Deferred Expense- With Add ons

Step 1-Enable the settings

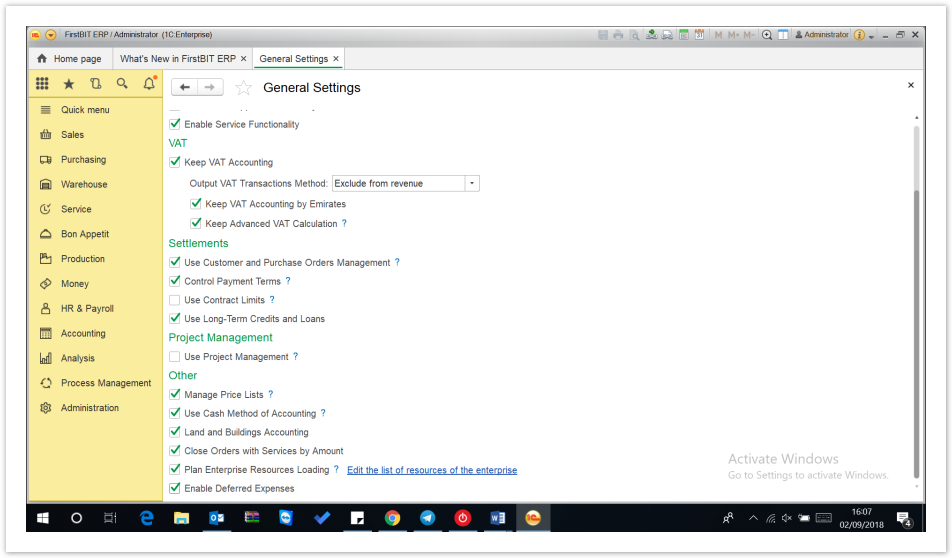

Administration-General Settings-Enable Deferred expense

A deferred expense is a cost that has been incurred but not yet recognized as an expense in the financial statements. Instead, it is recorded as an asset on the balance sheet until the expense is recognized in the period in which it will be used or consumed.

For example, if a company pays for a year of insurance upfront, the payment is initially recorded as a deferred expense. Each month, a portion of that payment is then recognized as an expense, reducing the deferred expense asset and reflecting the cost in the income statement.

Deferred expenses help align costs with the revenue they help generate, following the matching principle in accounting.

To create a deferred expense document- Go to Administration > General settings > Enable Deferred expense

Step 2- Create Invoice received- Add the expense which you want to allocate over the months/ period

...

To create the calculations manually, Click on expense

| Anchor | ||||

|---|---|---|---|---|

|