Problem: How to pass Pension Accrual, monthly payroll deduction and amount remittance to the government under GPSSA program for local employees?

Solution: Transactions under GPSSA program can be proceed in the system by the following steps:

1) Create two new GL accounts. Please refer to the manual on how to create GL account 7.2.1. Chart of Accounts.

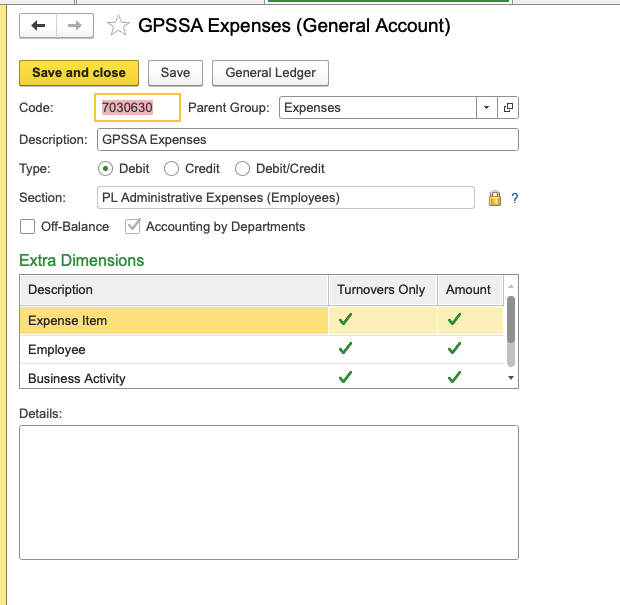

- Dr Expense Account (under PL Administrative Expenses (Employees) Section):

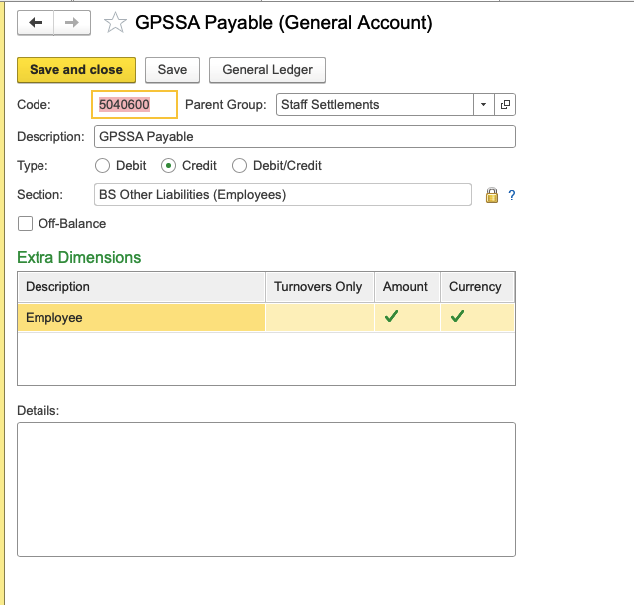

- Cr Liability Account (under BS Other Liabilities (Employees) Section

2) Monthly Deduction of 5% from Employees' Salary can be done using new deduction Type and adding to the Employment contract to be automatically reflect in Payroll Calculation:

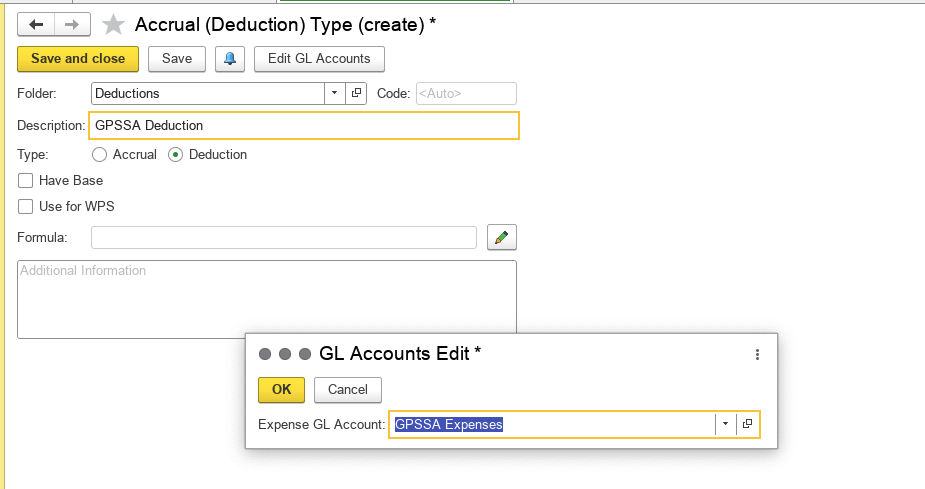

- Create a new Deduction Type without formula. Select GPSSA Expense GL account for it.

Please refer to the manual on how to create a new deduction type: 10.1.4. Accrual and Deduction Types

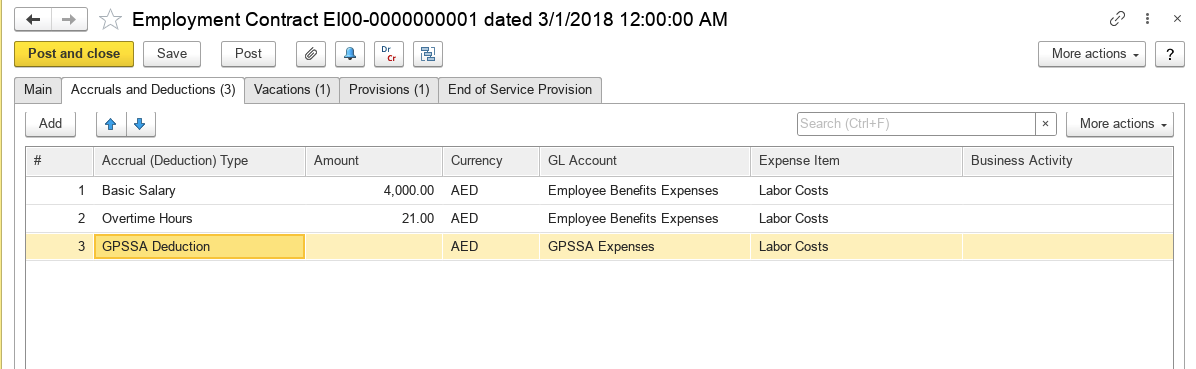

- Add new deduction type in the Employment Contract:

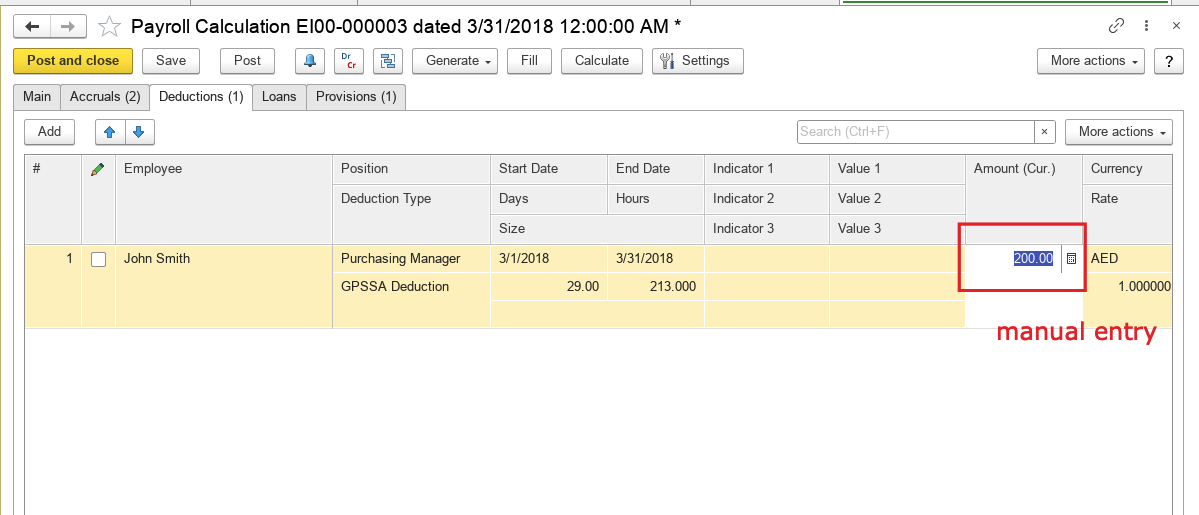

- In monthly Payroll Calculation calculate 5% deduction from Emoloyee's salary and put the deduction amount manually in the Deductions Tab (in Accruals and Deductions Tab in the releases before 2.1.1.26) :

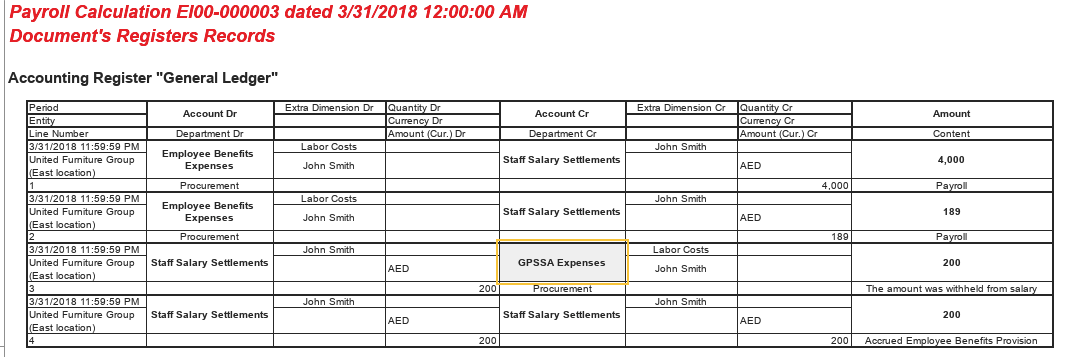

Payroll Calculation will create following entries:

3) GPSSA Payable Accrual and Payment

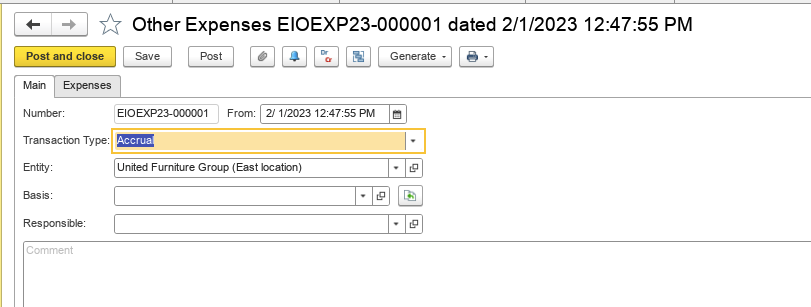

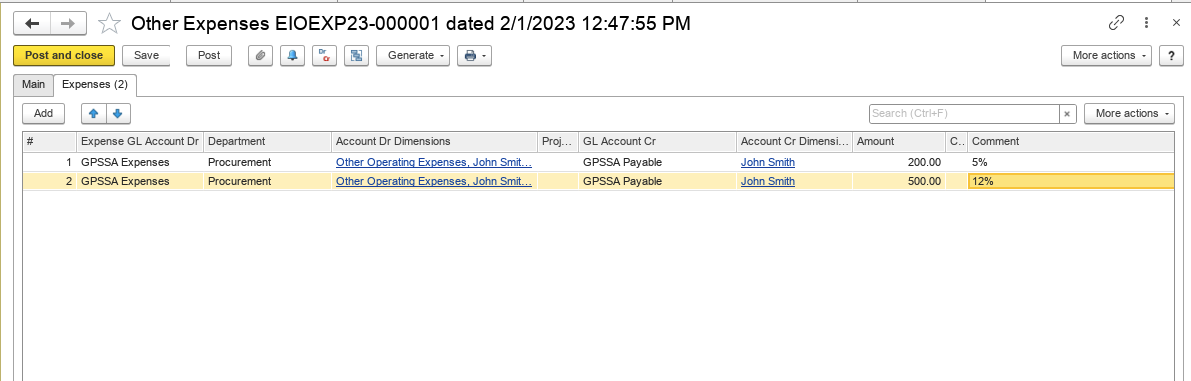

- GPSSA Expense Accrual should be done by Other Expense Document. Accrual of deducted 5% +12,5% GPSSA Payable can be done in single entry as in the screenshot below. Please refer to the manual on how to create Other Expense Document: 7.5.4. Other Expenses

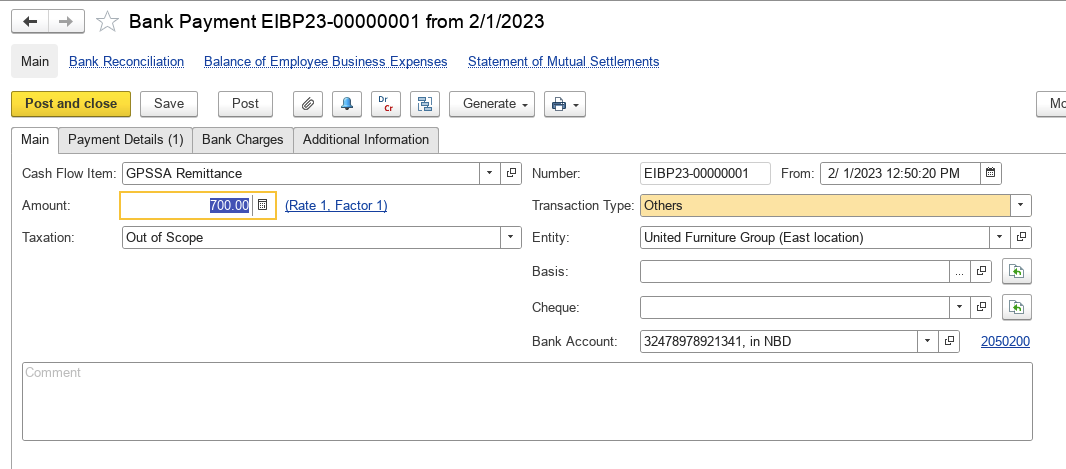

4) GPSSA Payment can be done by Bank/Cash Payment, Transaction Type - Others, you can create the new Cash Flow Item for this purpose:

In Correspondence GL account GPSSA Payable Account should be selected: