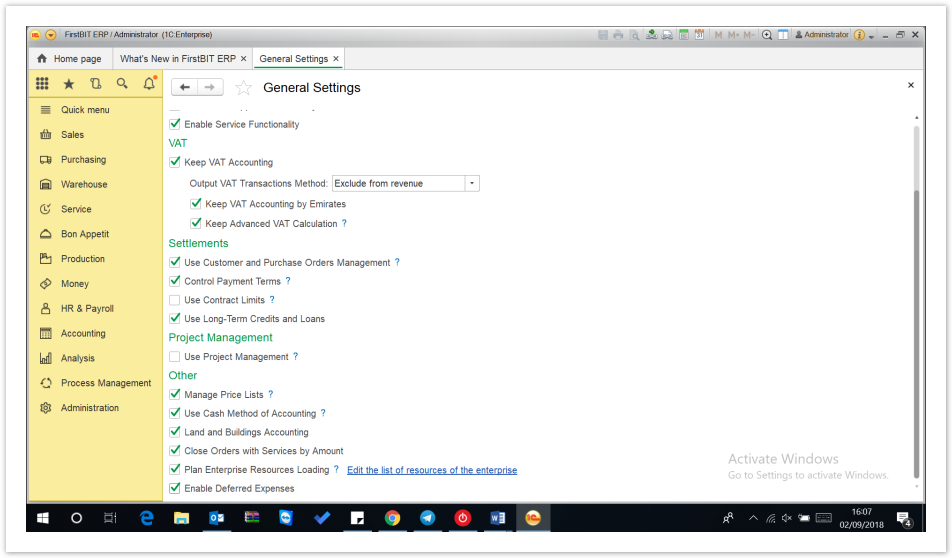

Step 1-Enable the setting

Go to Administration > General settings > Enable Deferred expense

Step 2

...

: Create Invoice

...

Received

Fill all the required details in the main tab, company, entity

Add Expense: Include the expense you want to allocate over the months

...

or period.

Add

expenseExpense Item

-: Click on the Create/Cancel

deferralDeferral option.

- A Deferred Expense dialog box appears- fill in the details as required.

- Deferred from/to- You must include the period from when to until when you want to defer these expense.

- Choose the calculation type-If you want to do the calculations monthly, Calendar days or Manually.

- Choose the GL Account-Deferred expense

- Expense GL account-The account through which month end closing will transfer the balance to profit and loss account.

- Expense item-Choose the expense item

Fill in Deferred Expense Dialog:

- Deferred From/To: Specify the period for deferring the expense.

- Calculation Type: Choose how you want to calculate the deferral (monthly, calendar days, or manually).

- GL Account: Select the deferred expense account.

- Expense GL Account: Choose the account for transferring the balance to the profit and loss statement at month-end.

- Expense Item: Select the relevant expense item.

The below icon, help you identify if these expense are being for the period or not.

Please note, these deferred expense will not be included to the cost of Invnetory.

...